BlackRock’s iShares Bitcoin Trust (IBIT) achieved a record single-day inflow of $1.12 billion on November 7, contributing to a total of $1.38 billion across all U.S. spot Bitcoin ETFs, signifying significant investor interest following the recent presidential election and favorable market conditions.

Key Points

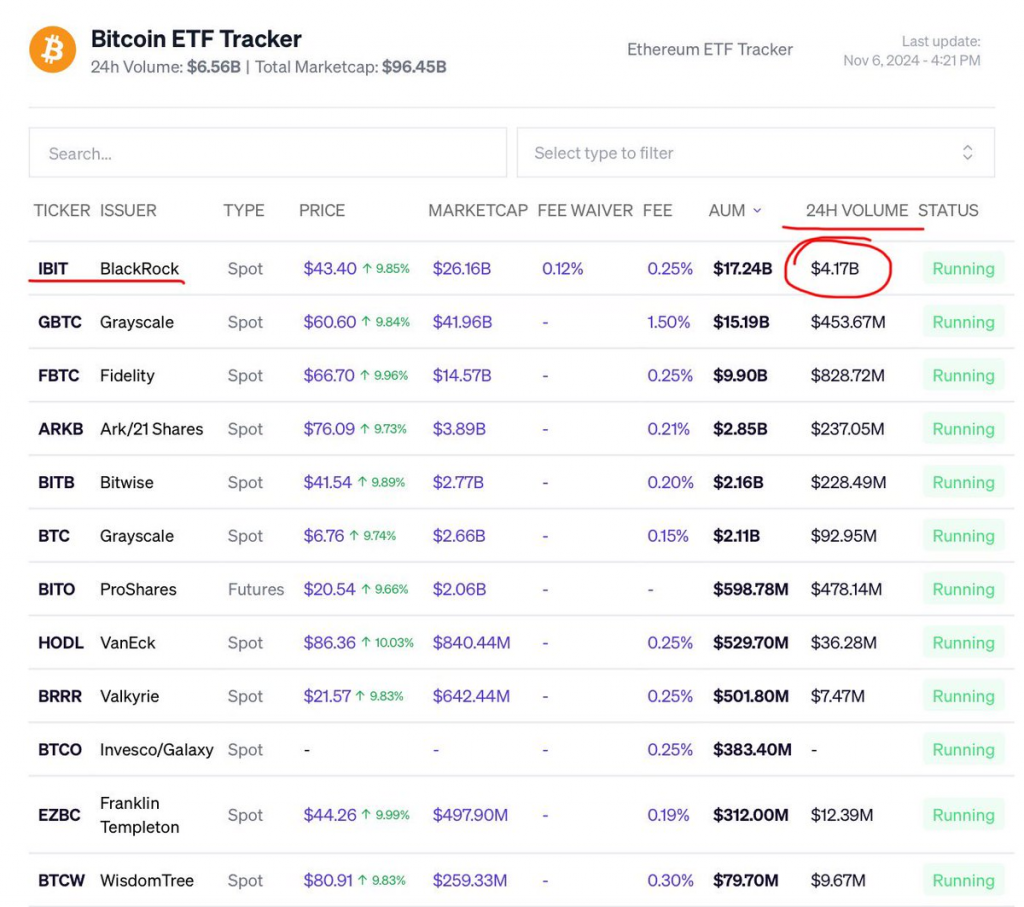

- On November 6, IBIT attained a remarkable trading volume of $4.1 billion, surpassing some traditional equities.

- IBIT’s consistent inflows contrast with outflows seen in other competitors like Grayscale’s GBTC.

- Donald Trump’s re-election has been perceived as a catalyst for increased cryptocurrency investments.

BlackRock’s Record Inflows

On November 7, BlackRock’s iShares Bitcoin Trust (IBIT) recorded a historic inflow of $1.12 billion, setting a new benchmark for single-day inflows into spot Bitcoin ETFs. This unprecedented capital movement highlighted the growing acceptance and interest in cryptocurrencies, particularly among institutional investors. The total inflow for all 12 U.S. spot Bitcoin ETFs reached $1.38 billion on that day, making it the highest daily inflow since these products were introduced in January.

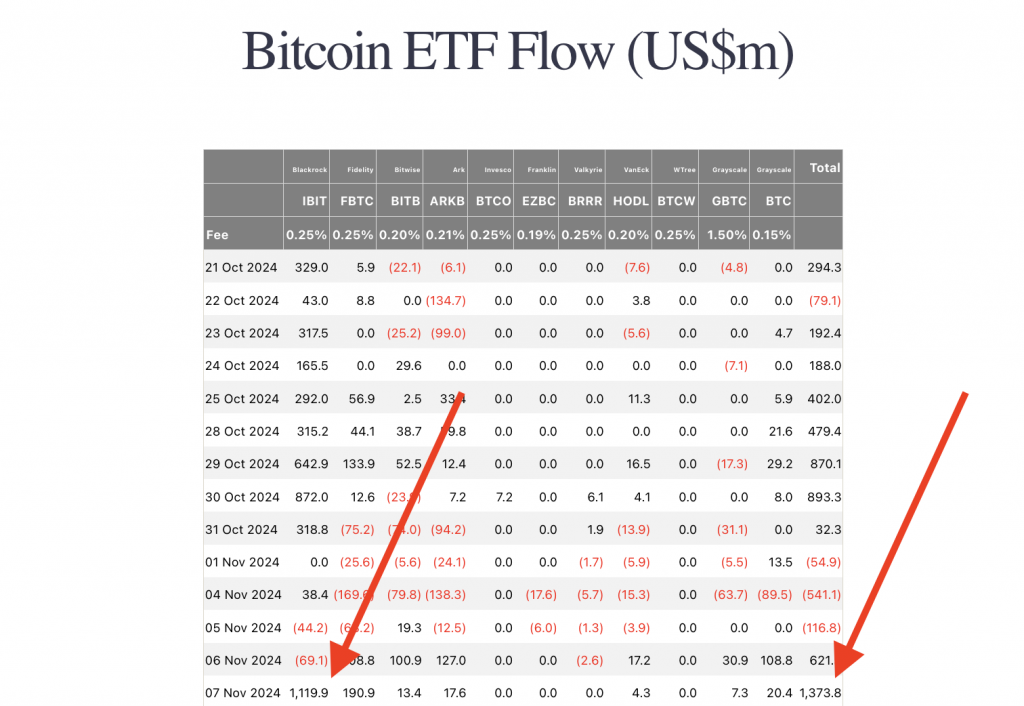

The previous record for IBIT was established on October 30, when it garnered $875 million in inflows. The significant increase in investor participation can be attributed to multiple factors, including BlackRock’s established reputation in financial markets, recent surges in Bitcoin prices, and the overall favorable conditions in the cryptocurrency market. Some analysts pointed out that institutional trust, fear of missing out (FOMO), and delayed capital flows following price increases are key contributors to this trend.

Market Conditions and Investor Sentiment

The record inflows into BlackRock’s Bitcoin ETF occurred concurrently with a historic trading volume of over $4 billion on November 6. This level of trading activity was unprecedented for the ETF, indicating a robust investor appetite for Bitcoin and related financial products. The surge in trading volume not only surpassed that of other Bitcoin ETFs but also outperformed many leading equities, reflecting a significant shift in market dynamics.

Moreover, the context of the recent U.S. presidential election has played a vital role in shaping investor sentiment. The election of Donald Trump, viewed favorably by segments of the crypto community, has sparked optimism for potential pro-crypto policies. Analysts suggest that Trump’s commitment to protecting crypto mining interests and establishing a Bitcoin reserve has resonated positively with institutional investors.

Comparative Performance of Bitcoin ETFs

In addition to BlackRock’s success, other notable asset managers have also reported significant inflows into their Bitcoin ETFs. Fidelity’s FBTC attracted $190.9 million, while Grayscale’s mini trust added $20.4 million, according to data from Farside Investors. Other funds like those from Ark & 21Shares, Bitwise, VanEck, and Valkyrie also experienced net inflows that contributed to the total of $1.38 billion across the 12 U.S. spot Bitcoin ETFs.

Despite this overall positive trend, some traditional Bitcoin investment vehicles, such as Grayscale’s GBTC, have encountered challenges. Grayscale’s high fees have led to negative outflows lasting for several months, while IBIT benefits from a much lower management fee of 0.25%, which is currently waived until January. This fee structure, combined with the strong performance of Bitcoin prices, underscores the competitive landscape in the cryptocurrency fund market.

The recent inflows into BlackRock’s iShares Bitcoin Trust and other spot Bitcoin ETFs represent a significant moment for the cryptocurrency market, driven by increased investor confidence and favorable economic conditions. The interplay between political developments, monetary policy, and market dynamics is reshaping the landscape for institutional cryptocurrency investment, suggesting a promising outlook for the future of Bitcoin and related financial products. The continuing evolution of the cryptocurrency market will be closely monitored, particularly as more institutions consider Bitcoin ETFs as viable investment vehicles.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.