Jim Cramer, host of CNBC’s “Mad Money,” reinforced his views on investing in cryptocurrencies, specifically Bitcoin and Ethereum, as a hedge against growing national debt, despite Bitcoin experiencing a 5% decline shortly after his bullish comments.

Key Points

- Following Cramer’s bullish remarks on Bitcoin, the cryptocurrency’s price dropped by 5%, translating to a decrease of nearly $5,000.

- Cramer is known for his controversial investment advice, leading to the development of an “Inverse Cramer” strategy.

- Cramer highlighted ongoing concerns regarding the U.S. national debt, which has surpassed $36 trillion, advocating for cryptocurrencies as a protective asset.

Cramer’s Cryptocurrency Advocacy

Jim Cramer, known for his lively commentary on CNBC’s “Mad Money,” reiterated his position on cryptocurrencies, arguing they should be included in investment portfolios. He suggests that Bitcoin and Ethereum, among others, can serve as a safeguard against the adverse effects of increasing government overspending and a burgeoning national debt, which currently exceeds $36 trillion. His recent endorsement followed a notable decline in Bitcoin’s price, which dropped by 6.2%, erasing more than $6,000 from it’s all-time high value.

Cramer’s remarks come at a time when many investors are seeking alternative assets to hedge against economic instability. While he acknowledged the absence of concrete evidence supporting the effectiveness of cryptocurrencies as a protective measure, he maintained that the narrative holds some plausibility. This endorsement comes despite the market’s unpredictable nature, highlighting the ongoing debate around the role of digital currencies in traditional investment strategies.

Market Reaction to Cramer’s Statements

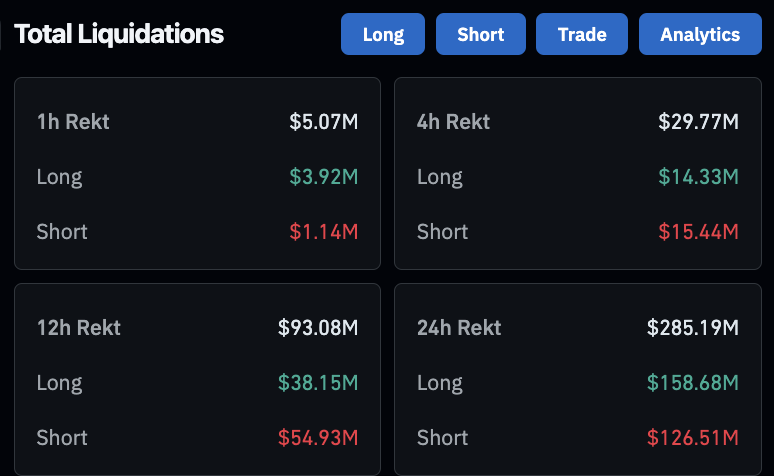

Following Cramer’s bullish sentiment on Bitcoin, the cryptocurrency market reacted with significant volatility. At the time of writing this post, Bitcoin’s value sits at approximately $93,404, while recent downturns led to a spike in long liquidations, which reached over $285 million. This fluctuation illustrates the market’s sensitivity to influential figures like Cramer, who has become something of an unintentional market indicator, though often not in the manner he intended.

Cramer faced criticism from some quarters for allegedly “calling the top” of the crypto market by advocating for investment in it. He responded to detractors by emphasizing that he was not responsible for market movements and pointed out that his advice was based on broader economic concerns rather than specific price predictions. His defense of cryptocurrencies is underscored by a long-standing belief in their potential, although seasoned traders remain wary of his track record, which includes instances of contradictory advice regarding Bitcoin’s value.

Cramer’s Investment Philosophy

Despite the criticism, Cramer continues to endorse cryptocurrencies as a viable option for investors, particularly in light of ongoing national debt concerns. He reiterated that Bitcoin, Ethereum, and other digital currencies “deserve a spot” in investors’ portfolios to protect against potential economic fallout from government spending. His belief stems from the idea that cryptocurrencies may offer a buffer against the devaluation of traditional assets, especially if the national debt crisis remains unaddressed.

Cramer also noted that while he is currently optimistic about cryptocurrencies, he may reassess his stance if the government successfully manages the deficit. This indicates a conditional approach to crypto investment, suggesting that his recommendations may adapt to changing economic conditions. He emphasized the need for investors to consider the long-term implications of government fiscal policies on their portfolios.

Cramer’s Legacy and Market Influence

Cramer’s track record has made him a polarizing figure in investment circles, especially among younger traders who have adopted the “Inverse Cramer” approach. This strategy involves taking positions opposite to Cramer’s recommendations, based on the belief that his predictions often lead to market losses rather than gains. While there is no definitive proof of this counter-strategy’s effectiveness, it reflects the skepticism surrounding his investment insights within the cryptocurrency community.

Over the years, Cramer’s relationship with Bitcoin has been complex, characterized by shifting opinions ranging from enthusiastic endorsements to outright dismissal. This has led many investors to categorize Cramer’s comments as an inverse indicator for the market. Moreover, there was an “Inverse Cramer” ETF, which took the Mad Money host’s advice as an indicator to do the exact opposite investment decision.

The Broader Economic Context

Cramer’s focus on cryptocurrencies is set against the backdrop of ongoing discussions about the U.S. national debt and its implications for economic stability. Major financial institutions, including BlackRock, have begun advocating for assets like Bitcoin as a potential hedge against risks stemming from the government’s fiscal policies. This aligns with Cramer’s claims that cryptocurrencies may serve as an alternative for investors looking to mitigate the effects of inflation and economic uncertainty fueled by excessive federal spending.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.