Bitcoin whales have accumulated over $442 million in Bitcoin amid Donald Trump’s victory in the U.S. presidential election, while major betting markets have resolved their predictions in favor of Trump following calls from key news organizations.

Key Points

- The total trading volume for U.S. presidential election bets on Polymarket surpassed $3 billion.

- Analysts forecast Bitcoin could soar to between $80,000 and $90,000 if Trump wins.

- 75% of Polymarket traders hold positions across various topics beyond the presidential election.

Bitcoin Whale Accumulation Amid Political Projections

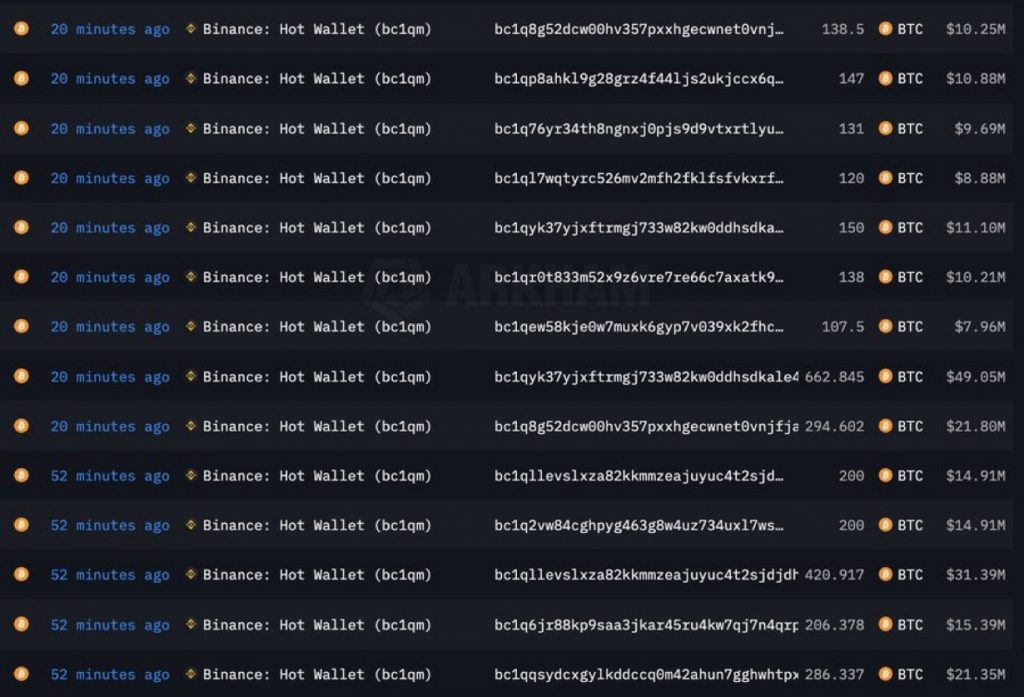

Investor interest in Bitcoin has seen a notable uptick as projections indicate Donald Trump have secured victory in the U.S. presidential election. Bitcoin “whales” (holding more than 100 BTC) have emerged, reportedly withdrawing over 6,200 Bitcoin (BTC), translating to more than $440 million.

This activity, highlighted by Lookonchain, underscores a significant shift in market dynamics, particularly with withdrawals noted from Binance, one of the largest centralized exchanges. The growing appetite for risk-on assets like Bitcoin often correlates with investor sentiment concerning political developments.

Major Betting Markets Resolve in Favor of Trump

In tandem with the accumulation of Bitcoin, the decentralized prediction market Polymarket has resolved its U.S. presidential election market following calls from major news agencies declaring Trump as the victor. Polymarket saw a remarkable trading volume exceeding $3 billion, evidencing robust engagement from investors.

As the election results unfolded, analysts anticipated significant fluctuations in cryptocurrency prices. A report from Bernstein suggested Bitcoin could surge to between $80,000 and $90,000 in the wake of the Trump election win.

In real-time responses to these projections, Bitcoin traded at approximately $73,757 following the electoral call, reaching new all-time highs of over $75,000 and reflecting a 7.3% increase over the previous 24 hours. The GMCI 30 index, which tracks a selection of the top 30 cryptocurrencies, rose by 9% in the past day, signaling a broader bullish sentiment within the cryptocurrency market landscape.

Conclusion

With Bitcoin’s price reacting to the political climate and the performance of prediction markets like Polymarket, the intersection of cryptocurrency and politics continues to garner attention. The implications for future market dynamics remain significant, underscoring the need to monitor how political events shape cryptocurrency trends.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.