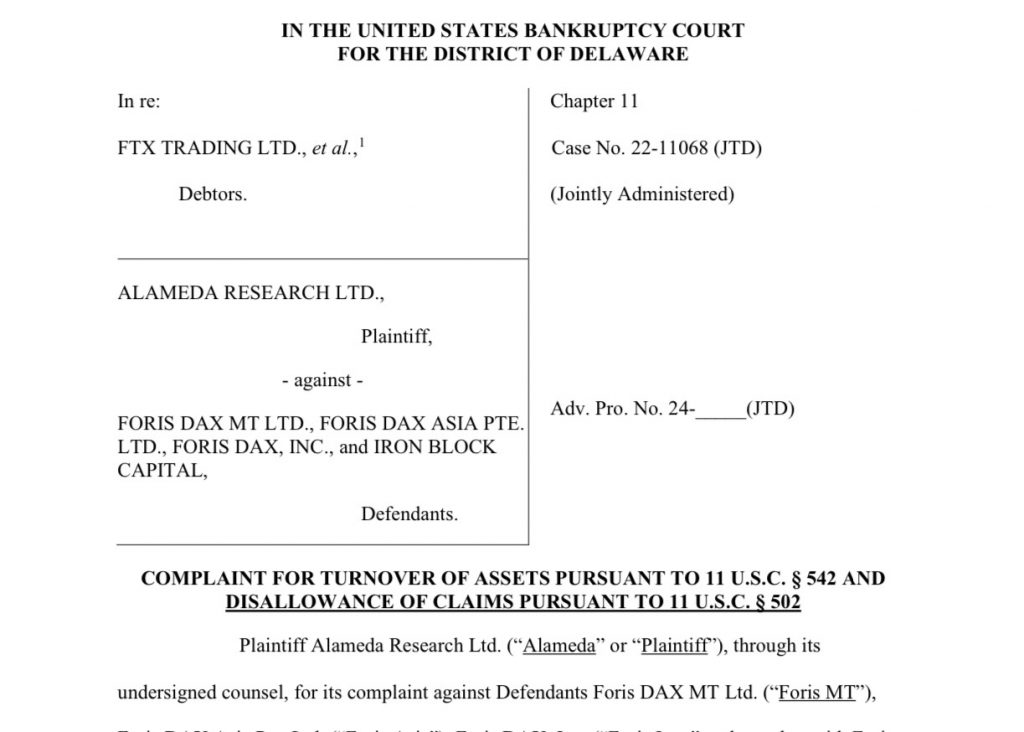

Bankrupt FTX has initiated a lawsuit against Crypto.com to recover approximately $11 million from an account linked to its sister company, Alameda Research, asserting that the funds are rightfully owed to the FTX estate.

Key Points

- FTX provided an affidavit from Caroline Ellison, former CEO of Alameda Research, affirming that the account in question was controlled by Alameda.

- FTX is pursuing claims against Foris MT and Iron Block for a total of $18.4 million and $237,800, respectively.

- FTX has requested that claims filed by Crypto.com against the exchange be deferred until the Alameda assets are returned.

FTX’s Legal Action Against Crypto.com

Amid ongoing bankruptcy proceedings, FTX has filed a lawsuit targeting Crypto.com with the aim of reclaiming at least $11 million that is currently tied up in an account associated with its sister company, Alameda Research. According to a court filing dated November 7, FTX asserts that the account is registered under the name Ka Yu Tin (also known as Nicole Tin) and that this arrangement is consistent with Alameda’s typical practice of using shell companies or employee names to obscure its trading activities.

The lawsuit alleges that although the account was ostensibly held in the name of an individual, it was funded and controlled by Alameda Research. FTX claims that following Alameda’s bankruptcy declaration, Crypto.com took the step of locking the account, subsequently denying repeated requests from FTX administrators for access to the funds. FTX contends that Crypto.com’s refusal to release the funds is based on a discrepancy in the names associated with the account, leading to complications in the recovery process.

The Role of Caroline Ellison’s Affidavit

To bolster its case, FTX has included an affidavit from Caroline Ellison, who previously served as CEO of Alameda Research. In her statement, Ellison confirmed that the accounts at Crypto.com were indeed under the control of Alameda affiliates or associated individuals. She further asserted that the assets within these accounts were always regarded as belonging to Alameda.

This affidavit plays a crucial role in establishing the legitimacy of FTX’s claim to the funds, as it directly ties the assets to a company that has been recognized as part of the bankrupt estate. FTX maintains that the assets in the Crypto.com account, valued at approximately $11.4 million as of the petition date, are significant and necessary for the estate’s recovery efforts. The firm is adamant that these assets must be returned to the debtors involved in the bankruptcy proceedings.

Additional Recovery Efforts

In conjunction with its lawsuit against Crypto.com, FTX has also initiated claims against companies affiliated with Crypto.com’s parent entities, identified as Foris MT and Iron Block. These claims amount to $18.4 million and $237,800, respectively, representing funds that were held in accounts on the now-defunct FTX.com platform before its collapse.

The strategic approach taken by FTX in pursuing these additional claims indicates a comprehensive recovery plan aimed at returning value to its creditors and users affected by the bankruptcy. FTX is requesting that any claims made by Crypto.com against the exchange be postponed until the assets linked to Alameda are released. This request underscores FTX’s intent to prioritize the retrieval of funds over other outstanding claims.

Ongoing Legal Landscape

The developments surrounding FTX’s recovery efforts are part of a broader legal context involving multiple parties and assets. Notably, the bankrupt exchange has also filed a separate lawsuit against the crypto exchange KuCoin, seeking to recover over $50 million in assets allegedly withheld in an account belonging to Alameda Research. This lawsuit, filed on October 28, further illustrates the ongoing challenges and complexities faced by FTX in navigating its bankruptcy proceedings and the retrieval of assets.

As FTX attempts to piece together its financial standing and fulfill its obligations to users, the outcomes of these lawsuits could significantly influence the trajectory of its bankruptcy case. The intertwined nature of these legal claims highlights the ongoing struggles within the cryptocurrency sector, particularly in the wake of multiple high-profile bankruptcies that have shaken investor confidence and raised questions about the regulatory landscape.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.