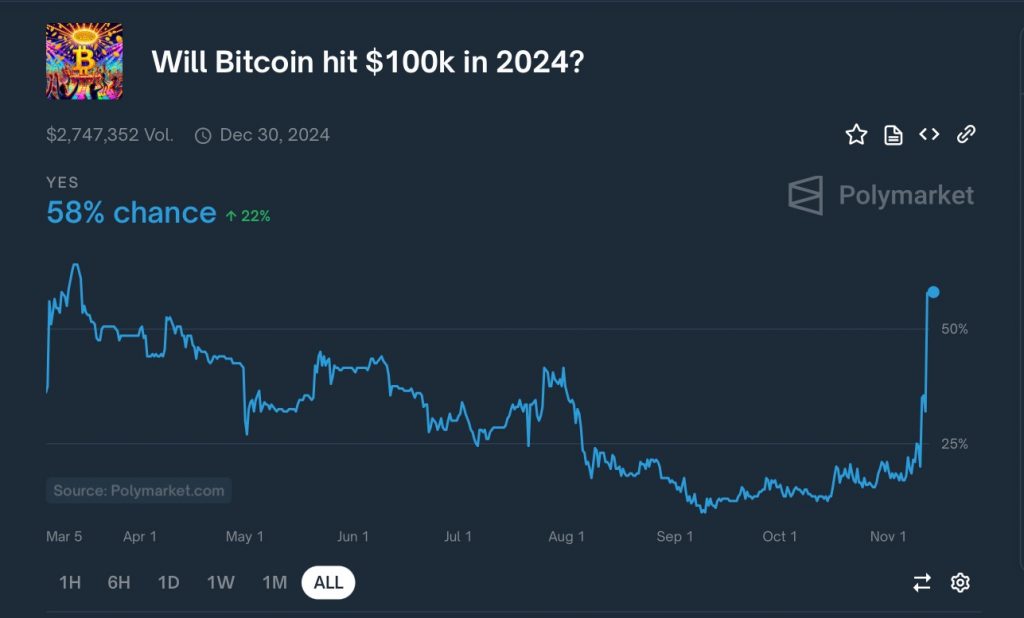

Prediction markets are currently estimating a 59% probability that Bitcoin will reach $100,000 by the end of 2024, driven by significant price movements and institutional interest.

Key Points

- Bitcoin has recently hit an all-time high of $87,000, contributing to a market capitalization of $1.7 trillion.

- In the past 24 hours, Bitcoin experienced a trading volume of $88.4 billion, with $193.17 million in liquidations.

- Historically, November has been Bitcoin’s most profitable month, with an average return of 45%.

Current Market Sentiment on Bitcoin

Recent analyses from prediction markets indicate that there is a 59% chance of Bitcoin reaching the significant milestone of $100,000 by the end of 2024. This sentiment has been bolstered by Bitcoin’s recent ascent to $87,000, which many attribute to a combination of factors, including heightened institutional demand and the implications of Donald Trump’s presidential victory, which have spurred increased investor optimism.

Kalshi, a popular prediction market platform, has reported these estimates, alongside a 77% probability of Bitcoin hitting $90,000 this year. The rising prices and positive forecasts reflect a growing belief among traders that Bitcoin’s current rally could lead to unprecedented gains.

Market Performance and Historical Trends

Bitcoin’s recent performance is noteworthy; it reached an all-time high of $87,000 with a market capitalization of approximately $1.7 trillion. This growth is further evidenced by record-high open interest in Bitcoin futures, which stood at $48 billion, suggesting that many traders are taking positions in anticipation of future price movements. The increasing capital inflows into Bitcoin highlight a robust interest in the cryptocurrency as an investment vehicle.

Historically, November has proven to be a particularly strong month for Bitcoin, with CoinGlass data indicating an average return of 45% during this period. As of early November, Bitcoin has already recorded a 20% increase, which positions it well as it seeks to achieve the $100,000 target. To reach this milestone, Bitcoin would need to gain an additional 17% from its current level.

Factors Influencing Market Behavior

The recent surge in Bitcoin’s price can also be attributed to an increase in stablecoin market capitalization, which has surpassed $180 billion. This indicates a substantial amount of capital is entering the cryptocurrency market, potentially shifting towards Bitcoin and other digital assets.

Moreover, Trump’s electoral win has initiated what some analysts describe as a “crypto buying spree,” as investors anticipate a regulatory environment more favorable to cryptocurrencies under his administration. The expectation of favorable regulations could lead to more institutional investment, further boosting Bitcoin’s price.

Polymarket, a decentralized prediction platform, has gained significant traction with predictions largely focused on the upcoming U.S. presidential election and its implications on various markets, including cryptocurrencies. As of now, Polymarket has achieved a cumulative trading volume of $6.01 billion, showcasing the platform’s growing popularity as a venue for speculating on cryptocurrency outcomes.

Overall, the interplay of Bitcoin’s price movements, market predictions, and historical performance trends suggests a landscape full of opportunity and risk, underscoring the dynamic nature of the cryptocurrency market as it evolves.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.