Ethereum has surpassed the $3,000 mark for the first time since August, driven by a surge in bullish sentiment following Donald Trump’s election victory, while Bitcoin continues to reach new all-time highs, influencing the overall cryptocurrency market.

Key Points

- Ethereum’s recent price increase of 20% over the past week contrasts with Bitcoin’s 10% rise.

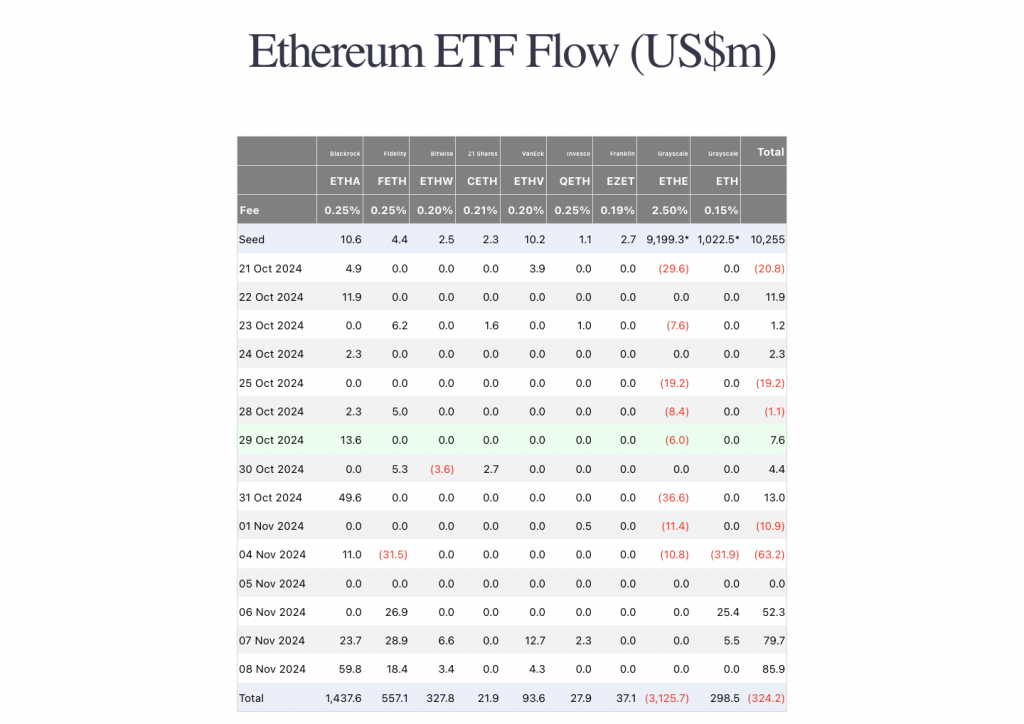

- BlackRock’s spot Ether ETF has recorded its largest inflow in nearly three months.

- Potential regulatory shifts under Donald Trump’s administration may positively impact Ethereum.

Ethereum’s Price Surge

Ethereum has recently reclaimed the significant price level of $3,000, a psychological barrier it had not crossed since August 2. This resurgence comes amid a broader rally in the cryptocurrency market, particularly as Bitcoin has achieved multiple all-time highs, including a record peak of $77,235 on Friday afternoon. The price of Ethereum reached a high of $3,056 early on Saturday, marking its second breach of the $3,000 threshold this year. Notably, just prior to the recent election, Ethereum’s price had dropped to a low of $2,350, illustrating a remarkable recovery.

This upward movement in Ethereum’s price can be attributed to a shift in market sentiment spurred by political developments. The favorable outlook towards digital assets from President-elect Donald Trump has boosted investor confidence, which in turn has facilitated a broader positive movement in crypto prices. Over the past week, Ethereum has increased by 20%, significantly outpacing Bitcoin’s 10% rise, reflecting a notable shift in bullish sentiment within the market.

Bitcoin’s Continuous Growth

Bitcoin’s dominance in the cryptocurrency market remains robust, as it continues to break its own records. After setting a previous all-time high of $73,737 in March, Bitcoin has surged once again, further solidifying its status as the leading digital asset. The momentum for Bitcoin had already been building up prior to the election, with substantial investments flowing into spot Bitcoin ETFs and increasing market dominance over Ethereum, which peaked at a three-year high last month.

With its latest high of $77,235 established on November 8, Bitcoin’s growth has been supported by a mix of investor optimism and strategic market movements. The anticipation surrounding Trump’s victory added momentum, particularly as he outlined various commitments to support the cryptocurrency ecosystem. This includes potential legislative actions that could significantly alter the regulatory landscape for digital assets.

Regulatory Climate and Future Prospects

The election results have implications for the cryptocurrency regulatory environment, particularly for Ethereum. With the possibility of a Trump-led administration at the helm of the SEC, there are indications of a shift towards more favorable treatment of digital assets, particularly in the decentralized finance (DeFi) space. The current scrutiny on DeFi applications, including enforcement threats faced by platforms like Uniswap, could see a more collaborative regulatory approach under the new administration.

Furthermore, the recent developments regarding BlackRock’s spot Ether ETF, which recorded $59.8 million in inflows—the highest in 94 days—coincide with Ethereum’s price hovering around the $3,000 mark. This reflects a growing institutional interest in Ethereum, potentially leading to greater market stability and growth as regulatory clarity improves.

Impact of Ethereum’s Upgrades

In addition to market movements, Ethereum’s ongoing upgrades are also a focal point of discussion within the community. The Dencun upgrade, which was designed to enhance the efficiency of layer-2 networks, has sparked debate regarding its impact on Ethereum’s supply dynamics. Some experts suggest that this upgrade has unintentionally made Ethereum’s overall supply inflationary, leading to concerns about fee revenue and value retention for ETH.

Recent price performance has seen ETH around the $2,500 range for several months, raising questions about whether the scaling solutions are detracting value from Ethereum itself. Despite these concerns, there is a prevailing bullish sentiment in the market, suggesting that investors remain optimistic about Ethereum’s long-term prospects.

Market Sentiment and Future Predictions

Industry analysts have noted a notable increase in market sentiment, particularly for Ethereum, which is often seen as a riskier investment compared to Bitcoin. The current market dynamics indicate a positive outlook for the near future, with reports highlighting a surprising upturn in bullish sentiment across various timeframes for Ethereum.

Standard Chartered has released optimistic projections for the cryptocurrency market, estimating that the total market capitalization could reach $10 trillion by the end of 2026. The bank anticipates significant price increases for both Bitcoin and Ethereum, projecting Bitcoin could hit $200,000 and Ethereum could exceed $10,000. This growth is expected to be driven not just by Bitcoin but also by emerging altcoins and the increasing prevalence of real-world applications, particularly in sectors like gaming and decentralized infrastructure.

The current state of the cryptocurrency market, coupled with the SEC’s ongoing review of options on spot Ethereum ETFs, underscores the critical intersection of regulation and market dynamics that investors must monitor closely.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.