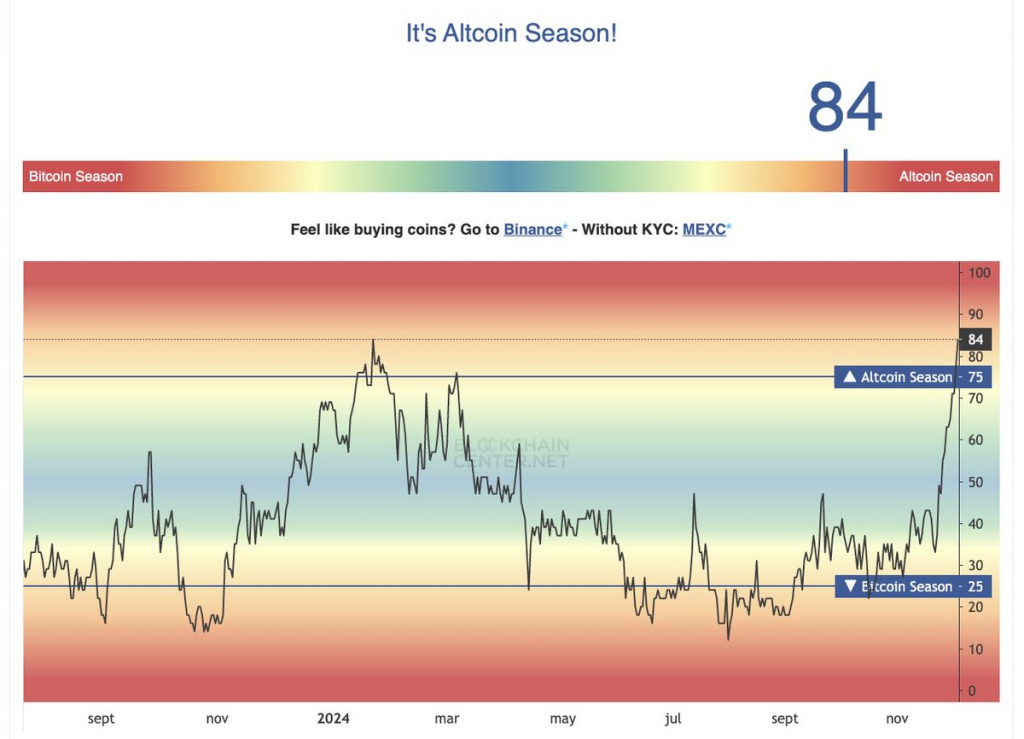

The Altcoin Season Index has reached 84 points, signaling a significant shift towards altcoins as XRP and other major cryptocurrencies experience substantial price increases, reflecting investor activity and market dynamics.

Key Points

- Recent observations indicate a strong enthusiasm for altcoins on social media platforms.

- The TOTAL2 index has been trending near the upper Bollinger Band, indicating sustained positive momentum for altcoins.

- The fear and greed index currently sits at 77 (greed), suggesting that investors are feeling optimistic.

Understanding Altcoin Season

An altcoin season is characterized by alternative cryptocurrencies significantly outperforming Bitcoin in price growth. This phase occurs when investors pivot their focus from Bitcoin, seeking potentially higher returns in altcoins. The Altcoin Season Index serves as a key metric, evaluating the performance of the top altcoins against Bitcoin over a 90-day period. A score above 75 typically denotes an active altcoin season; with the index now at 84, it suggests robust altcoin performance.

Bitcoin dominance, defined as Bitcoin’s share of the overall cryptocurrency market capitalization, plays a crucial role in signaling altcoin season. A decline in Bitcoin’s dominance indicates that capital is shifting towards altcoins. Currently, Bitcoin dominance has fallen from 61.5% to below 55.27%, a significant shift that historically precedes altcoin rallies. This suggests a broader movement toward altcoins as investor preferences evolve.

Latest Indicators of Altcoin Season

Recent trading volumes and market capitalization metrics have shown an uptick in altcoin activity. Increased trading volumes for altcoins imply a growing interest and investment flow, as highlighted by current discussions on social media platforms. The correlation between rising altcoin volumes and the elevated Altcoin Season Index score underscores the current market dynamics favoring altcoins.

Market sentiment further reinforces the emergence of altcoin season. Enthusiasm surrounding altcoins, particularly in sectors such as decentralized finance (DeFi), has been prominently featured in discussions among analysts and investors. This collective sentiment can significantly drive investment behavior, leading to increased buying pressure and price surges for altcoins.

From a technical analysis perspective, the TOTAL2 index—tracking the total market capitalization of cryptocurrencies excluding Bitcoin—has remained aloft the upper Bollinger Band in recent weeks. This movement indicates sustained performance for altcoins, suggesting that the momentum is likely to continue as long as the index remains in this range.

Market Dynamics and Implications

The ongoing shift of capital from Bitcoin to altcoins results in heightened liquidity and potential price volatility within altcoin markets. This liquidity influx can prompt rapid price increases, as seen in the current market landscape. However, it is essential to recognize the inherent risks associated with altcoin investments, marked by their higher volatility compared to Bitcoin.

The relationship between declining Bitcoin dominance and rising altcoin prices can catalyze a feedback loop that fosters further speculative investments in the altcoin sector. While this enthusiasm may push prices higher, it also raises the risk of market corrections if the speculation outpaces fundamental growth. Investors are advised to diversify their portfolios across various altcoins to mitigate risks while remaining cautious about potential bubbles driven by speculative fervor.

Research and analysis of the fundamentals behind each altcoin are crucial before making investment decisions. Understanding the underlying technology, market potential, and news dynamics—such as regulatory developments—can provide a clearer picture of potential investments in the altcoin space.

XRP and Other Major Altcoins

XRP has experienced a notable price increase, attributed to a resurgence in investor interest possibly influenced by favorable regulatory news or a positive shift in market sentiment. As one of the leading altcoins by market cap, XRP’s performance often serves as a bellwether for broader altcoin trends.

Other major projects are also witnessing sharp price increases, indicating a more systemic movement within the altcoin market rather than isolated events. This could encompass a variety of projects across different sectors, including DeFi applications and NFTs, which have garnered significant interest from investors.

In addition to the ongoing altcoin surge, Ethereum (ETH) recently outperformed Bitcoin in terms of daily net inflows, with Ethereum ETFs attracting $332.9 million compared to Bitcoin’s $320 million on a recent date. This shift highlights changing investor preferences and growing institutional interest in Ethereum, paralleling the dynamics observed in altcoin performance.

With Bitcoin’s current price around $96,000 and a fear and greed index indicating 78 (greed), the current market environment suggests a high level of investor confidence. Such a backdrop underscores the potential for continued altcoin growth as investors navigate these shifting dynamics. As the market evolves, cautious and informed investment strategies remain vital in this volatile landscape.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.