Peter Schiff has urged President Biden to sell the U.S. government’s Bitcoin holdings, arguing that such a move could reduce the 2024 budget deficit and prevent the establishment of a potentially destabilizing “Strategic” Bitcoin Reserve.

Key Points

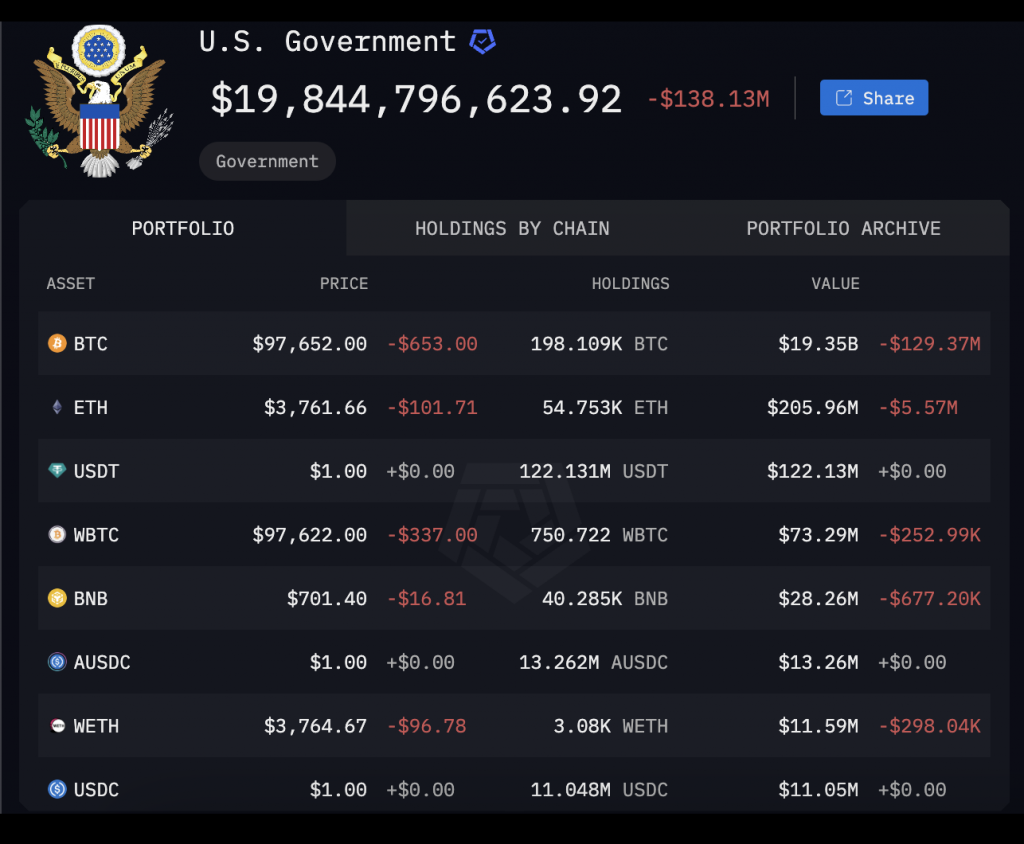

- If the Biden administration sells the U.S. Bitcoin holdings, estimated at around $19.35 billion, it could lead to a significant market crash.

- Discussions regarding a federal Bitcoin reserve have gained traction, suggesting a shift in governmental perspective on Bitcoin.

- The current U.S. national debt stands at approximately $36 trillion, prompting discussions on how Bitcoin could help mitigate this financial burden.

Schiff’s Call to Action

Peter Schiff, a well-known economist and proponent of gold, has made a public appeal for President Joe Biden to liquidate all Bitcoin holdings currently held by the U.S. government prior to the anticipated transition to Donald Trump’s administration in January 2025. Schiff asserts that such a decision would not only generate substantial revenue but would also help address the ongoing budget deficit for the year 2024.

In his statement, Schiff emphasizes that the sale of Bitcoin could eliminate the discussions surrounding a “Strategic” Bitcoin Reserve, which he deems potentially harmful. He argues that creating and maintaining such a reserve could lead to economic instability, exacerbated by Bitcoin’s notorious price volatility. By selling off these assets, he believes the Biden administration would make a prudent financial move that would benefit the country.

Implications of a Bitcoin Sale

The impact of liquidating the U.S. Bitcoin holdings, which are valued at around $19.35 billion, could be profound on the cryptocurrency market. Given the volume of Bitcoin involved, analysts predict that such a sale could result in a significant downturn in market prices. The fear is that the market may not have the capacity to absorb the sudden influx of Bitcoin for sale, potentially leading to a drastic decline in its value.

Additionally, Schiff’s remarks come at a time when discussions regarding a federal Bitcoin reserve are intensifying. With Trump and other officials suggesting the possibility of using Bitcoin as part of a national reserve strategy, Schiff warns that this could lead to adverse economic effects. He predicts that if the government were to acquire a substantial quantity of Bitcoin, it would necessitate ongoing purchases to maintain its perceived value, thus risking hyperinflation and destabilizing the cryptocurrency market further.

Critique of Government Bitcoin Investment

Schiff’s criticisms extend to the use of public funds for Bitcoin investments, which he regards as a serious overstep by government officials. He has labeled Bitcoin a national security threat and “public enemy number one,” particularly in light of proposals advocating for government investment in Bitcoin using taxpayer money. His contention is that individuals may choose to invest their own money in Bitcoin, but it becomes problematic when government officials are influenced to direct public funds towards this volatile asset.

These assertions come in response to ongoing discussions led by politicians such as Wyoming Senator Cynthia Lummis, who introduced proposals like the Bitcoin Act in July 2024. This legislation suggested that the U.S. Treasury should acquire one million Bitcoin gradually, aiming to establish a government-backed reserve akin to the nation’s gold reserves. Schiff views these developments with skepticism, predicting that they would ultimately lead to adverse economic consequences.

Rising Support for Federal Bitcoin Reserves

As the prospect of a Bitcoin reserve gains traction, its implications on the U.S. financial landscape are becoming increasingly debated. Trump, if he returns to office, has signaled support for the idea of a “Strategic National Bitcoin Stockpile,” potentially using Bitcoin seized by the Department of Justice to build this reserve. Proponents argue that such a reserve would enhance financial stability and bolster the U.S.’s influence within the global financial system.

However, not all reactions have been supportive. Critics, including former Treasury Secretary Lawrence Summers, have dismissed the notion of a federal Bitcoin reserve as unrealistic. There are significant concerns that establishing a Bitcoin reserve could lead to market fluctuations that would benefit current Bitcoin holders while destabilizing the broader economy.

Exploring Fiscal Strategies Amid National Debt

With the U.S. national debt soaring to $36 trillion, equating to over $107,000 per citizen, the conversation has shifted towards innovative fiscal strategies that might include leveraging Bitcoin’s rising value. Bitcoin recently reached an all-time high of approximately $103,000, although its price has since stabilized around $97,826.56. This has led some crypto advocates to propose that a Bitcoin reserve could help mitigate national debt pressures.

The premise is that as Bitcoin’s value continues to grow, a government reserve could facilitate substantial revenue generation, which could be utilized to address the national debt crisis. Companies like MicroStrategy, which have invested heavily in Bitcoin, showcase potential financial benefits that could arise from Bitcoin’s appreciation, thereby further legitimizing the concept of a Bitcoin reserve.

The Growing Landscape of Cryptocurrency

As discussions surrounding federal Bitcoin reserves evolve, so does the role of cryptocurrencies in traditional financial systems. The contrasting views between advocates like Schiff and proponents of Bitcoin reserves highlight a divide in how cryptocurrencies are perceived concerning economic stability, government policy, and future financial strategies.

The discourse around Bitcoin and its potential role in U.S. financial policy continues to garner attention, with stakeholders across the spectrum weighing in on the feasibility and implications of proposed government initiatives. As the cryptocurrency landscape matures, the interactions between state policies and digital assets like Bitcoin will undoubtedly shape economic narratives in the years to come.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.