The State of Michigan’s pension fund has revealed substantial investments in both Ethereum and Bitcoin ETFs, with approximately $10 million allocated to Grayscale’s Ethereum Trusts and $6.9 million in the ARK Bitcoin ETF, indicating a growing adoption of cryptocurrency assets among institutional investors.

Key Points

- The Michigan pension fund is the first public pension fund in the U.S. to invest in an Ethereum ETF.

- The fund holds approximately $10 million in Grayscale’s Ethereum Trusts.

- The pension fund has also invested $6.9 million in the ARK Bitcoin ETF.

Michigan Pension Fund’s Investment in Ethereum

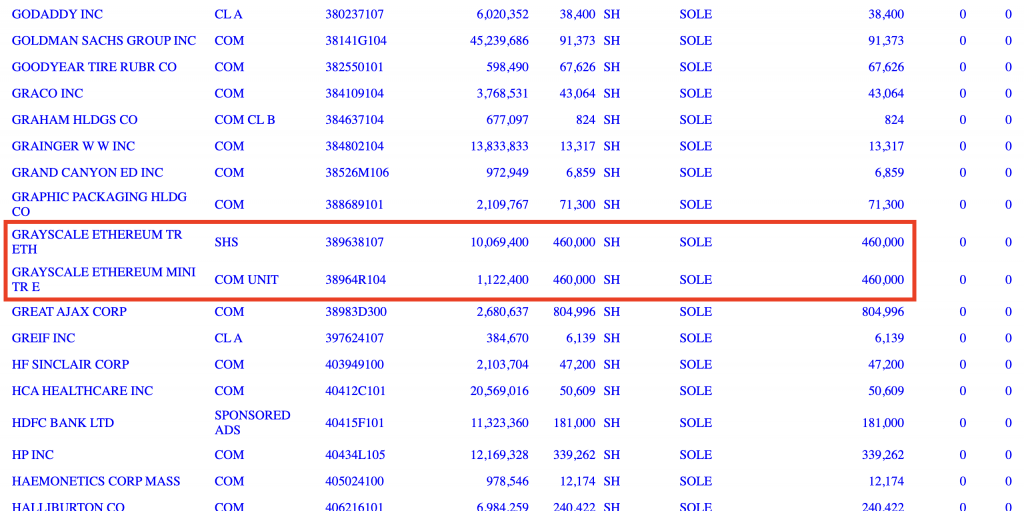

The State of Michigan’s pension fund has officially disclosed its investment in Ethereum, making headlines as the first public pension fund in the United States to venture into Ethereum ETFs. According to documents submitted to the U.S. Securities and Exchange Commission (SEC), the fund acquired approximately 460,000 shares of Grayscale’s Ethereum Trust. This move underscores the increasing institutional adoption of cryptocurrencies, as pension funds, which have traditionally favored more stable asset classes, begin to explore the potential of digital currencies.

As of the close of the third quarter, the Michigan pension fund reported its holdings in Grayscale’s Ethereum Trust valued at around $10 million. This substantial investment indicates a strategic shift toward including digital currencies in mainstream investment portfolios. The move not only positions Michigan’s pension fund as a pioneer among U.S. public pension funds but also highlights the escalating interest in Ethereum as a legitimate asset class within institutional circles.

Bitcoin Investment and SEC Disclosure

The State of Michigan’s pension fund has also disclosed its $6.9 million investment in the ARK Bitcoin ETF unchanged. The SEC filing indicates that the pension fund still holds approximately 110,000 shares of the Bitcoin investment vehicle. This report reiterates the pension fund’s sustained interest in cryptocurrency, particularly Bitcoin, which has been gaining traction among institutional investors.

This is particularly relevant considering the broader trend of pension funds exploring digital assets, which has gained momentum since the approval of the first U.S. crypto-based ETF earlier this year. The pension fund’s ongoing involvement signifies a growing acceptance of Bitcoin and Ethereum as potential investment opportunities in the face of an evolving financial landscape.

Broader Trends in Institutional Crypto Investments

The activities of Michigan’s pension fund are part of a larger narrative of institutional adoption of crypto. Other states have made similar announcements, reflecting a shift in the approach of traditional institutional investors towards digital assets. Notably, the State of Wisconsin’s retirement fund has reported investments in both BlackRock’s iShares Bitcoin Trust and the Grayscale Bitcoin Trust, collectively valued at $162 million as of March. This trend suggests that institutional investors are increasingly willing to allocate a portion of their portfolios to cryptocurrencies, signaling potential maturation of the crypto market.

Moreover, the incremental investments by pension funds like Michigan’s and Wisconsin’s illustrate a growing recognition of the importance and legitimacy of cryptocurrencies in the investment world. As these funds seek to enhance their portfolios and meet the expectations of beneficiaries, the exploration of digital assets may become a standard practice among institutional investors.

The investments by the State of Michigan’s pension fund in both Ethereum and Bitcoin ETFs reflect a significant shift in the investment landscape, showcasing the growing interest of institutional investors in cryptocurrency assets. With substantial investments in Grayscale’s Ethereum Trust and the ARK Bitcoin ETF, Michigan’s pension fund is not only participating in the burgeoning crypto economy but also setting a precedent for other public pension funds across the United States.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.