Grayscale Investments has filed with the NYSE for a Solana spot ETF, aiming to convert its Solana Trust into an exchange-traded product, signaling increasing institutional interest in Solana amidst a shifting regulatory environment.

Key Points

- The Grayscale Solana Trust holds approximately $134.2 million in assets, making it the largest SOL investment fund.

- Private keys for SOL are managed in secure vaults by Coinbase Custody, ensuring high-level protection.

- The Grayscale Solana Trust is often priced at a premium over its net asset value (NAV), which may lead to future pricing fluctuations.

Grayscale’s Application for a Solana Spot ETF

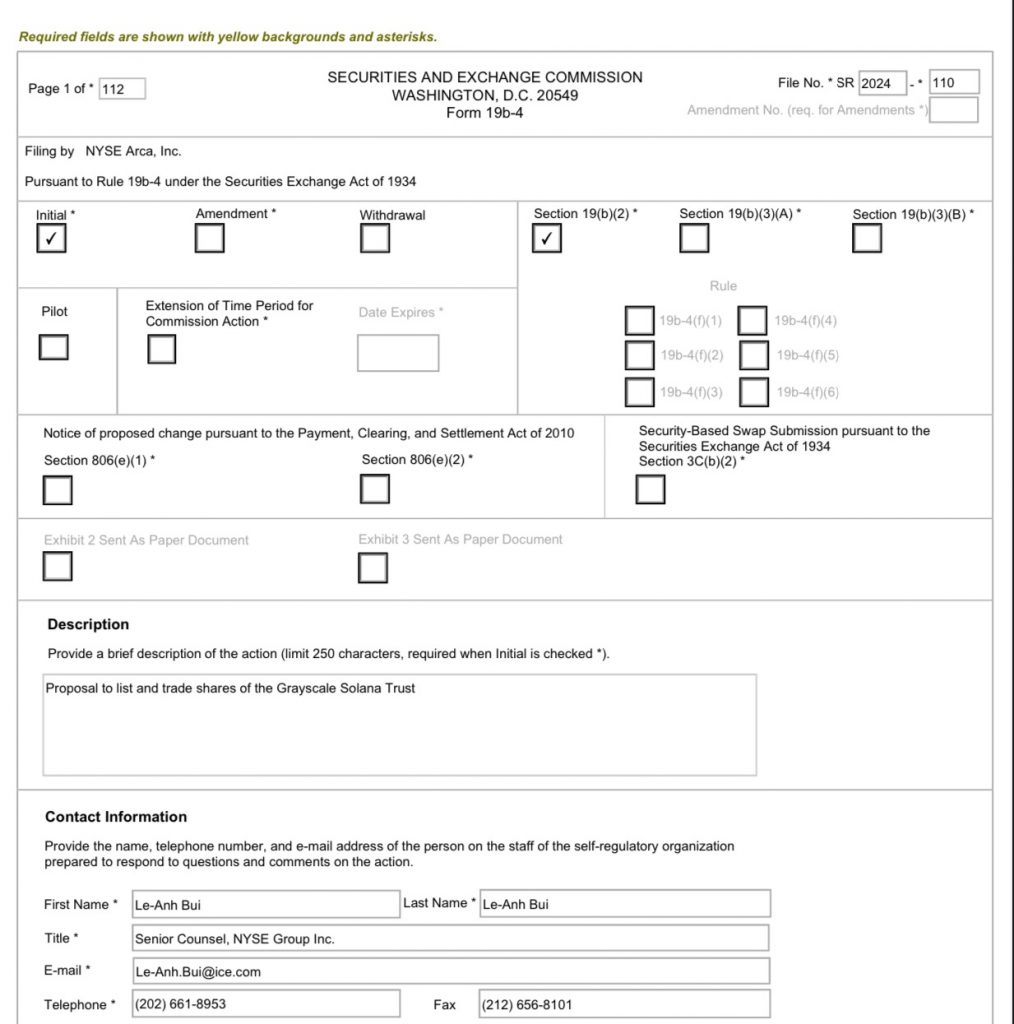

Grayscale Investments has submitted a formal application to the New York Stock Exchange (NYSE) for a Solana spot Exchange-Traded Fund (ETF), indicating its intention to transform the existing Grayscale Solana Trust into a regulated ETF product. This move is captured in a 19b-4 filing, a necessary protocol for introducing new securities for listing on an exchange, with the filing date recorded as December 3, 2024.

The proposed ETF would allow Grayscale to list the trust on the NYSE under established regulatory frameworks governing commodity-based trust shares.

Currently, the Grayscale Solana Trust trades over-the-counter (OTC) but seeks to align its offerings with traditional exchange-listed products. This transition could enhance the trust’s visibility and accessibility to a broader range of investors, including institutional players increasingly interested in the Solana ecosystem.

Contextual Background and Implications

The filing by Grayscale aligns with a broader trend among institutional investors showing a keen interest in Solana, a blockchain platform recognized for its operational efficiency and rapid transaction capacity. Other asset managers such as Bitwise, Canary Capital, VanEck, and 21Shares are also pursuing similar applications for Solana ETFs, indicating a collective movement toward mainstream acceptance of Solana as an investment asset.

Investor sentiment is notably optimistic, as observed from discussions on social media platforms. Enthusiasm within the crypto community suggests that the approval of such an ETF could strengthen institutional confidence in Solana, further legitimizing its market position. This momentum could translate to increased investment products linked to Solana, broadening options for retail and institutional investors alike.

Regulatory Environment and Market Dynamics

The timing of Grayscale’s filing coincides with expectations of potential changes in the U.S. Securities and Exchange Commission (SEC) leadership, which could influence policies related to cryptocurrency and ETF approvals. Although the SEC has previously exercised caution, particularly with regard to spot ETFs, emerging leadership may prompt a reevaluation of regulatory stances. This creates a layered complexity in Grayscale’s pursuit of ETF approval, as the regulatory landscape remains fluid.

If the ETF is approved, it may offer investors a more structured and regulated method to gain exposure to Solana without directly managing the cryptocurrency. The existence of a spot ETF could also provide a more accurate valuation of SOL in the market, potentially decreasing discrepancies between the trust’s share price and the underlying asset’s market value.

Challenges and Considerations in Approval

Navigating the regulatory approval process poses significant challenges for Grayscale. The SEC’s historical reluctance to approve spot crypto ETFs is underscored by previous rejections of Bitcoin spot ETF applications. Given these precedents, Grayscale’s current filing may face a lengthy review process, necessitating thorough scrutiny to satisfy regulatory benchmarks.

Additionally, the Grayscale Solana Trust is trading at substantial premiums over its net asset value, reflecting high demand but also raising concerns about potential price corrections if market conditions shift post-ETF approval. Such dynamics suggest that while there is interest in the trust, fluctuations in asset valuation may occur, influencing investor strategies.

Security and Operational Insights

The Grayscale Solana Trust is positioned as the largest investment fund for SOL, managing about $134.2 million in assets. Each share of the trust represents a proportional interest in its SOL holdings, adjusted for liabilities and fees. Currently, the trust does not actively manage these assets, choosing instead to hold SOL exclusively.

Robust security measures are in place, with private keys secured in geographically distributed vaults managed by Coinbase Custody, reinforcing the safety of digital assets. This custodial approach mitigates risks associated with digital asset management, ensuring that keys are generated in secure environments to prevent unauthorized access.

The introduction of a spot ETF could attract both institutional and retail investors seeking exposure to Solana without the complexities of directly handling the cryptocurrency. As the crypto market continues to evolve, the developments surrounding Grayscale’s filing may serve as a tipping point for further mainstream adoption of Solana and related investment vehicles.

This news coincides with ongoing efforts by other issuers, including Bitwise, seeking various crypto ETF approvals with the SEC. As of now, Bitcoin is trading at approximately $96,113.98, with a Fear & Greed Index score of 79 indicating a market sentiment leaning toward greed.

In conclusion, Grayscale’s application for a Solana spot ETF represents a significant milestone within the cryptocurrency landscape, emphasizing institutional interest and the potential for broader market acceptance of Solana as an investment asset, while the regulatory complexities remain a crucial factor in the approval process.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.