FTX has initiated legal action against Binance Holdings and its former CEO Changpeng Zhao, seeking to recover nearly $1.8 billion allegedly fraudulently transferred by Sam Bankman-Fried during a share repurchase deal.

Key Points

- FTX alleges that nearly $1.8 billion was fraudulently transferred during a share repurchase deal.

- The share repurchase raised questions about FTX’s financial health.

- Zhao’s tweet on November 6, 2022, triggered a surge in withdrawals from FTX.

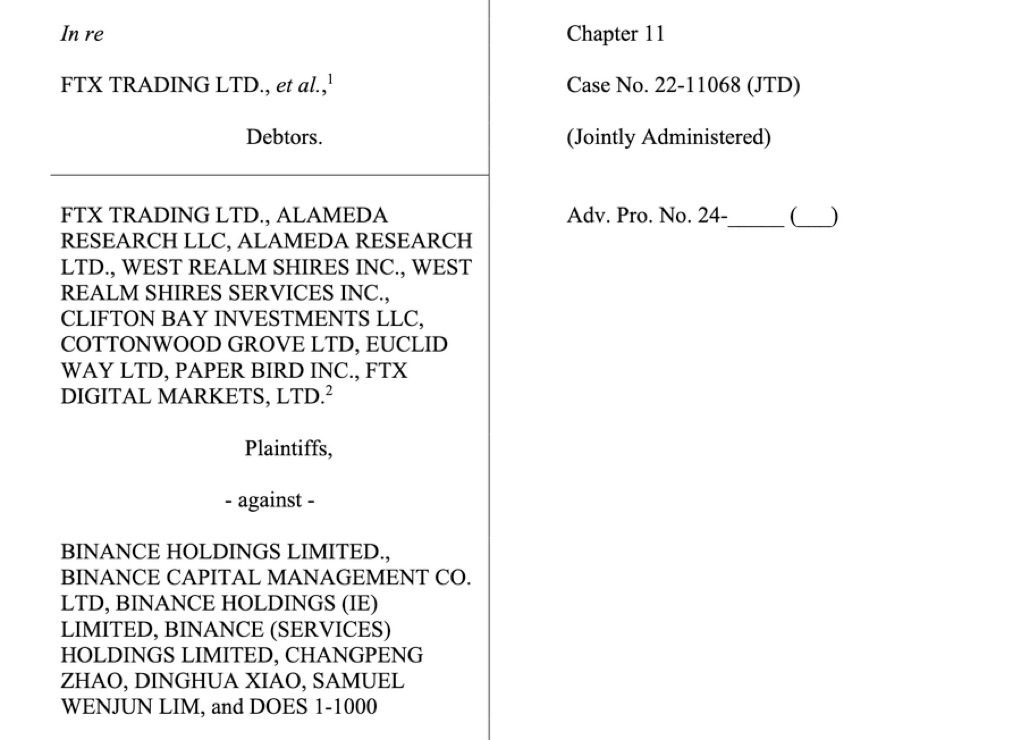

Legal Action Against Binance Holdings

FTX has taken legal action against Binance Holdings Ltd. and its former CEO, Changpeng Zhao, in an effort to recover nearly $1.8 billion. According to the lawsuit, FTX alleges that these funds were transferred fraudulently by Sam Bankman-Fried, the co-founder of FTX who is currently incarcerated. This claim is rooted in a share repurchase agreement that took place in July 2021, during which Binance, Zhao, and other executives reportedly received substantial amounts of capital from Bankman-Fried.

In this arrangement, Bankman-Fried sold approximately 20% of FTX’s international unit and 18.4% of its U.S. subsidiary. The legal documents filed by the FTX estate on November 11 outline the details of the transaction, indicating that Bankman-Fried financed this stock repurchase through a combination of FTX’s exchange token, FTT, along with Binance-branded cryptocurrencies, BNB and BUSD. The total value of these tokens at the time was estimated to be around $1.76 billion.

Financial Health of FTX

The FTX estate asserts that both FTX and its trading counterpart, Alameda Research, may have been insolvent from their inception and were certainly in a state of balance-sheet insolvency by early 2021. This assertion raises critical concerns about the legitimacy of the share repurchase transaction, suggesting that it may have been executed under fraudulent pretenses. The implications of insolvency prior to the share transfer could mean that the transaction was not only ill-advised but also legally questionable.

The situation reflects broader concerns regarding the management and financial oversight of cryptocurrency exchanges during a period of rapid growth and increased regulatory scrutiny. The allegation of insolvency indicates a potential lack of transparency and accountability within the organizations involved, which can have lasting repercussions in the realm of digital assets.

Zhao’s Social Media Actions

In addition to the claims surrounding the financial transactions, the lawsuit also targets Zhao for allegedly posting misleading and fraudulent tweets just prior to FTX’s downfall. Specifically, a tweet from Zhao on November 6, 2022, indicated that Binance intended to liquidate its holdings of FTT tokens, valued at approximately $529 million at that time. This announcement is said to have resulted in a dramatic increase in withdrawal activity from FTX, further exacerbating the exchange’s financial instability.

This incident underscores the power of social media in the cryptocurrency market, where a single comment can lead to widespread panic or shifts in behavior among investors. Zhao’s statements were perceived as maliciously aimed at damaging FTX, showcasing the competitive tensions in the rapidly evolving crypto landscape.

Broader Legal Implications

The lawsuit against Binance is part of a larger wave of legal actions taken by FTX against various former investors, affiliates, and clients amid its bankruptcy proceedings in Delaware. FTX’s strategy involves targeting a range of entities that it believes played a role in its financial decline. Other defendants named in this ongoing litigation include prominent figures and organizations, such as former White House communications officer Anthony Scaramucci and the digital asset exchange Crypto.com.

This extensive legal maneuvering illustrates the complex web of relationships and transactions that characterized the growth and subsequent collapse of FTX. As the FTX estate seeks to recoup losses, the potential outcomes of these lawsuits could have a considerable impact on the cryptocurrency sector, influencing future legal frameworks and investor confidence.

Alameda Research, FTX’s trading arm, is also pursuing its legal remedies against Aleksandr Ivanov, the founder of the Waves blockchain. Alameda is seeking to recover at least $90 million in assets allegedly tied to the FTX bankruptcy case. The legal action is based on claims that Ivanov mismanaged funds and engaged in deceptive practices that inflated the value of the WAVES token.

These developments collectively represent the ongoing struggle for recovery and accountability in the wake of significant financial losses within the cryptocurrency sector. The actions taken by both FTX and Alameda highlight a concerted effort to reclaim lost assets while navigating the complicated landscape of cryptocurrency regulations and legal precedents. The ramifications of these cases will likely resonate throughout the industry, setting important precedents for how legal disputes in the crypto space are handled in the future.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.