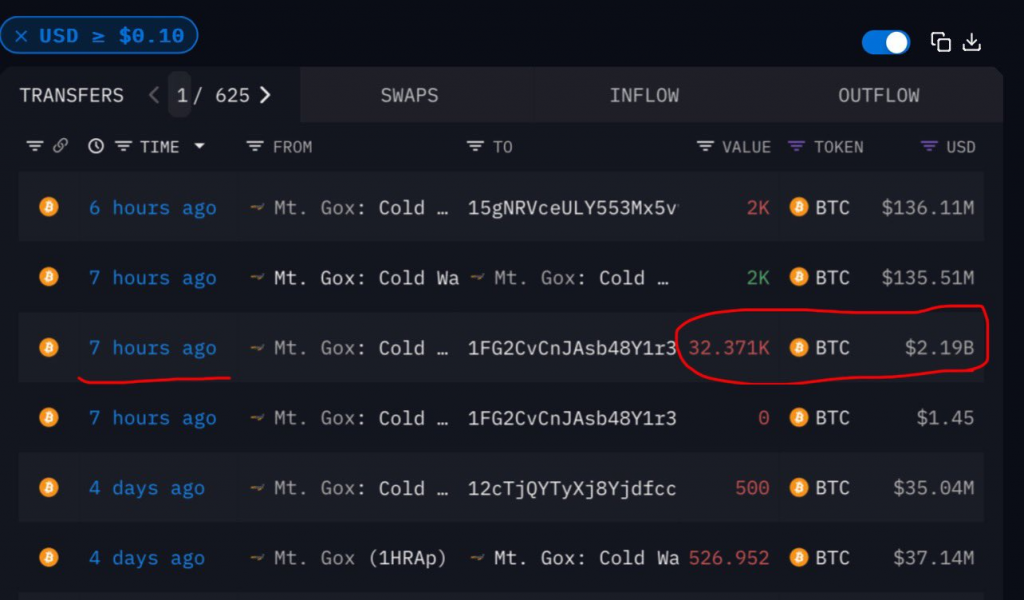

Mt. Gox, the defunct cryptocurrency exchange, recently transferred over 32,000 BTC (approximately $2.2 billion) to unmarked wallets, raising concerns about market volatility as Bitcoin prices stands at $68,000 amid an extended repayment timeline for creditors.

Key Points

- Mt. Gox moved approximately 32,371 BTC to new addresses for creditor repayments.

- Bitcoin prices remained partially stable around $68,000.

- Mt. Gox’s historical significance highlights the long-lasting repercussions of its 2014 hack.

Mt. Gox’s Recent Bitcoin Transfers

On Monday, Mt. Gox executed a substantial transfer of approximately 32,371 BTC, valued at around $2.2 billion, to unmarked wallet addresses. This movement has been flagged by blockchain analytics firm Arkham Intelligence, which noted that the majority of the transferred Bitcoin—30,371 BTC—was directed to the wallet address “1FG2C…Rveoy.” An additional 2,000 BTC was first sent to a cold wallet belonging to Mt. Gox before being directed to another unmarked wallet. This latest transfer marks the most significant activity from the exchange in recent months, following a previous transfer of 500 BTC to unidentified wallets just a week prior.

The rationale behind these large transfers is believed to be tied to the exchange’s long-standing commitment to repay creditors who suffered losses in the wake of its infamous 2014 hack. While it remains unclear whether this specific transfer is intended for future distributions to those creditors, historical patterns indicate that such sizable movements often precede payments made through centralized exchanges like Bitstamp and Kraken.

Market Reactions and Bitcoin Price Trends

In conjunction with these transfers, Bitcoin’s price experienced some volatility, dipping below $68,000 at first, then recovering the $69,000 territory within hours. Market analysts are predicting heightened volatility throughout the week as U.S. elections loom, with potential price fluctuations estimated at around $8,000. The timing of these Bitcoin transfers appears to have compounded the uncertainty in the market, as traders brace for potential shifts in investor sentiment prompted by current U.S. elections.

The ongoing volatility surrounding Bitcoin prices can be partially attributed to the significant sell pressure expected from early investors in Mt. Gox. Many of these individuals stand to receive Bitcoin at values substantially higher than their original investment, potentially motivating them to sell portions of their holdings once payments are issued. This dynamic can create ripple effects throughout the market, leading to rapid price changes.

Historical Significance of Mt. Gox

Founded in 2010, Mt. Gox was once the preeminent Bitcoin exchange, processing over 70% of all Bitcoin transactions during its operational peak. However, its reputation suffered a catastrophic blow in early 2014 when hackers accessed the platform, resulting in the loss of approximately 740,000 BTC—an amount that exceeds $15 billion at current valuations. This breach not only marked a significant setback for the exchange but also instigated ongoing legal battles and recovery efforts that continue to shape the cryptocurrency landscape today.

In light of these events, trustees managing Mt. Gox’s bankruptcy have been working diligently on a repayment plan, which has experienced multiple extensions. Initially set for October 2024, the repayment deadline was recently pushed to October 31, 2025. This extension underscores the complexity of the situation, as thousands of creditors await restitution from the exchange while navigating the enduring ramifications of the 2014 hack.

Broader Implications for the Cryptocurrency Market

The events surrounding Mt. Gox serve as a critical reminder of the importance of security and trust within the cryptocurrency industry. The exchange’s historical significance and the scale of its past transactions illustrate the lasting impact of its collapse on market dynamics and investor confidence. As the cryptocurrency ecosystem continues to evolve, the stories of past exchanges like Mt. Gox will likely influence regulatory discussions and consumer protection measures designed to enhance the safety of digital asset trading.

Additionally, the ongoing repayment process represents one of the most prolonged recovery efforts in the cryptocurrency sector, with significant implications for market behavior and investor strategies. While short-term volatility may be anticipated in response to Mt. Gox’s movements, the maturation of the market since 2014 may offer some resilience against dramatic price swings, suggesting a more sophisticated investor base that can withstand such fluctuations.

Conclusion

In summary, the recent transfer of Bitcoin by Mt. Gox highlights the ongoing complexities surrounding the defunct exchange’s repayment strategy and its potential influence on market dynamics. As the situation unfolds, both the cryptocurrency community and affected creditors remain watchful of developments that may shape the future of digital asset trading and recovery efforts, paving the way for a more secure and transparent cryptocurrency market.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.