Kamala Harris’s odds of winning the U.S. presidential election have risen on Polymarket amid increasing allegations of election fraud against Donald Trump, highlighting a significant shift in trader sentiment and market dynamics as the election approaches.

Key Points

- Polymarket operates as a decentralized betting platform with dynamic odds.

- Traders are adjusting positions in response to voting irregularities and polling data

- Polymarket has seen increased activity but faces scrutiny over potential wash trading.

Harris’s Rising Odds on Polymarket

On the betting platform Polymarket, the odds of Kamala Harris winning the upcoming U.S. presidential election have seen a notable increase.

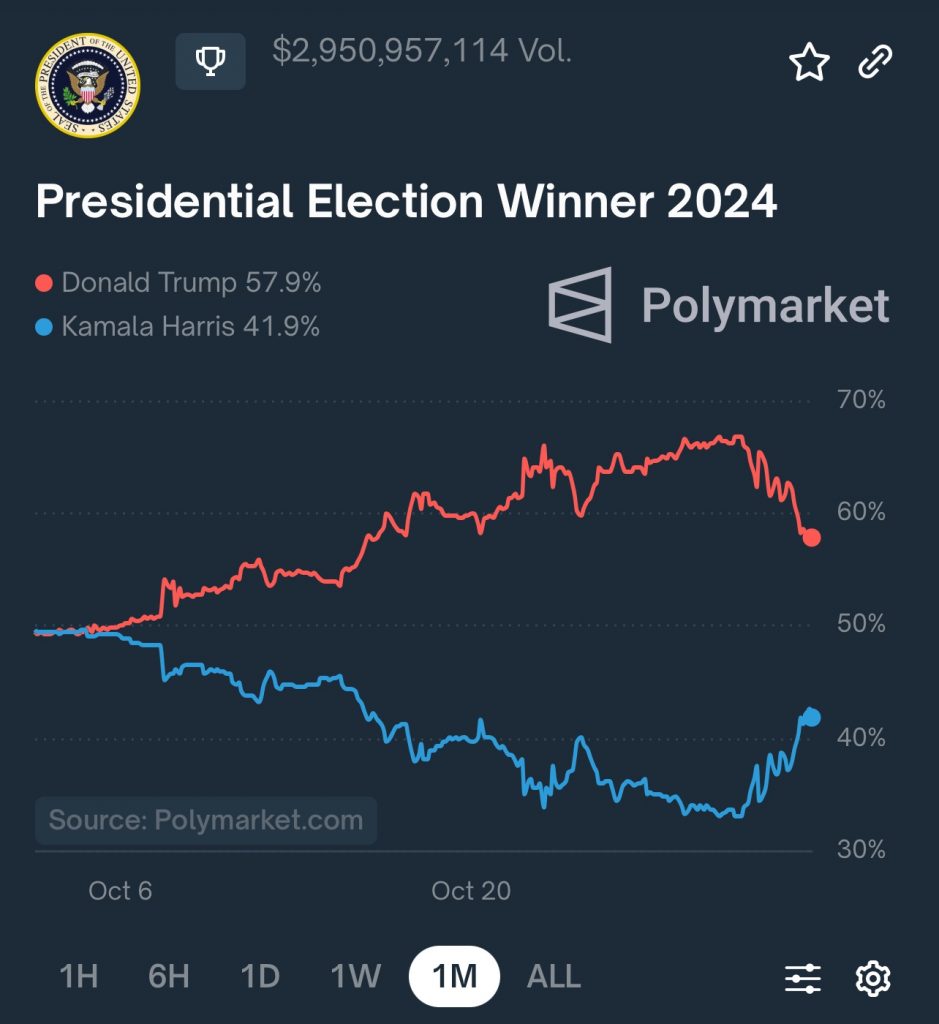

As of October 30, her chances were estimated at 33%, which has risen to approximately 42% in the days leading up to the election. This shift in odds is accompanied by a corresponding decline in Donald Trump’s chances, which have decreased to 58%. Analysts suggest that this change may reflect traders hedging their positions, as significant trades exceeding $10,000 indicate substantial investments in Harris alongside protective strategies against a potential Trump victory.

Traders on Polymarket can place bets on various outcomes, with the market interpreting the cost of shares as probabilities for those outcomes. For example, if a share for Harris’s victory is priced at $0.60, it suggests a 60% likelihood according to market consensus. The dynamic nature of these odds highlights how quickly trader sentiment can shift, influenced by both external events and internal market activities.

The Impact of Market Activity

The recent trading activity on Polymarket has demonstrated significant engagement, especially with large transactions. Reports indicate a surge in trades of over $10,000, with a notable focus on purchasing Harris “yes” shares and Trump “no” shares. This suggests a strategic approach by traders who are looking to mitigate risks associated with their Trump investments. For instance, a $10,000 bet on Harris could yield a payout of $23,900 if she emerges victorious, representing a 139% return on investment.

Market participants are continuously adjusting their strategies based on the evolving political landscape and the potential ramifications of voter behavior. As the election approaches, this activity is not only indicative of growing interest in the betting markets but also highlights the intricate relationship between public sentiment, polling data, and market movements.

Election Odds and Swing States

As the electoral race tightens, recent polling and market trends have shown significant changes in the odds pertaining to key battleground states. Particularly in Michigan and Wisconsin, Harris has seen a rise in her odds of winning by 5% and 6%, respectively, following the release of a CNN poll that indicated no clear frontrunner. With these shifts, Harris’s overall odds of winning the election increased to 39.6%, although she still trails Trump’s 60.3%.

The importance of swing states like Pennsylvania cannot be overstated, as they are pivotal in determining the election outcome. Current data suggests that Trump holds a lead in Pennsylvania, but the competitive nature of these states indicates that the election could still hinge on voter turnout and sentiment in these critical regions. Overall, while Trump maintains an advantage in terms of odds, the momentum is shifting, underscoring the volatility that is characteristic of election seasons.

Record Participation and Market Integrity

The heightened interest in the 2024 election has led to unprecedented levels of participation on Polymarket, with the platform reporting 220,682 unique traders in October—a remarkable 174% increase from the previous month. This surge in user engagement has translated into a monthly trading volume of nearly $2.3 billion, marking a 353% increase over the same period. Notably, approximately 85% of the activity on Polymarket last month was related to election betting, reflecting the market’s central role in gauging political sentiments.

However, alongside this growth, concerns regarding market manipulation have emerged. A study by Chaos Labs suggested that Polymarket might be susceptible to “wash trading,” where traders buy and sell shares to create misleading appearances of volume and price movements. Although these allegations remain unproven, they highlight the need for scrutiny in prediction markets. Industry voices, such as Tarek Mansour, CEO of prediction market Kalshi, argue that the integrity of betting odds in such markets remains intact despite these concerns.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.