Coinbase’s stock has surged past $300 for the first time since November 2021, coinciding with a broader resurgence in the cryptocurrency market, while the Coinbase app has also climbed into the top 60 of the US Apple App Store.

Key Points

- Bitcoin recently surpassed the $85,000 threshold, contributing significantly to the bullish momentum in the cryptocurrency market.

- The rise in the Coinbase app’s ranking in the Apple App Store has shown historical correlation with market peaks.

- The recent electoral outcomes suggest a potential shift in legislative attitudes towards cryptocurrencies.

Coinbase Stock Performance

Coinbase Global Inc., recognized as the largest cryptocurrency trading platform in the United States, has experienced a notable increase in its stock value, surpassing the $300 mark. This milestone has not been achieved since November 2021 and indicates a significant recovery in the stock’s performance. According to data from Yahoo Finance, this increase corresponds to an approximate 11% rise at the market’s opening. The surge in Coinbase’s stock aligns closely with Bitcoin’s impressive climb, having recently crossed the $85,000 threshold.

Market analysts have observed that the resurgence in cryptocurrency values is part of a broader trend, sometimes referred to as the “Trump trade” effect. This term describes the increased interest in sectors perceived to benefit from the policies of Donald Trump, the recently elected 47th president of the United States. With the crypto sector gaining traction among investors, the pro-cryptocurrency stance of Trump may enhance optimism amid the ongoing recovery in crypto valuations.

Coinbase App Rankings Surge

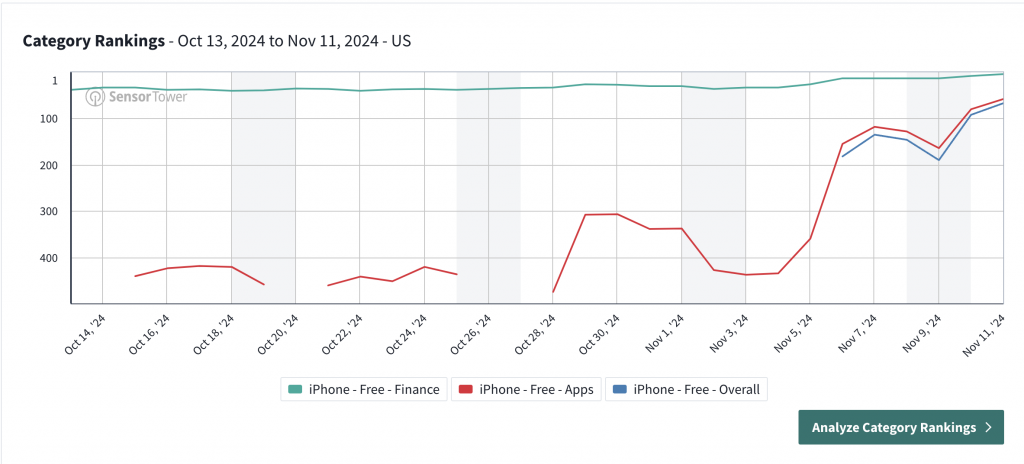

In conjunction with the rise in stock value, Coinbase’s mobile application has also seen a significant improvement in its rankings within the US Apple App Store. Following the beginning of 2024, when the app was positioned outside the top 400, its popularity has surged to heights previously unseen. According to data from AppFigures, the Coinbase app reached as high as 67th overall in the Apple App Store rankings and fourth among US financial apps.

The historical context of Coinbase’s app rankings serves as a barometer for market sentiment. In previous cycles, particularly during December 2017 and October 2021, peaks in the app’s ranking were closely associated with heightened market interest and investments in cryptocurrencies. This trend suggests that as the app gains traction among users, it could be indicative of a broader bullish sentiment in the cryptocurrency sector.

Political Influence on Coinbase Business

Brian Armstrong, CEO of Coinbase, emphasized the implications of these electoral results, stating that there is a clear public message against anti-crypto sentiments in Washington, D.C. According to Armstrong, the electoral landscape reflects a growing discontent among voters with the existing financial system and a desire for meaningful change.

However, the election landscape was not fully favorable for the cryptocurrency sector. Prominent crypto critic, Senator Elizabeth Warren, secured reelection, maintaining her position with nearly 60% of the votes. Warren’s stance on cryptocurrency has often been viewed as a challenge to the industry, raising concerns about potential regulatory hurdles that could impact market dynamics.

Armstrong’s comments underscore the ongoing commitment of industry leaders to advocate for sensible legislation that protects consumers and the cryptocurrency sector. The collective effort to promote favorable policies could result in a more conducive environment for crypto enthusiasts and investors in the coming years.

The significant movements in Coinbase’s stock and app rankings reflect broader trends within the cryptocurrency market, influenced not only by market forces but also by changing political landscapes. As interest in cryptocurrencies grows, the interplay between market sentiment and regulatory developments will continue to shape the industry’s trajectory.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.