Goldman Sachs has significantly increased its holdings in various Bitcoin ETFs, now totaling around $710 million, with a notable 83% rise in its investments in BlackRock’s iShares Bitcoin Trust (IBIT), according to its latest SEC filing.

Key Points

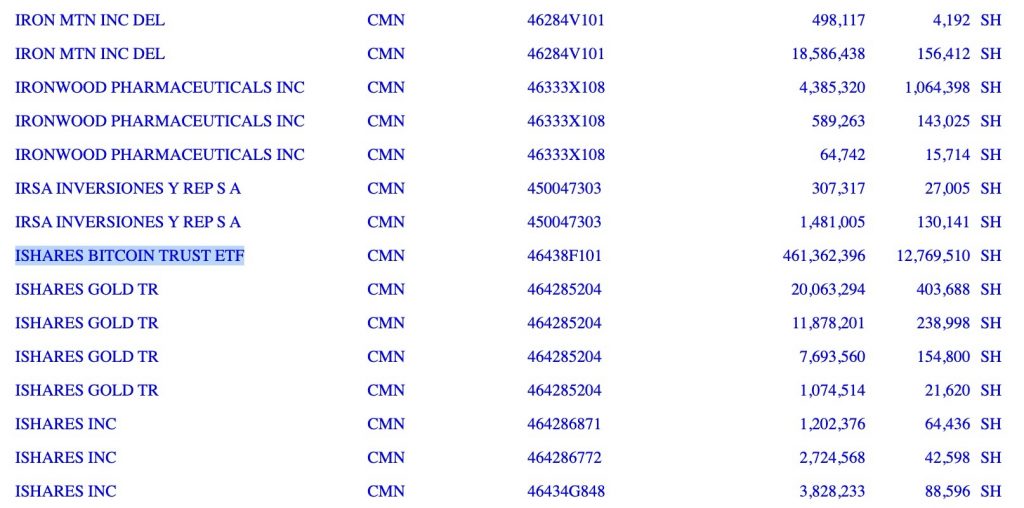

- Goldman Sachs now holds 12.7 million shares of BlackRock’s IBIT, valued at $461 million, marking a substantial increase from 6.9 million shares previously.

- The bank has expanded its investment across multiple Bitcoin ETFs, including Fidelity’s Wise Origin (FBTC), Grayscale’s Bitcoin Trust (GBTC), and Bitwise’s Bitcoin ETF (BITB).

- The approval of 11 spot Bitcoin ETFs earlier this year has facilitated institutional investment in cryptocurrencies without the need for direct ownership of the underlying assets.

Goldman Sachs’ Increased Holdings in Bitcoin ETFs

According to its recent 13F filing with the U.S. Securities and Exchange Commission (SEC), Goldman Sachs has made considerable strides in its Bitcoin ETF investments as of September 30, 2024. The firm has amplified its positions in various Bitcoin ETFs, reflecting a robust interest in digital assets amid favorable market conditions. Specifically, Goldman Sachs reported an impressive $461 million investment in BlackRock’s iShares Bitcoin Trust (IBIT), which corresponds to 12,769,510 shares. This marks a significant increase of 83% from its previous level of approximately 6.9 million shares.

This additional exposure has placed Goldman Sachs as the second-largest holder in this category, trailing only Millennium Management, which has approximately $844 million in IBIT shares. This dramatic increase in IBIT holdings underscores Goldman Sachs’ strategic positioning within the growing cryptocurrency market and reflects a bullish outlook on the future of Bitcoin.

Expansion into Various Bitcoin ETFs

In addition to its substantial investment in IBIT, Goldman Sachs has diversified its cryptocurrency exposure through investments in other Bitcoin ETFs. The firm currently holds over 1.7 million shares of Fidelity’s Wise Origin Bitcoin ETF (FBTC), valued at $95.5 million, which is a 13% increase from its previous holdings. Furthermore, Goldman Sachs has increased its stake in Grayscale’s Bitcoin Trust (GBTC) to over 1.4 million shares, equating to a valuation of $71.8 million, representing a remarkable 116% increase from earlier disclosures.

Moreover, Goldman Sachs’ investment in Bitwise’s Bitcoin ETF (BITB) has also seen substantial growth. The bank now owns 650,961 shares valued at $22.5 million, reflecting a striking 156% increase since the last filing. The firm has also maintained a steady position in BTCO, holding $59.7 million without any change from previous reports. This diverse range of holdings across various ETFs illustrates Goldman Sachs’ strategy to capitalize on the expanding opportunities within the cryptocurrency market.

Regulatory Changes and Market Impact

With the U.S. regulatory environment becoming more accommodating for cryptocurrency products, firms like Goldman Sachs are now able to gain exposure to Bitcoin and other digital assets without directly holding the cryptocurrency itself. This regulatory shift has allowed for increased institutional participation in the crypto economy, contributing to the growing legitimacy of Bitcoin as an investment vehicle.

The implications of these regulatory developments have been felt across the broader market. Bitcoin reached a peak valuation of +$93,000 on November 13, 2024, following widespread anticipation of a cryptocurrency rally, partly fueled by Donald Trump’s electoral win. Although Bitcoin experienced a slight decline of 4.5% after this peak, the overall market sentiment remains bullish, with many analysts expecting further growth.

Future Projections and Market Sentiments

Analysts and cryptocurrency enthusiasts are keeping a close watch on Bitcoin’s price trajectory, with predictions varying based on market conditions and regulatory developments.

Some prominent figures in the cryptocurrency sector, such as Microstrategy CEO Michael Saylor, have expressed their belief that Bitcoin could reach $100,000 before the year ends. As institutional interest continues to rise alongside positive market sentiment, the future of Bitcoin and its associated ETFs looks increasingly promising.

Overall, Goldman Sachs’ significant investments in Bitcoin ETFs highlight a growing trend among institutional investors to engage more deeply with digital assets, driven by a favorable regulatory landscape and evolving market dynamics.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.