The crypto casino MetaWin suffered a significant exploit on its hot wallets, resulting in the theft of over $4 million in Ethereum (ETH) and Solana (SOL), marking a continuation of alarming cybersecurity breaches in the decentralized finance (DeFi) sector.

Key Points

- MetaWin’s CEO reported that access to the platform was restored, stolen funds replenished, and law enforcement notified.

- October 2024 saw 20 reported crypto attacks, resulting in losses of approximately $88.47 million.

- Phishing and private key compromises have led to significant losses, highlighting vulnerabilities in user security.

MetaWin Hacked: Overview of the Incident

On November 3, 2024, the crypto casino MetaWin was compromised, leading to the loss of roughly $4 million due to an exploit targeting the platform’s withdrawal system. Hackers managed to breach the hot wallets associated with Ethereum and Solana, leveraging what the CEO, Richard Skelhorn, described as a “frictionless withdrawal system.” This incident has raised considerable security concerns given the rising number of similar attacks on decentralized finance platforms.

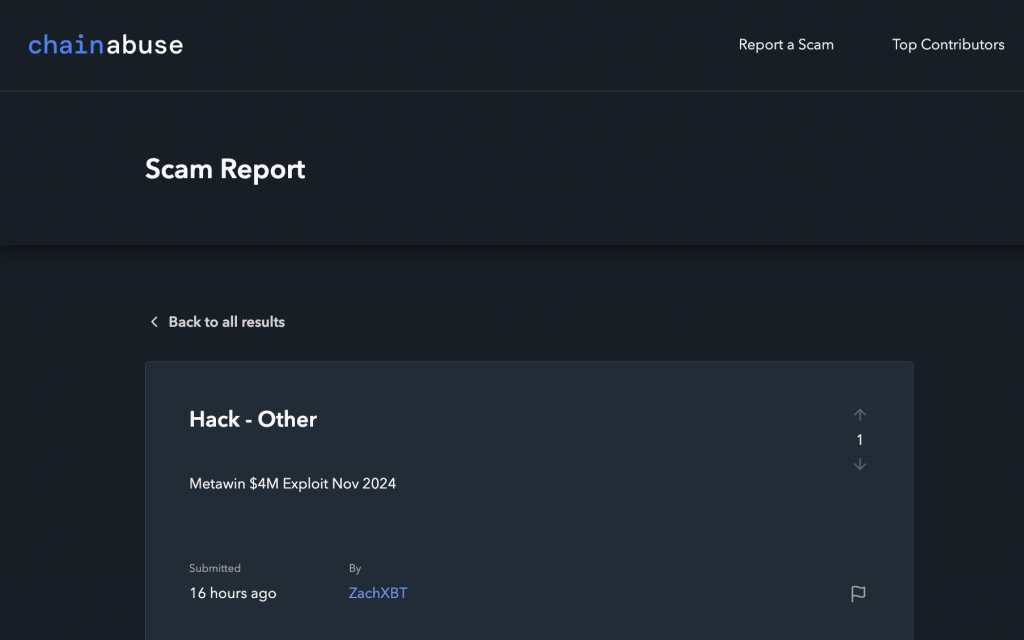

Blockchain investigator ZachXBT was quick to flag the exploit on Telegram, indicating that the hackers were able to trace the stolen assets to more than 115 addresses. The illicit funds were subsequently transferred to cryptocurrency exchanges KuCoin and a nested service on HitBTC, raising alarms about the potential for laundering the stolen assets. In response to the breach, MetaWin temporarily disabled withdrawals until security measures could be reassessed.

Restoration Efforts and Internal Adjustments

In light of the attack, Skelhorn detailed the steps taken by MetaWin to recover from the incident. He announced that access to the platform had been restored and that they had backfilled the stolen assets from the company’s reserves. Furthermore, the CEO confirmed that law enforcement had been contacted regarding the breach, signaling a serious attempt to track and recover the stolen funds.

Skelhorn’s transparency in addressing the incident included a personal note about covering the losses, stating, “I just emptied my piggy bank.”. He emphasized that the focus would not be on dwelling on the hack but rather on making necessary internal adjustments to enhance security and maintain user trust.

Context of Ongoing Cyber Threats in the Crypto Sector

Significant incidents this month included the $58 million hack of Radiant Capital, where attackers targeted weaknesses in the platform’s smart contracts, and the theft of nearly $20 million from a U.S. government-linked wallet.

The return of most stolen funds from the latter incident adds an unusual twist to the ongoing crime wave, emphasizing the unpredictable nature of cybersecurity in the cryptocurrency world.

Phishing attacks and private key compromises remain two of the most prevalent methods by which hackers infiltrate crypto platforms. These attacks generally involve tricking users into revealing private keys or clicking on malicious links, resulting in devastating financial consequences.

Other methods, such as code vulnerabilities and re-entrancy exploits, have also emerged as significant threats. These techniques leverage weaknesses in smart contract programming to enable hackers to drain assets by executing multiple contract calls in a single transaction, a tactic that continues to be effective.

The high-stakes environment of cryptocurrency trading and investment demands continuous scrutiny and adaptation to emerging threats, ensuring that security is always a top priority for all participants in this rapidly changing industry.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.