MicroStrategy has ascended to the 97th position among publicly traded companies in the U.S., fueled by a significant stock price increase and its ongoing commitment to Bitcoin investments, which has resulted in a remarkable year-to-date growth of over 500%.

Key Points

- MicroStrategy has boosted its latest convertible note offering from $1.75 billion to $2.6 billion, reflecting bullish market sentiment on Bitcoin’s future price potential.

- Since adopting Bitcoin as a treasury asset in August 2020, MicroStrategy has significantly increased its Bitcoin holdings, which now total 331,200 BTC, valued at over $30 billion.

- Over the last five years, MicroStrategy’s stock has surged 2,739%, eclipsing NVIDIA’s 2,688% increase during the same period, highlighting the performance impact of its Bitcoin investments.

MicroStrategy Enters the Top 100 Public Companies

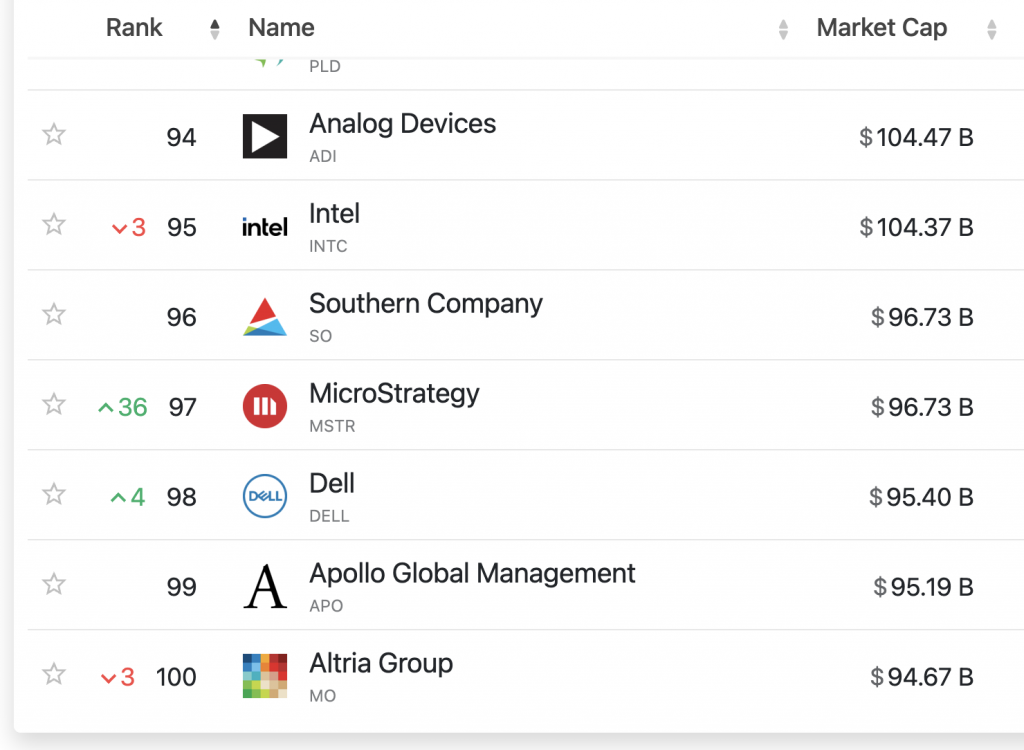

MicroStrategy (MSTR) has successfully entered the upper echelon of publicly traded companies in the United States, securing the 97th spot based on market capitalization. This notable achievement follows a substantial 11.39% increase in its stock price, which concluded on Tuesday at $430 per share after briefly surpassing the $400 threshold earlier in the day. This upswing is closely correlated with Bitcoin reaching a new all-time high of over $94,000, showcasing the intertwined nature of MicroStrategy’s financial performance with the cryptocurrency market.

The ascent within the ranks of public companies signals a remarkable turnaround for MicroStrategy, primarily known for its aggressive Bitcoin investment strategy. The company has established itself as a pivotal player in the cryptocurrency landscape, leveraging its holdings to drive shareholder value. With a current market capitalization of +$96 billion, MicroStrategy stands as the largest corporate holder of Bitcoin, reinforcing the significance of digital currencies in conventional financial markets.

Exceptional Stock Performance

In 2024, MicroStrategy has emerged as one of the most compelling narratives in the stock market, with its shares soaring well over 528% year-to-date. This performance surpasses Bitcoin’s own growth of approximately 113% during the same timeframe, illustrating MicroStrategy’s success as a corporate entity heavily invested in cryptocurrency.

These extraordinary numbers underscore the effectiveness of MicroStrategy’s strategic pivot to Bitcoin as a treasury asset, a decision initiated in August 2020. The firm’s commitment to accumulating Bitcoin has proven lucrative, as it now holds 331,200 BTC, valued at over $30 billion based on market fluctuations. This considerable investment positions MicroStrategy not only as a tech company but also as a formidable player in the cryptocurrency market.

Funding Bitcoin Purchases Through Convertible Notes

On November 18, MicroStrategy announced its acquisition of Bitcoin worth $4.6 billion, emphasizing its ongoing dedication to building its cryptocurrency portfolio. To facilitate further purchases, the company revealed plans to raise an additional $2.6 billion through a new issuance of convertible senior notes, increasing its previously announced offering from $1.75 billion. The notes, which bear a 0% interest rate and are set to mature in December 2029, will provide investors the option to convert their debt into equity, a strategy that has been a hallmark of MicroStrategy’s funding efforts in the past.

The ability to issue convertible notes allows MicroStrategy to secure capital with minimal interest obligations while simultaneously expanding its investment in Bitcoin. This approach has garnered investor interest, especially given the company’s strong stock performance and the appealing nature of conversion features. Investors have the dual advantage of capital appreciation from rising share prices or the possibility of reclaiming their principal upon maturity, enhancing the attractiveness of MicroStrategy’s investment strategy.

Continued Investor Confidence

As of Wednesday’s pre-market trading, MicroStrategy’s stock has shown a continued upward trend, rising over 3% and reflecting sustained investor confidence in its Bitcoin-centric strategy. The increasing valuation of the company’s shares can be attributed in part to positive market sentiment surrounding Bitcoin and its recent price surges, which have drawn significant attention from the investment community.

In addition, the growing interest from major investment firms, such as Vanguard, which has increased its stake in MicroStrategy, further validates the company’s strategy and reinforces its market position. This institutional support highlights a broader trend of corporate acceptance and investment in cryptocurrencies, as firms recognize the potential for digital assets to enhance shareholder value.

Saylor has pointed out that companies with substantial cash reserves, like Microsoft, Berkshire Hathaway, Apple, and Google, are missing a vital opportunity to bolster shareholder value by not incorporating Bitcoin into their asset portfolios. He argues that a significant portion of Microsoft’s enterprise value is heavily reliant on quarterly earnings, while tangible assets account for a mere fraction. By integrating Bitcoin into its balance sheet, Saylor suggests that Microsoft could enhance stock stability and mitigate inherent risks associated with market volatility.

As MicroStrategy navigates the evolving landscape of cryptocurrency investment, its ongoing commitment to Bitcoin acquisition and innovative funding strategies position it as a leading force in both the corporate and cryptocurrency sectors. The company’s trajectory reflects not only its success but also the growing acceptance of digital assets among traditional financial institutions.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.