As of December 3, 2024, Coinbase has reclaimed the top position in the Finance category of the Apple App Store in the United States, driven by rising cryptocurrency prices, particularly XRP, amidst a favorable regulatory environment.

Key Points

- Bitcoin has surpassed $97,000, nearing its all-time high of over $99,000.

- The Fear & Greed Index indicates a level of 78, suggesting a strong lean towards greed among investors.

- Coinbase CEO Brian Armstrong announced a policy against collaborating with law firms that employ individuals perceived as acting against the cryptocurrency industry.

Coinbase’s Market Position

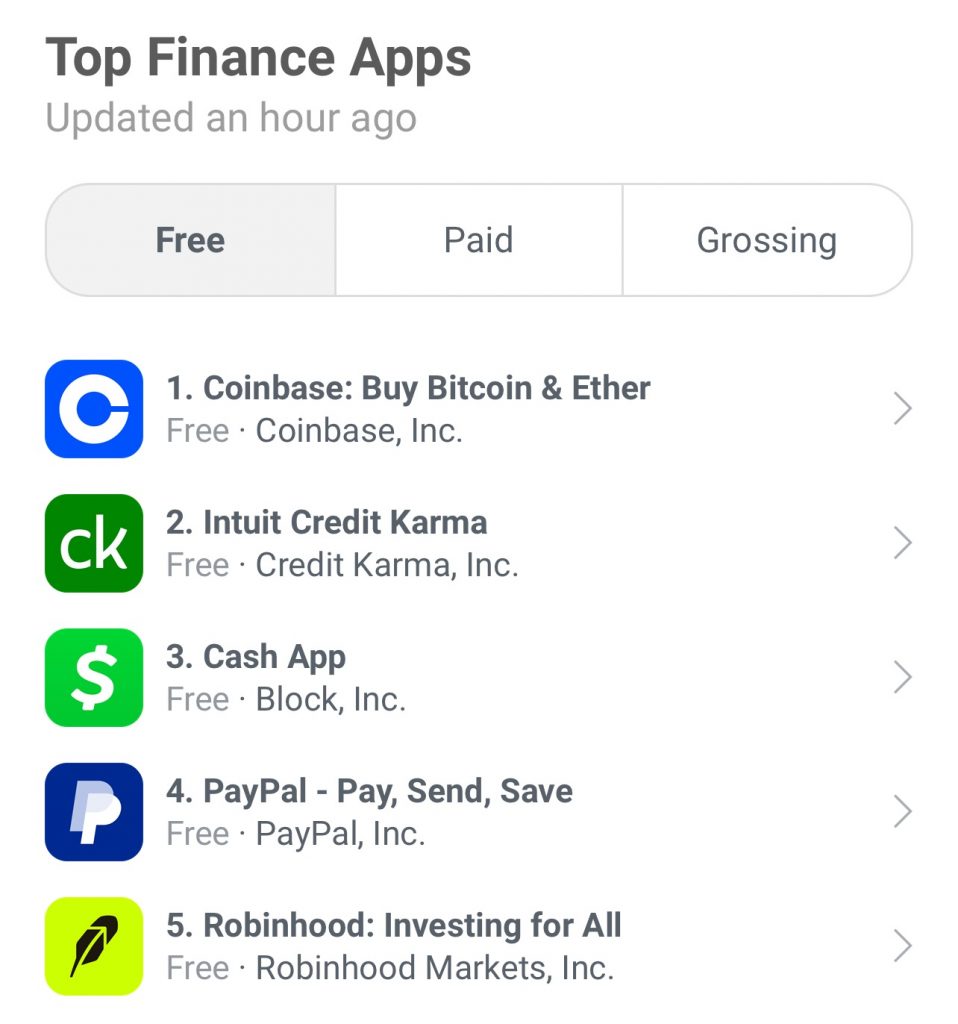

As of December 3, 2024, Coinbase has regained its status as the leading app in the Finance category on the Apple App Store in the U.S., according to App Figures.

This significant achievement reflects heightened interest in the cryptocurrency market, potentially linked to favorable trends such as the recent spike in Bitcoin prices. The app’s popularity may also indicate growing engagement from users, driven by market dynamics and regulatory developments.

The rise in cryptocurrency values, particularly Bitcoin, is noteworthy. Bitcoin recently crossed the $97,000 threshold, inching closer to its all-time high of over $99,000. This surge typically catalyzes increased downloads and usage of crypto-related applications, as users seek to capitalize on the market’s upward momentum. Coinbase’s performance can be viewed as a direct response to these favorable market conditions, reinforcing its position as a primary gateway for cryptocurrency transactions.

XRP and Regulatory Influences

In addition to Bitcoin’s performance, XRP has experienced a significant rally, recently surpassing $2.87, a peak not seen since 2018. This upward movement can be attributed to pro-cryptocurrency policies endorsed by newly elected President Donald Trump, which have fostered a more conducive regulatory environment for digital assets.

The anticipated departure of SEC Chair Gary Gensler has further fueled optimism among crypto investors, encouraging engagement with various cryptocurrencies beyond Bitcoin.

These developments illustrate a broader trend in the cryptocurrency landscape, where regulatory shifts can have a profound impact on market sentiment and asset values. The presence of pro-crypto policies has the potential to attract new investors, thereby increasing the user base for platforms like Coinbase and other cryptocurrency exchanges.

Coinbase’s App Rankings

In terms of overall rankings, Coinbase has attained a position within the top 17 of all free apps in the U.S. App Store, demonstrating its appeal beyond the finance category. This broad interest signifies that the app is not only a popular choice among cryptocurrency enthusiasts but is also capturing attention from a wider audience interested in financial technology.

The app’s ascent in the rankings may be linked to the growing interest in Bitcoin Spot ETFs and the overall excitement surrounding retail investor engagement with cryptocurrencies. Such factors contribute to a favorable environment for app downloads and user acquisition, bolstering Coinbase’s market position.

Historical Trends and User Engagement

Historically, Coinbase’s app has shown a tendency to rise in the Apple App Store rankings during periods of heightened market activity. Such patterns often correlate with increased retail interest, suggesting that fluctuations in the crypto market can directly influence app performance. As cryptocurrency prices soar, retail investors often seek platforms to facilitate their transactions, leading to a surge in downloads.

The recent spike in Bitcoin prices, along with the notable performance of XRP, serves as a reminder of how market dynamics can shape user behavior. The current sentiment in the cryptocurrency market, as indicated by the Fear & Greed Index, which stands at 78 (Greed), further emphasizes this trend. A high level of greed typically suggests that investors are more inclined to engage in riskier assets, supporting a bullish outlook for cryptocurrencies.

Regulatory Context and Strategic Moves

Coinbase’s recent initiatives to distance itself from law firms that hire individuals associated with anti-crypto actions demonstrate a strategic effort to align with the cryptocurrency community’s interests. CEO Brian Armstrong’s comments on this policy highlight a commitment to maintaining a pro-crypto stance, which may help solidify Coinbase’s reputation within the industry.

In summary, Coinbase’s strong performance in the app rankings coincides with significant movements in the cryptocurrency market, especially surrounding Bitcoin and XRP. As regulatory conditions evolve, platforms like Coinbase are likely to continue adapting their strategies to capitalize on emerging trends and maintain user engagement.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.