Bitwise, together with VanEck, 21Shares, and Canary Capital, has filed for a Solana SOL spot ETF on the CBOE, marking significant progress in providing cryptocurrency investment avenues in the U.S.

Key Points

- Solana (SOL) holds a market capitalization exceeding $121 billion, making it the third-largest cryptocurrency globally.

- Bitwise manages over $11 billion in client assets, showcasing its influence in the cryptocurrency investment space.

- Solana highlights its operational efficiency and scalability.

Filings for Solana ETF

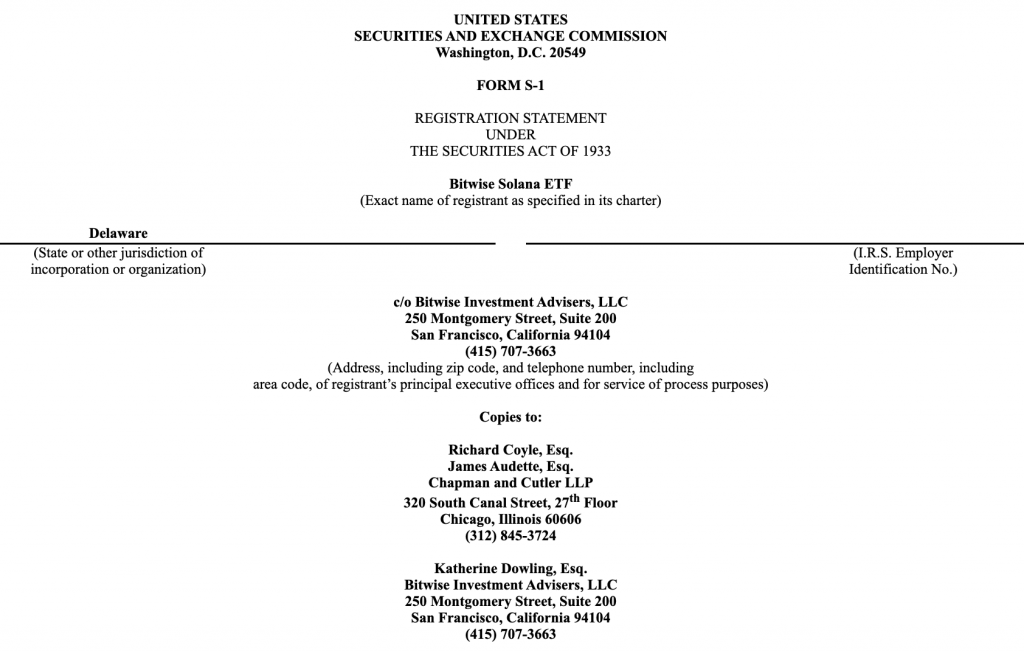

Bitwise, VanEck, 21Shares, and Canary Capital have submitted 19b-4 forms to the CBOE for a Solana SOL spot ETF. This application positions Bitwise as the latest entrant in the competitive race to offer a Solana ETF in the United States, following earlier submissions from Canary Capital in October and from VanEck and 21Shares. Bitwise has also filed a S-1 form with the SEC, which is a crucial step towards potential approval expected in August, 2025.

This initiative reflects a growing interest in providing cryptocurrency investment options to traditional financial markets. The involvement of multiple firms indicates a robust demand for Solana-based investment products, particularly as SOL has gained traction as a significant player in the cryptocurrency sector.

Solana’s Growing Popularity

Solana’s SOL token is experiencing a resurgence as one of the key assets during this year’s bullish trends in the crypto market. The platform has become increasingly popular among traders, especially in the memecoin space. With the SOL token approaching all-time highs not witnessed since late 2021, the momentum around Solana highlights its relevance and appeal among crypto investors.

Bitwise has indicated its commitment to bringing a Solana ETF to market, as confirmed by Chief Investments Officer Matt Hougan. The firm is actively promoting SOL, recognizing its advantages, including lower transaction costs and faster processing times compared to other blockchain networks.

Cboe and Bitwise

Cboe BZX Exchange has filed to list Bitwise’s proposed Solana exchange-traded product (ETP), which aims to directly hold SOL tokens. The approval of the Form 19b-4 filing is essential for the launch of this ETP, and it must also be in conjunction with the effectiveness of the S-1 filing.

Bitwise has positioned itself as a pioneer in offering diverse crypto investment products. The company has reported significant growth in its offerings, now managing over $11 billion in assets, showcasing its influence and stability in the crypto investment landscape.

Market and Regulatory Context

The ongoing developments in the cryptocurrency sector coincide with broader regulatory transitions, notably the anticipated departure of SEC Chair Gary Gensler on January 20th, aligning with the prospective return of Donald Trump to the White House. This political shift may influence regulatory approaches to cryptocurrencies and potentially pave the way for more favorable conditions for crypto investment products.

Risks and Considerations

Investors should approach cryptocurrency investments with caution, as market volatility can lead to significant financial risks. The dynamic nature of cryptocurrency trading requires investors to have a solid understanding of the market and the inherent risks associated with it.

Bitwise emphasizes the importance of investor education, encouraging potential investors to conduct thorough research before committing to crypto investments. The firm has established itself as a partner to financial professionals, providing educational resources to navigate the complexities of crypto assets.

In summary, the filing for a Solana ETF represents a significant step in the integration of cryptocurrencies into traditional finance, with Bitwise leading the charge alongside other key industry players. As interest in Solana and its applications continues to grow, the implications for the broader cryptocurrency market remain substantial.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.