U.S. spot Ethereum ETFs recorded a historic daily inflow of $295.5 million, while spot Bitcoin ETFs attracted $1.1 billion in inflows, amid a surge in trading volume and positive market sentiment towards Ethereum.

Key Points

- U.S. spot Ethereum ETFs now hold approximately $9.43 billion in total net assets.

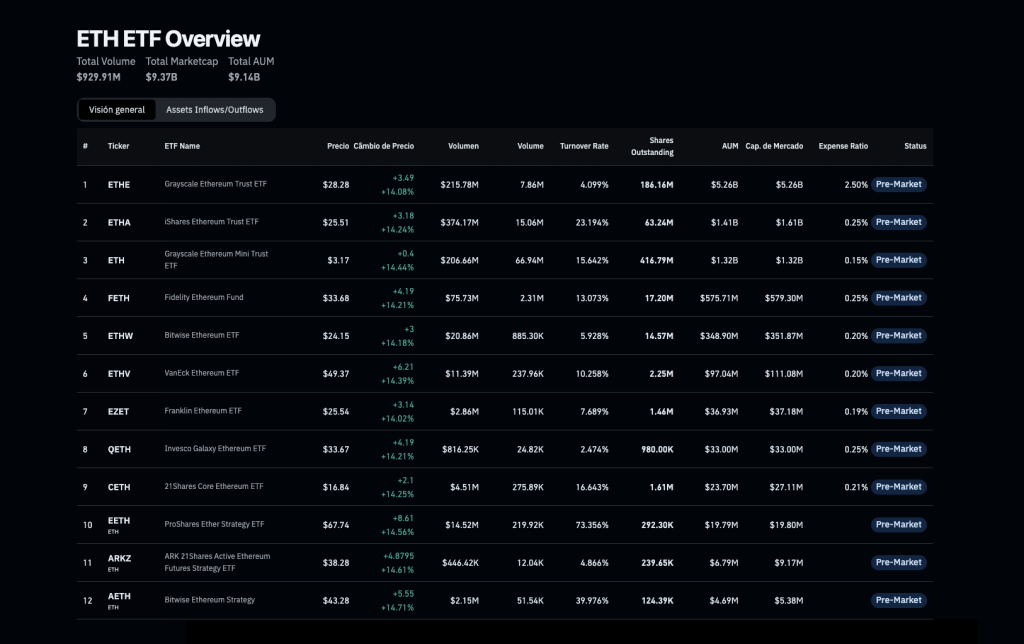

- Trading volume for spot Ethereum ETFs hit a record $912.9 million.

- Analysts note a potential shift towards a more favorable regulatory environment for cryptocurrencies.

Historic Inflows for Ethereum ETFs

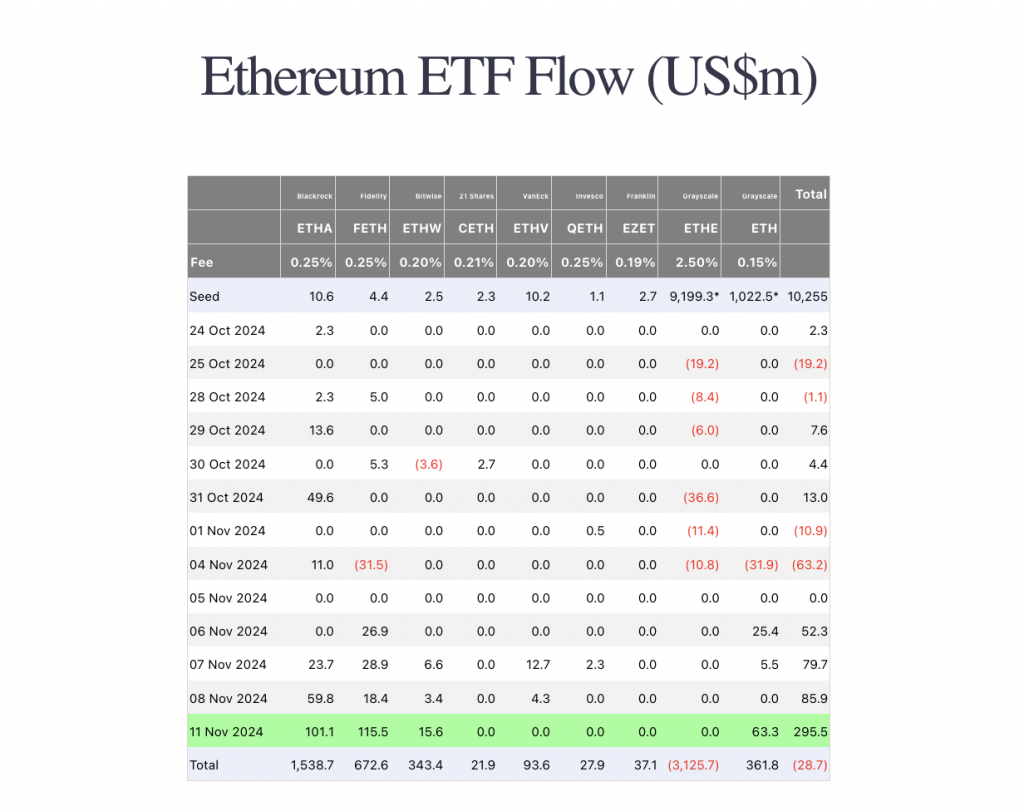

Spot Ethereum exchange-traded funds (ETFs) in the United States achieved a remarkable milestone on Monday, registering total net inflows of $295.5 million—the highest single-day inflow recorded to date. This significant uptick more than doubles the previous record of $106 million set on the funds’ inception day. Following this surge, the total net assets held by U.S. ether ETFs reached approximately $9.43 billion, which constitutes around 2.4% of Ethereum’s overall market capitalization.

Leading the charge in Monday’s inflows was Fidelity’s ether ETF, which attracted $115.5 million. This was closely followed by BlackRock’s ETHA, which garnered $101.1 million in net inflows. Additional notable contributions came from Grayscale’s Mini Ethereum Trust, which recorded $63.3 million in positive flows (biggest since launch), while Bitwise’s ETHW saw $15.6 million enter the fund. In the four trading days since Donald Trump’s presidential win, spot Ethereum ETFs have collectively accumulated around $513 million in net inflows.

Trading Volume and Market Sentiment

In conjunction with the record inflows, spot ether ETFs experienced a significant boost in trading volume, culminating in a total of $929.91 million on Monday. This figure not only exceeded last Friday’s total of $469.1 million but also surpassed the typical trading range of $100 million to $200 million. Some crypto analysts noted that the easing of regulatory concerns has encouraged investors to adopt a more optimistic outlook on Ethereum and decentralized finance (DeFi) assets. If this trend persists, it could lead to sustained or increasing inflows into Ethereum ETFs as institutional investors position themselves ahead of potential regulatory changes.

Bitcoin ETFs Maintain Momentum

In tandem with the activities surrounding Ethereum ETFs, spot bitcoin ETFs also demonstrated robust performance, achieving net inflows of +$1.11 billion on Monday. This marks the third instance in which these funds collectively drew over $1 billion, following inflows of +$1.36 billion recorded on November 7. The leading driver for this surge was BlackRock’s IBIT, which saw +$750 million in net inflows. Fidelity’s FBTC attracted $135 million, while Ark and 21Shares’ ARKB received $108.6 million in net inflows, with five other ETFs also benefiting from positive flows.

The overall trading volume for the 12 bitcoin ETFs reached an impressive +$8 billion, the highest level since March. Cumulatively, these funds have recorded total net inflows of $26.97 billion. The price of bitcoin surged by 10% within a 24-hour period, trading at $89,455 at the time of writing.

Ethereum’s Transaction Activity

Recent data from the on-chain analytics firm Santiment indicates that Ethereum has experienced a notable increase in both transaction volume and whale transaction count. The transaction volume metric measures the total value of Ethereum being transferred across the network. A high transaction volume suggests that a substantial amount of ETH is being actively traded, signaling strong investor interest.

The whale transaction count, which tracks transfers exceeding 8,480 ETH, has also seen a spike. This uptick implies that significant investors, often referred to as “whales,” are actively participating in the market. While it remains unclear whether these transactions represent buying or selling activities, the recent price rally suggests that such movements are likely linked to accumulation.

Overall, the noticeable increase in Ethereum’s transaction volume, alongside the elevated whale transaction count, underscores a revitalized interest in the cryptocurrency. The correlation between heightened network activity and price rallies offers a positive outlook for Ethereum’s market dynamics.

The recent inflows into Ethereum and bitcoin ETFs, coupled with rising transaction volumes and whale activities, highlight a growing confidence in the cryptocurrency market. As regulatory conditions evolve and investor sentiment shifts, the landscape for crypto assets, particularly Ethereum, appears poised for potential growth.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.