This story is still under development and its content, sources or opinions may change over time.

Japanese lawmaker Satoshi Hamada is advocating for the government to consider integrating Bitcoin into its foreign exchange reserves, emphasizing its potential as a strategic asset amidst growing global interest in cryptocurrencies.

Key Points

- Countries including the U.S. and Brazil are exploring similar initiatives, potentially setting a precedent for Japan’s approach to Bitcoin reserves.

- Hamada argues that adopting a Bitcoin reserve could enhance Japan’s financial flexibility, particularly as the country navigates economic challenges.

- Other Japanese lawmakers, such as Yuichiro Tamaki, are also vocal about cryptocurrency adoption, which may help bolster Hamada’s proposal despite his party’s limited representation.

Proposal Overview

Satoshi Hamada, a member of Japan’s House of Councillors, has actively pushed for the government to investigate the integration of Bitcoin (BTC) into the nation’s foreign exchange reserves. He perceives Bitcoin as a strategic asset that could enhance Japan’s economic resilience, aligning with similar discussions occurring in other nations such as the United States and Brazil.

These countries are contemplating Bitcoin reserves as a safeguard against economic volatility, indicating a broader trend of increasing acceptance and recognition of cryptocurrency’s potential benefits.

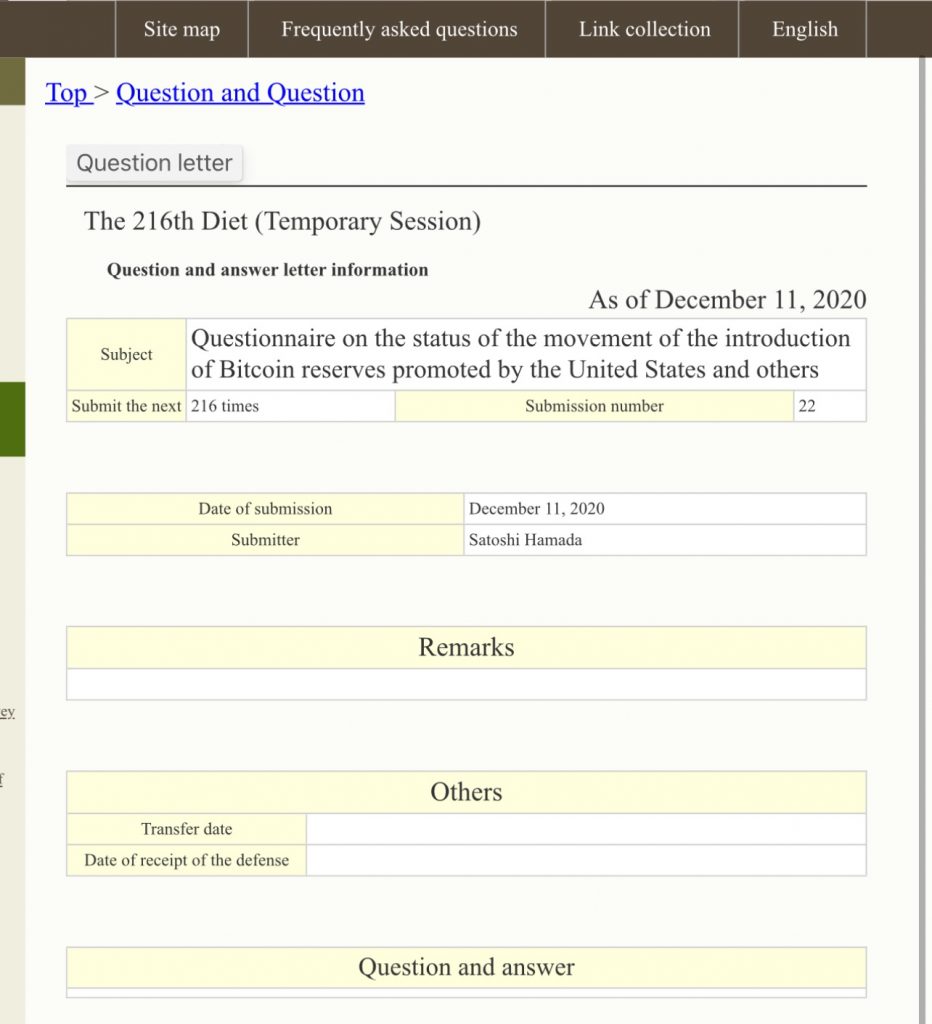

Hamada’s proposal was formally submitted on December 11, 2024, during a parliamentary session, highlighting the urgency of Japan’s need to adapt to evolving global financial landscapes. His initiative reflects a growing trend among lawmakers worldwide to consider digital currencies as viable components of national financial strategies.

Context and Timing

The timing of Hamada’s proposal is significant, coinciding with a surge in global interest in cryptocurrencies as strategic reserve assets. This mounting fascination with Bitcoin aligns with its recent milestone price of approximately 101,242.05, suggesting a growing acceptance and valuation in financial markets. The inquiry into Bitcoin reserves reflects Japan’s need to solidify its position in a rapidly changing economic environment, especially as it faces competition as the fourth-largest economy, having recently fallen behind Germany.

Hamada’s questions during the parliamentary session also served as a catalyst for discussions on Japan’s economic positioning in the global arena. By addressing the potential for Bitcoin reserves, he aims to encourage a broader dialogue about innovative financial strategies that could bolster Japan’s economic security.

Reasons for Proposal

Hamada underscores Bitcoin’s unique characteristics, particularly its neutrality and decentralized nature, which allows it to operate independently of any specific nation or institution. This independence positions Bitcoin as an attractive option for economic activity, reducing reliance on traditional currencies that may be subject to geopolitical tensions and fluctuations.

By advocating for a Bitcoin reserve, Hamada argues that Japan could enhance its financial flexibility and diversify its reserves. He asserts that such a move could empower the nation in both domestic and international markets, providing a counterbalance to potential economic risks associated with fiat currency dependency.

Global Influence

Hamada’s proposal is part of a larger global movement where several nations are examining the strategic use of cryptocurrencies. Notably, U.S. senators, including Cynthia Lummis, have been vocal about establishing a Bitcoin strategic reserve, projecting a target to acquire a significant amount of Bitcoin for the Treasury. Meanwhile, Brazilian lawmakers have initiated discussions about adding Bitcoin to their national reserves, reflecting the growing momentum behind this asset class.

Additionally, Russian lawmakers have proposed similar initiatives, suggesting a coordinated interest among various governments in utilizing Bitcoin as a financial instrument. Such international developments could influence Japan’s legislative approach and validate Hamada’s calls for consideration of Bitcoin reserves.

Current Status

As of December 13, 2024, the Japanese government has yet to respond to Hamada’s proposal. However, there is a noticeable shift among some lawmakers recognizing the potential impact of cryptocurrencies on national economic policies. This acknowledgment indicates a slowly evolving perception of digital assets within the Japanese legislative landscape.

Despite his political party holding only two seats in the National Diet’s upper house, Hamada’s proposal may gain traction with support from influential figures like Yuichiro Tamaki, who leads a political party advocating for cryptocurrency-friendly policies. Recent discussions surrounding tax reductions and regulatory reforms for crypto holders and businesses in Japan signal a growing acceptance of the digital asset ecosystem.

Public and Social Media Reaction

The reaction to Hamada’s proposal has been notable across social media platforms, particularly on X, where users highlight the irony of a lawmaker named Satoshi advocating for Bitcoin reserves.

Social media discussions often emphasize the significance of such proposals in light of Bitcoin’s performance in the financial markets, reinforcing the idea that legislative actions could shape the future of cryptocurrency in Japan and beyond.

Potential Impact

Should Japan proceed with the establishment of a Bitcoin reserve, it could fundamentally alter global perceptions of Bitcoin as a legitimate financial asset. This move could serve as a pioneering example for other nations contemplating similar steps, potentially leading to a ripple effect in terms of cryptocurrency acceptance in sovereign financial planning.

The implications of such a decision extend beyond Japan, potentially influencing international markets and prompting other countries to reevaluate their own stances on digital currencies. Japan’s proactive approach could position it as a leader in the adoption of cryptocurrencies, especially at a time when Bitcoin’s value continues to rise and garner attention from investors and policymakers alike.

This ongoing discourse reflects a broader trend of governments worldwide exploring innovative strategies for integrating cryptocurrencies into their financial frameworks, amidst the backdrop of evolving digital economies and the increasing legitimacy of Bitcoin and other digital currencies in mainstream finance.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.