BlackRock’s spot Bitcoin ETF achieved a record inflow of $875 million on October 30, marking a significant milestone as U.S. spot ETFs collectively surpassed the 1 million Bitcoin threshold.

Key Points

- The U.S. spot Bitcoin ETFs have seen a total of approximately $24.18 billion in cumulative inflows.

- Institutional investment in spot Bitcoin ETFs could reach 40% within the next year.

- Market analysts suggest a complex environment for Bitcoin and other cryptocurrencies due to economic policy changes.

Record Inflows into BlackRock’s Bitcoin ETF

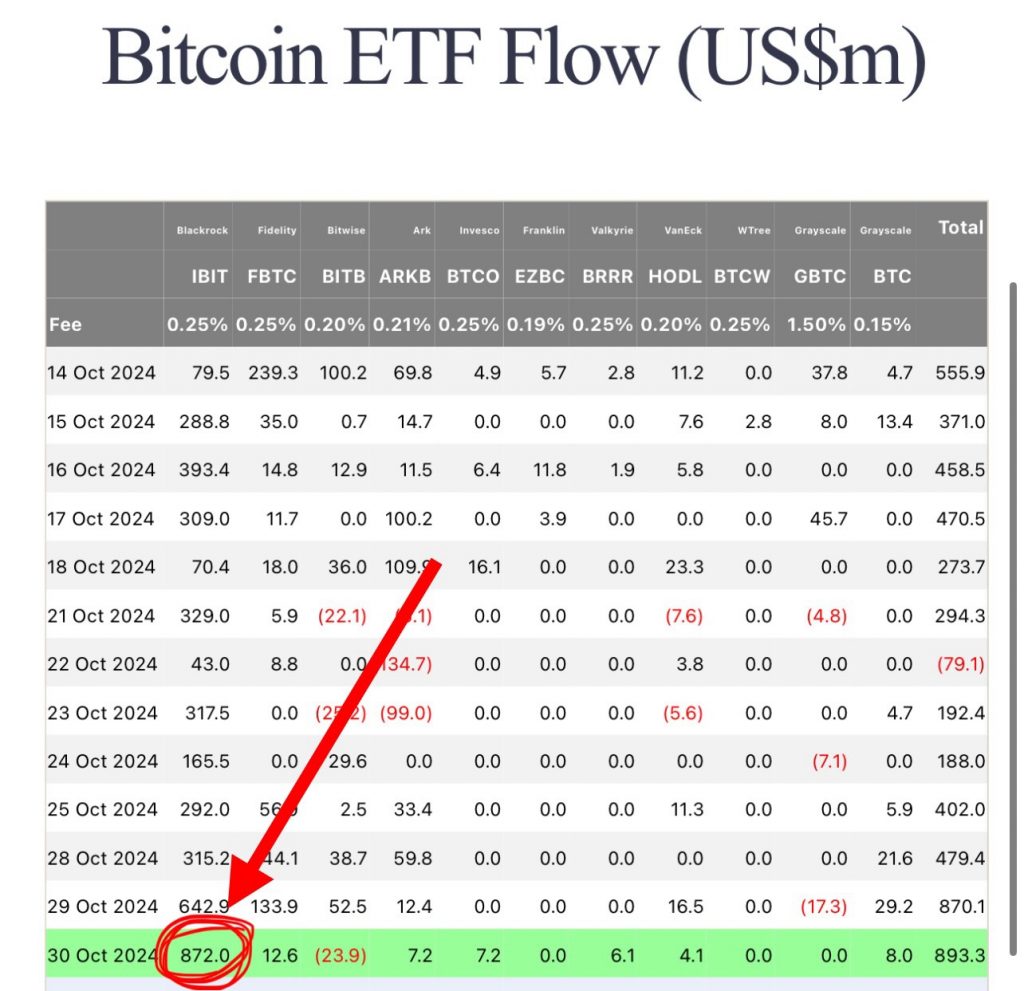

On October 30, BlackRock’s spot Bitcoin ETF recorded an unprecedented inflow of $875 million ($872 depending on the source), the highest since its launch in January.

This surge was documented by Farside Investors data, which indicated a substantial increase that exceeded the previous record of $849 million set on March 12 for the iShares Bitcoin Trust (IBIT). The inflows contributed to the collective holdings of U.S. spot Bitcoin ETFs surpassing 1 million BTC, a noteworthy benchmark in the cryptocurrency investment landscape.

Eric Balchunas, an analyst at Bloomberg, noted the significance of this record inflow, suggesting that it played a crucial role in pushing U.S. ETFs’ combined Bitcoin holding over the substantial 1 million BTC mark, and closely approaching the 1.1 million BTC supposedly held by Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

Additionally, on the same day, U.S. ETFs collectively acquired 12,418 Bitcoin, with BlackRock holding 429,129 BTC, followed by Grayscale with 220,415 BTC, and Fidelity with 188,592 BTC.

In terms of asset growth, BlackRock’s ETF has achieved a total of $29.3 billion in assets under management, with nearly half of that amount accumulated in just the past month. This rapid growth reflects both rising market confidence and an increasing appetite for cryptocurrency investments amid a favorable market environment.

Factors Driving Inflows

The substantial inflows into BlackRock’s Bitcoin ETF can be attributed to various factors, including a broader rally in cryptocurrency markets fueled by optimism among investors. The data indicated that October 30 not only marked a record day for BlackRock’s ETF, but it also represented the 13th consecutive day of inflows, accumulating approximately $4.08 billion during that stretch.

Rachael Lucas, a crypto analyst at BTCMarkets, attributed the recent surge in inflows to key macroeconomic factors, such as central banks globally transitioning toward reducing interest rates. This shift increases liquidity, making capital more accessible for investors.

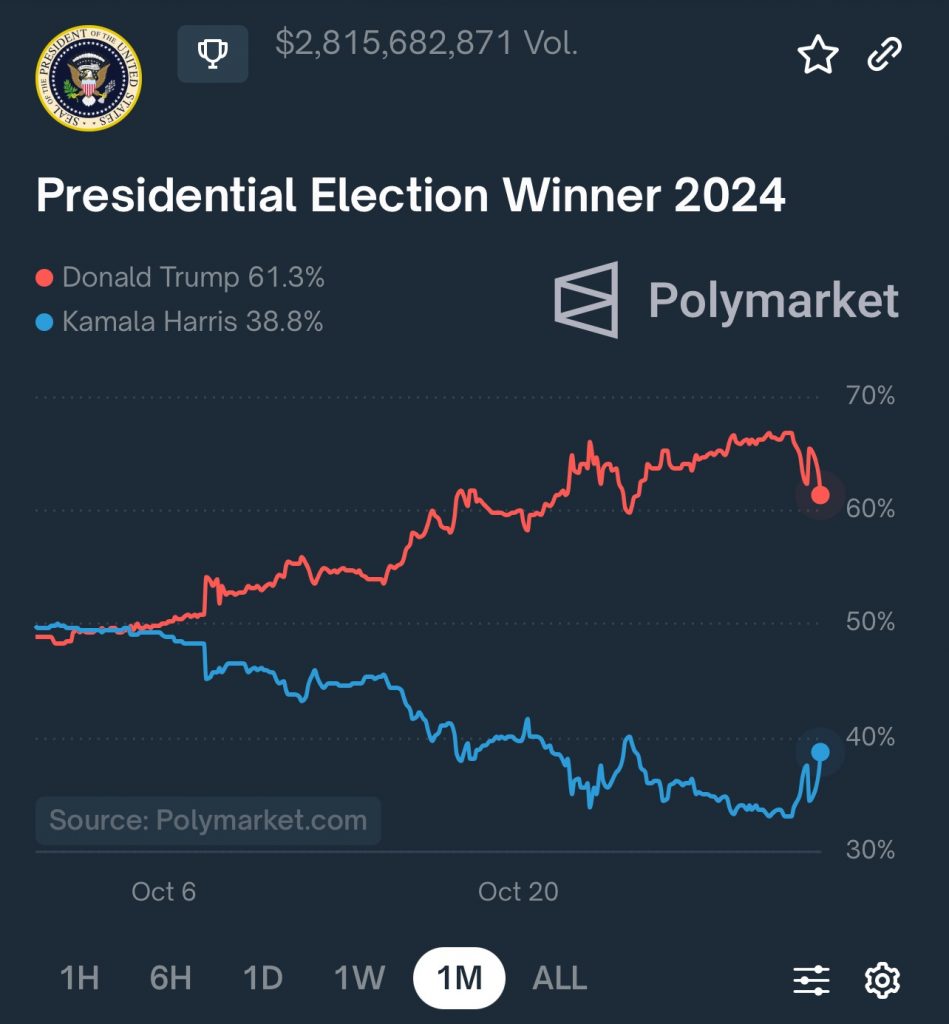

Additionally, the anticipation surrounding the upcoming U.S. presidential elections, especially the prospect of a pro-crypto stance from former President Donald Trump, may have further incentivized investment in Bitcoin and related products.

Future Market Implications

As the U.S. presidential elections approach, analysts suggest that Bitcoin ETFs could experience heightened inflows as investors position themselves to hedge against potential economic and policy shifts. Volatility in the markets is expected to increase due to reactions to political developments, polling data, and policy announcements regarding the regulatory landscape for digital assets.

The upcoming FOMC (Federal Open Market Committee) meeting, scheduled shortly after the election, will also be critical for determining future monetary policy.

Market participants are currently anticipating another 25 basis point rate cut, alongside expectations of additional cuts by the end of the year. This could create a favorable environment for cryptocurrencies, although inflationary pressures remain a concern.

Larry Fink, CEO of BlackRock, recently indicated that he expects the Federal Reserve to implement at least a 25 basis point rate cut by the end of 2024. This forecast aligns with his firm’s outlook, which predicts a range of 25 to 50 basis point cuts within the year. However, Fink also highlighted concerns about persistent inflation, suggesting that the rates may not fall to the levels currently anticipated by the market.

Market traders are currently pricing in expectations for another 25 basis point cut. This juxtaposition of potential rate cuts against embedded inflationary pressures creates a complex environment for cryptocurrencies like Bitcoin.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.