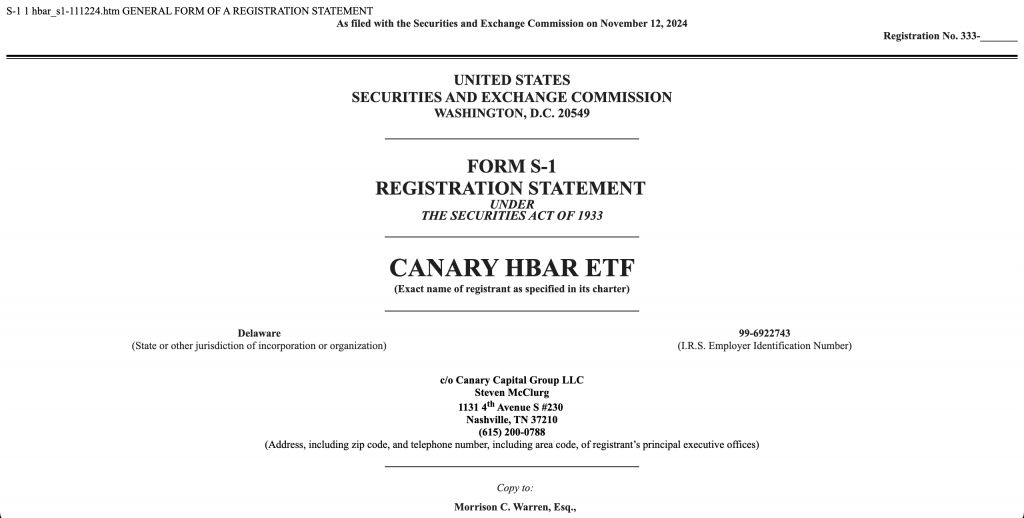

Canary Capital Group LLC has filed a registration statement with the SEC to launch an HBAR ETF, which aims to directly hold the HBAR cryptocurrency and track its dollar price.

Key Points

- The ETF will directly hold HBAR assets rather than using derivatives, allowing for a more straightforward ownership model.

- Although the Trust will insure its assets, it will not be backed by FDIC insurance, which is important for investor risk assessment.

- The Trust’s classification as an “emerging growth company” under the JOBS Act allows it to bypass certain regulatory requirements, potentially streamlining its operational processes.

Overview of the Canary HBAR ETF

Canary Capital Group LLC has recently filed with the Securities and Exchange Commission (SEC) to create an exchange-traded fund (ETF) focused on HBAR, the native cryptocurrency of the Hedera Network. This ETF is designed to provide investors with direct exposure to HBAR by holding the asset directly instead of utilizing derivatives. The main objective is to track the price of HBAR in U.S. dollars while accounting for the operational expenses and liabilities of the Trust. The net asset value (NAV) of the ETF will be based on a benchmark, likely sourced from CoinDesk, which aggregates HBAR prices across multiple digital asset platforms. The Canary Capital Group LLC will serve as the Sponsor, supported by various service providers tasked with administrative duties, custody, and oversight.

The Trust operates as a Delaware statutory trust, which allows it to hold HBAR assets both in “hot” (online) and “cold” (offline) storage. A New York-based custodian will manage these assets, ensuring that the majority is kept in cold storage for enhanced security, while a smaller portion will be held in hot storage for liquidity needs. The Trust will incorporate insurance for its assets, although it will not be protected under FDIC insurance.

ETF Operations and Interactions

Investors will be able to engage with the HBAR ETF through traditional brokerage accounts. This arrangement eliminates the need for investors to manage HBAR directly or handle the complexities of private keys. Shares of the ETF will be issued and redeemed in large blocks known as “Baskets,” which can be exchanged by Authorized Participants based on the NAV reflecting HBAR’s value. The NAV will be calculated on a daily basis, using a Pricing Benchmark to mirror HBAR’s market value against the U.S. dollar. An independent entity, likely CoinDesk, will update this Benchmark, ensuring that trade data from notable HBAR platforms is accurately accounted for.

Risks Associated with Investment

The prospectus for the Canary HBAR ETF highlights several significant risks linked to HBAR and the Hedera Network. One of the primary concerns is the volatility and market risks associated with the relatively new presence of the Hedera Network and HBAR in the cryptocurrency market. This volatility can be exacerbated by potential disruptions or fraudulent activities on HBAR trading platforms, which could negatively impact the Trust’s operations.

Additionally, custodial and key management risks are critical factors. If the Trust were to lose access to private keys associated with its HBAR wallets, it would be unable to retrieve its assets, leading to substantial losses. The custodial methods implemented are essential for safeguarding HBAR holdings, with the expectation that custodians will favor cold storage for the majority of assets. Furthermore, the accuracy of the Benchmark used for pricing is vital. Any discrepancies in HBAR pricing could misrepresent the ETF’s NAV, affecting the perceived value of the investment.

Technical Foundations of the Hedera Network

The Hedera Network differentiates itself from other distributed ledger technologies (DLT) through its unique hashgraph consensus mechanism, designed to provide both high speed and security in decentralized settings. Unlike blockchain, which structures data in blocks, hashgraph operates using a Directed Acyclic Graph (DAG) that captures all transaction events in the network. This approach eliminates data redundancy and can lower processing costs. The consensus on the network is facilitated through techniques known as “gossip about gossip” and “virtual voting,” which enable agreement among network participants without central oversight, fostering an environment of fairness and enhanced security.

Governance of the Hedera Network is managed by a council comprised of global corporations from a variety of industries. This council plays a crucial role in decentralized decision-making, enhancing the security of the network by overseeing governance issues, software updates, and compliance. In terms of its economic model, HBAR serves dual purposes: it secures the network through staking and acts as a medium for transaction fees and applications. Since its launch in 2018, the Hedera Treasury has controlled the total supply of HBAR, which is capped at 50 billion units, following a strategic release schedule to balance supply with demand.

Operational Framework and Service Providers

The operational framework of the Canary HBAR ETF involves several service providers to manage its assets and ensure effective functioning. Canary Capital Group LLC takes on the role of Sponsor, overseeing the creation, marketing, and overall logistics of the ETF. The Sponsor also covers most operational costs through a unified fee structure.

Additional service providers include administrators and transfer agents who manage the daily NAV calculations and investor communications. The Trust’s HBAR custodian and cash custodian are responsible for securely holding digital and fiat assets, respectively. Compliance with marketing standards is ensured by a FINRA-registered broker-dealer acting as the distributor.

Fee Structure and Tax Implications

Investors in the HBAR ETF will incur an annual fee determined by the Trust’s HBAR holdings, which covers most operational expenses. Any extraordinary costs, such as regulatory compliance or litigation, will be the responsibility of the Trust, which may liquidate assets to meet these expenses or fulfill redemptions.

From a tax perspective, the Trust will be treated as a pass-through entity for U.S. investors. This means that investors will report gains, losses, or expenses based on their proportionate share of the Trust’s HBAR transactions, with each sale triggering taxable events that must be carefully considered.

Emerging Growth Company Status

Under the Jumpstart Our Business Startups (JOBS) Act, the Trust qualifies as an “emerging growth company,” allowing it to benefit from reduced regulatory requirements. This status means it is not obligated to submit an auditor’s assessment of its internal controls, and it can delay compliance with certain accounting standards, potentially facilitating a smoother operational process as the ETF seeks to attract investment.

As the filing for this ETF became public, there was a notable surge in HBAR’s price, rising from approximately $0.05433 to around $0.064, indicating a heightened investor interest in the cryptocurrency.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.