BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed its Gold ETF counterpart in assets under management, reaching approximately $33.17 billion shortly after its launch earlier this year.

Key Points

- IBIT achieved over $10 billion in assets within its first two months of trading.

- On November 7, IBIT recorded a net inflow of $1.1 billion in a single day.

- The surge in Bitcoin prices has fueled investor interest, with Bitcoin reaching an all-time high of $76,800.

BlackRock’s IBIT vs Gold ETF

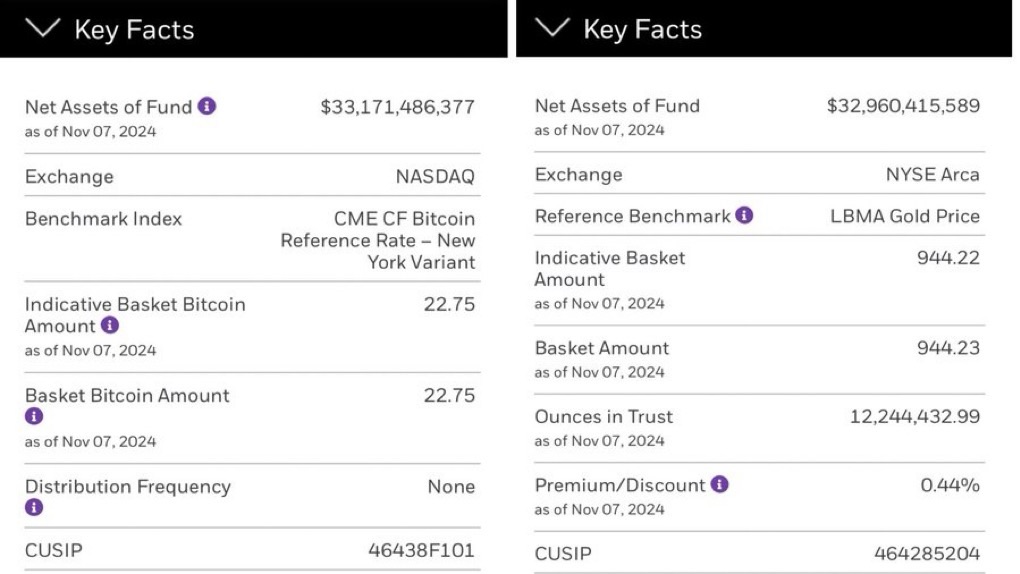

BlackRock’s iShares Bitcoin Trust (IBIT) has recently surpassed its Gold ETF, the iShares Gold Trust (IAU), in terms of assets under management (AUM). As of November 7, 2024, IBIT boasts approximately $33.17 billion in net assets, while IAU currently has about $32.9 billion. This remarkable achievement follows IBIT’s debut in January 2024, illustrating the rapid acceptance and growth of Bitcoin-focused investment products.

The iShares Gold Trust, which has been available for nearly two decades, reached its current asset level in a much longer timeframe. This rapid ascent of IBIT highlights a shift in investor preferences, as interest in cryptocurrencies, particularly Bitcoin, continues to grow. Such trends are indicative of a broader evolution in asset allocation strategies among both retail and institutional investors.

Rapid Asset Accumulation

Following its launch earlier this year, IBIT quickly garnered more than $10 billion in assets within its initial two months of trading. This level of asset accumulation is particularly noteworthy when compared to the historical performance of gold ETFs. The iShares Gold Trust took approximately two years to reach a similar benchmark, suggesting a stark contrast in investor enthusiasm for Bitcoin against traditional safe-haven assets.

According to data from Farside Investors, IBIT has recorded over $27 billion in net inflows since its inception, which underscores the growing demand for cryptocurrency investment vehicles. Notably, on November 7, IBIT experienced a single-day inflow of $1.1 billion, setting a new record for inflows in the Bitcoin ETF market. This influx of capital is reflective of favorable market conditions and heightened investor confidence in Bitcoin as a viable investment.

Historical Context and Market Dynamics

The growing popularity of Bitcoin ETFs, including IBIT, signals a significant departure from traditional investment norms, particularly regarding gold, which has long been viewed as a safe-haven asset during periods of economic uncertainty. The recent performance of Bitcoin, including reaching an all-time high of $76,800, has further incentivized investors to consider Bitcoin as a relevant and potentially lucrative alternative to gold.

The substantial inflows into Bitcoin ETFs coincide with evolving market conditions influenced by various economic factors. Analysts point to the recent U.S. presidential election results and the anticipated interest rate cuts by the Federal Reserve as catalysts that have encouraged institutional investors to explore cryptocurrency options. Such favorable conditions contribute to a broader narrative of acceptance and integration of digital assets into mainstream investment portfolios.

Investor Sentiment and Future Outlook

As Bitcoin continues to capture the attention of both retail and institutional investors, a recent study from Charles Schwab indicated that Millennials show a strong preference for cryptocurrencies compared to other asset types. This demographic trend highlights a shift in investment strategies among younger investors who are increasingly looking for personalized and innovative ways to engage with financial markets.

Additionally, BlackRock’s proposal to list and trade options for its Bitcoin ETF was approved by the U.S. Securities and Exchange Commission (SEC) in September. The introduction of options trading for IBIT is anticipated to attract further institutional interest, as options can serve both speculative and hedging purposes. Market structure analysts have noted that increasing open interest in options tends to reduce volatility while enhancing market liquidity, creating a more stable trading environment for Bitcoin.

Conclusion

The impressive performance of BlackRock’s iShares Bitcoin Trust amidst a backdrop of growing acceptance of cryptocurrencies underscores a pivotal moment in the investment landscape. The surpassing of traditional gold ETFs in terms of assets under management marks a notable shift in investor sentiment, pointing toward an increased willingness to embrace Bitcoin as both a speculative and strategic investment.

With ongoing developments in regulatory frameworks and the evolving dynamics of market participation, the trajectory for Bitcoin and its associated investment products appears promising. As institutional interest continues to build, the cryptocurrency market may very well redefine traditional asset classes, paving the way for new investment paradigms.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.