Bitwise has registered a Solana-focused Exchange-Traded Fund (ETF) in Delaware, signaling the firm’s intention to potentially file with the SEC, which could enhance investor access to Solana and influence its market dynamics.

Key Points

- The registration of the ETF establishes a legal framework under Delaware law, which is favorable for financial enterprises.

- The next phase involves submitting a registration statement to the SEC, requiring extensive regulatory scrutiny.

- The introduction of a Solana ETF could stimulate liquidity and broad interest in the cryptocurrency market.

Legal Formation of the ETF

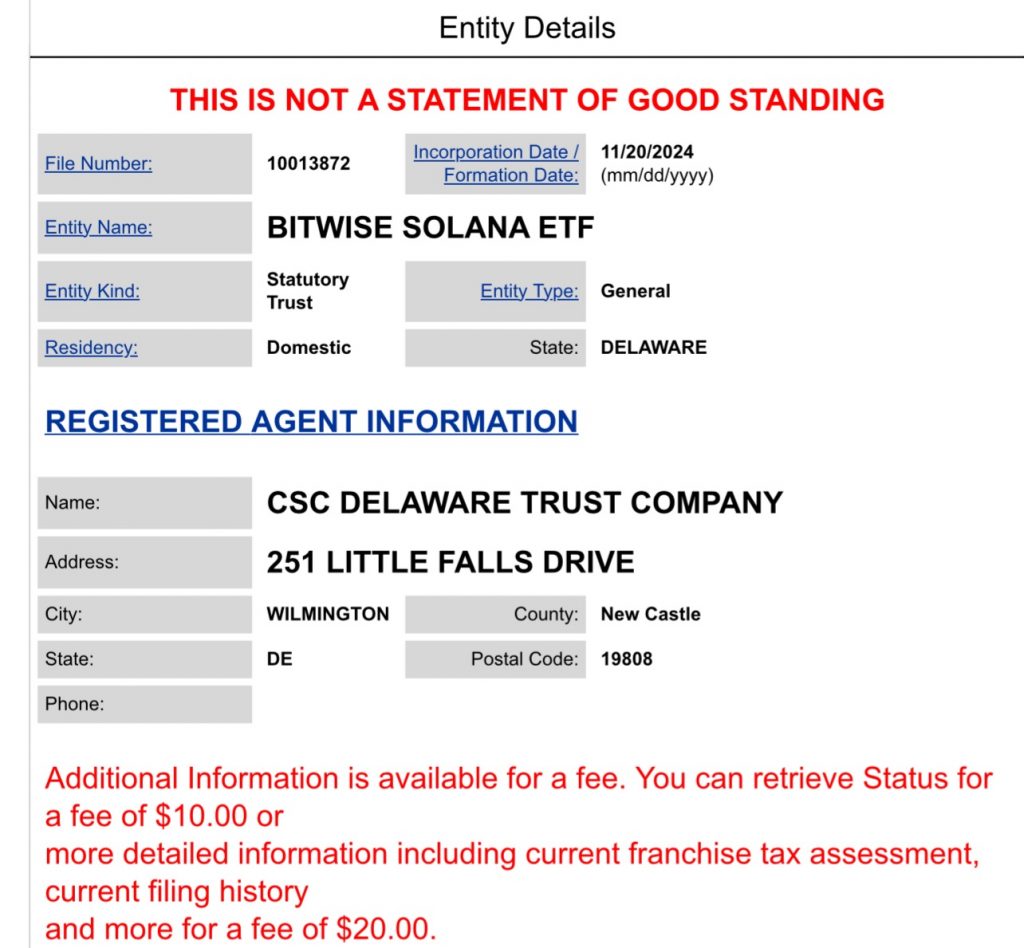

The recent registration of a “Bitwise Solana ETF in Delaware” highlights Bitwise’s initiative to create a legal foundation for a potential Exchange-Traded Fund (ETF) centered on Solana (SOL). By establishing a Delaware Statutory Trust (DST), Bitwise is taking advantage of Delaware’s favorable legal environment for business, which is attractive to many asset management firms seeking to launch financial products.

This registration is significant as it represents the initial legal step taken by Bitwise towards offering an ETF tied to Solana, a cryptocurrency known for its high transaction throughput and scalability. The move aligns with ongoing trends in the cryptocurrency sector, which has seen a growing interest in integrating digital assets into regulated investment vehicles.

Intent to Launch an ETF

The registration of the ETF indicates Bitwise’s intention to possibly pursue official approval from the U.S. Securities and Exchange Commission (SEC). This process, while initiated, does not guarantee that the ETF will be approved or made available for trading.

An ETF focused on Solana would provide investors with the ability to buy shares that reflect the cryptocurrency’s price without the need to purchase Solana directly. This would simplify access for investors who are hesitant to engage with cryptocurrency exchanges or navigate the complexities of managing digital assets.

Regulatory Process Ahead

Proceeding the registration in Delaware, Bitwise’s next step will involve filing a detailed registration statement with the SEC. This document will outline the ETF’s structure, investment strategy, and compliance measures.

If the SEC grants approval, the Solana ETF could potentially be listed on a stock exchange, allowing shares to be traded similarly to traditional stocks. This would create a pathway for both institutional and retail investors to gain exposure to Solana while adhering to established financial practices.

Market Impact Considerations

The potential launch of a Solana ETF could have significant implications for the cryptocurrency market. By providing a regulated avenue for investment, the ETF may enhance both institutional and retail access to Solana, thereby increasing its liquidity in the market.

Furthermore, the news surrounding ETF registrations often generates market speculation, which can temporarily influence the price of the underlying asset. While the actual effects could vary until the ETF receives SEC approval, the anticipation of new investment vehicles tends to create enthusiasm among investors.

Current Context and Trends

The registration of Bitwise’s Solana ETF coincides with a resurgence of interest in Solana, particularly highlighted by the success of its Phantom wallet app, which has recently emerged as one of the top 16 most downloaded apps on the US Apple App Store.

This uptick in user engagement suggests a vibrant ecosystem around Solana, which may further support the case for an ETF focused on this cryptocurrency. As financial institutions continue to explore the intersection of cryptocurrencies and regulated financial products, the move by Bitwise to register a Solana ETF reflects a broader trend of integrating digital assets into traditional investment frameworks.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.