This story is still under development and its content, sources or opinions may change over time.

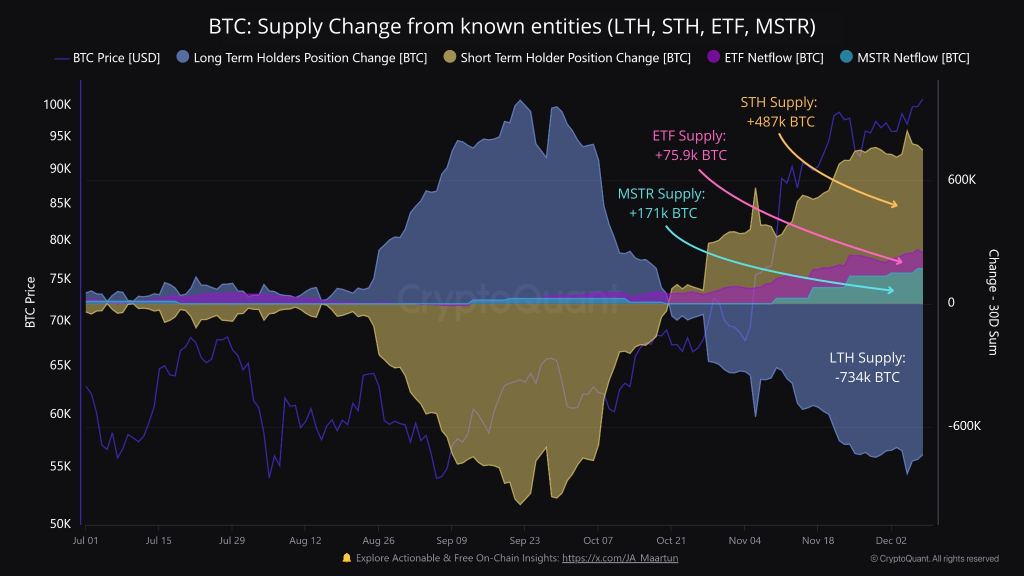

Over the past 30 days, Bitcoin long-term holders have sold over 734,000 BTC, while institutional demand has increased, leading to a net absorption of 487,000 BTC by short-term holders.

Key Points

- Despite significant selling by long-term holders, Bitcoin’s trading volume has remained high.

- MicroStrategy’s purchase of an additional 171,000 BTC reflects sustained institutional interest.

- The high level of trading activity among short-term holders contributes to market volatility.

Long-Term Holder Selling Activity

Recent data shows that Bitcoin long-term holders (LTHs) have engaged in extensive selling over the last 30 days, offloading approximately 734,000 BTC. This sell-off marks the highest activity level since April 2024, coinciding with Bitcoin’s price movements as it surpassed $100,000 milestone. Analysts are monitoring this trend closely, as it raises discussions about potential market corrections or the possibility of a short-term peak in prices.

The behavior of LTHs during price surges is often viewed as a contrarian indicator, suggesting they might be taking profits rather than signaling a bearish trend. However, the scale of the current sell-off has sparked concerns surrounding market saturation, indicating a potential lack of new buying interest at current price levels.

Institutional Engagement in the Market

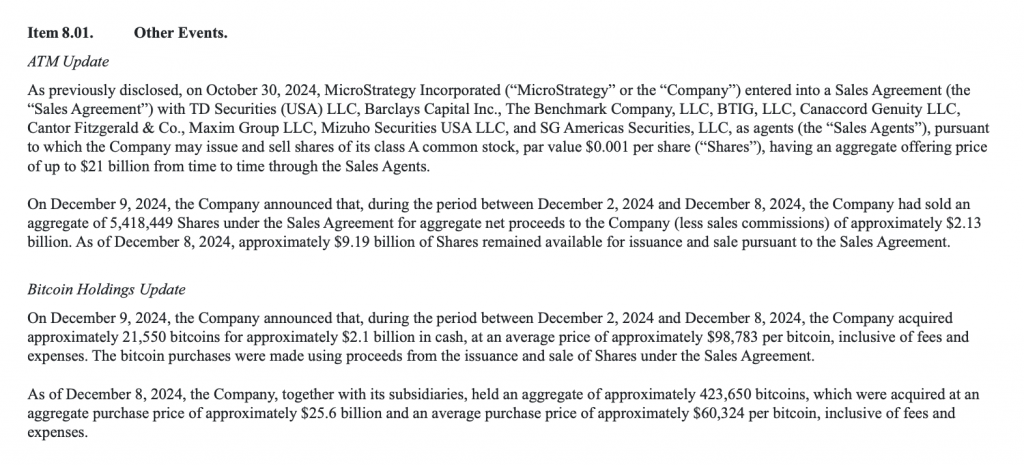

Amid the significant sell-off by LTHs, various entities have stepped in to absorb the supply. Notably, MicroStrategy has augmented its Bitcoin holdings by 171,000 BTC, reflecting increasing institutional confidence in the cryptocurrency market. Additionally, Bitcoin ETFs have seen inflows of 75,900 BTC, indicating sustained interest from institutional investors looking to gain exposure to Bitcoin through regulated financial products.

Despite this absorption, the overall volume of institutional purchases has not fully offset the LTH sell-off, suggesting that while institutional interest remains robust, it may not be sufficient to mitigate the pressure created by the substantial selling from long-term holders. The presence of such institutional players could lend stability to the market, although the ongoing sell-off raises questions about the sustainability of current price levels.

Market Dynamics and Price Volatility

The net absorption of 487,000 BTC by short-term holders (STHs) highlights ongoing demand for Bitcoin among market participants looking for short-term gains. This behavior suggests active speculation within the market despite the significant selling pressure from LTHs. The ongoing trading activities of STHs could indicate confidence in potential future price increases, yet they also introduce a layer of volatility.

The market’s ability to absorb the LTH sell-off without severe price declines is noteworthy. However, it raises concerns about balance; if STHs were to sell their holdings quickly due to adverse market developments, the potential for increased volatility or price corrections would rise. The current atmosphere of high trading volumes and active speculation may create a precarious environment, prompting analysts to watch for signs of market correction or stabilization.

Implications for Future Market Movements

Observers in the cryptocurrency sector will closely monitor whether the trend of LTH selling and STH buying continues and how this affects Bitcoin’s price trajectory. The current price of Bitcoin is reported at approximately $97,546.64, with the Fear & Greed Index indicating extreme greed at 83, suggesting that market sentiment is favoring bullish trends. However, extreme sentiment can often precede corrections, highlighting the need for vigilance among traders and investors.

Additionally, on-chain metrics indicate a reduction in LTH supply and suggest ongoing shifts in market dynamics. Indicators such as the Market-Value-to-Realized-Value (MVRV) and Net Unrealized Profit/Loss (NUPL) for LTHs further illustrate the complexity of the current market landscape. These metrics indicate that while there may still be room for further growth, market participants should remain aware of the historical context where significant sell-offs have previously led to price corrections.

In summary, the recent activity involving the sale of over 734,000 BTC by long-term holders has created notable selling pressure in the market. The response has been mixed, with institutional buying providing some counterbalance to LTH selling. Future developments in this dynamic will be crucial for understanding the trajectory of Bitcoin’s market performance.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.