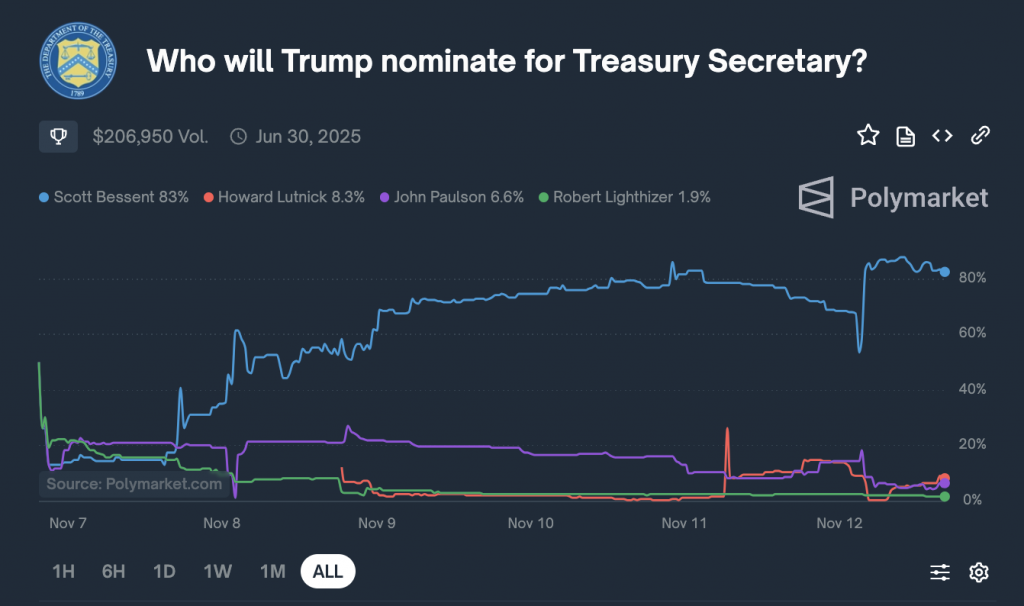

Prediction platform Polymarket indicates an 83% likelihood that Scott Bessent, a pro-Bitcoin advocate, will be appointed Treasury Secretary in a second Trump administration, potentially signaling significant changes to U.S. economic policies regarding cryptocurrencies.

Key Points

- Scott Bessent is a strong advocate for cryptocurrencies and aligns with Republican principles.

- His potential appointment could lead to significant policy changes regarding digital assets.

- Trump’s transition team is focusing on pro-crypto candidates for key regulatory positions.

Bessent’s Advocacy for Cryptocurrencies

Scott Bessent, an influential figure in favor of crypto and Bitcoin, is reportedly the most likely candidate to become the next Treasury Secretary under President’s Donald Trump term. Polymarket, a prediction market platform, estimates an 83% chance of this appointment, which could have profound implications for the U.S. economic policy concerning digital currencies. Bessent, known for his leadership of the macro hedge fund Key Square Group and his previous role as chief investment officer at Soros Fund Management, has made his stance on cryptocurrencies clear.

Describing Bessent, Fox Business journalist Eleanor Terrett highlights his strong pro-crypto position, emphasizing his belief with some statements:

“Crypto is about freedom and the crypto economy is here to stay.”

“One of the most exciting things about Bitcoin is that it brings in young people and those who have not participated in markets before.”

Bessent argues that cryptocurrencies, especially Bitcoin, resonate well with the Republican Party’s ideals. He expresses optimism about Bitcoin’s potential to engage younger demographics and individuals previously excluded from traditional financial markets. In his view, creating a market culture in the U.S. that reinforces faith in a functional economic system is fundamental to capitalism.

Expected Transformations in U.S. Economic Policy

Should Bessent assume the role of Treasury Secretary, he may spearhead substantial changes in how the U.S. approaches digital assets. One of the notable ideas he could implement is the establishment of a strategic Bitcoin reserve, a concept hinted at by Trump during his address at the Bitcoin 2024 Conference earlier this year. This move would mark a significant step toward integrating cryptocurrency into the national financial strategy and could enhance the country’s status in the global cryptocurrency market.

The cryptocurrency industry has increasingly become a political force, contributing to various congressional campaigns and backing Trump’s presidential bid. Industry leaders are advocating for clearer regulatory guidelines as Congress has yet to enact comprehensive legislation governing cryptocurrencies. Sources cited by The Washington Post indicate that Trump’s strategy involves appointing pro-crypto candidates to influential regulatory positions, reinforcing his commitment to transforming the U.S. into a global hub for cryptocurrency.

Regulatory Landscape and Potential Changes

Trump’s transition team is currently evaluating candidates for critical regulatory roles, including the chairmanship of the Securities and Exchange Commission (SEC). Among the contenders are Hester Peirce and Mark Uyeda, both current Republican commissioners, as well as Daniel Gallagher, the legal chief at Robinhood. The anticipated appointment of a pro-crypto figure to the SEC would represent a departure from the current leadership under Gary Gensler, who has pursued an enforcement-driven approach against major cryptocurrency exchanges such as Binance and Coinbase.

The shift in SEC leadership could lead to a more lenient regulatory environment, potentially easing the operational challenges faced by cryptocurrency platforms. However, the process of removing Gensler might not be straightforward, as it raises legal questions regarding presidential authority. It is speculated that Gensler might choose to resign voluntarily, a common practice during leadership transitions, which could mitigate the likelihood of a contentious legal battle.

Linking to Broader Trends in Cryptocurrency Markets

The increasing prominence of cryptocurrencies in U.S. political discussions aligns with a broader trend observed in recent financial markets. Following Trump’s election victory over Kamala Harris, there has been a marked surge in optimism surrounding pro-crypto policies. This optimistic outlook has catalyzed significant movements in cryptocurrency values, notably pushing Bitcoin to an all-time high above $89,000 and Ethereum witnessing gains of approximately 40% in the past week.

Furthermore, this resurgence in the crypto market has spilled over into traditional equities, with notable gains recorded in the Dow Jones, Nasdaq Composite, and S&P 500 indices. The anticipation of a transformative economic policy under Trump’s administration is driving investor confidence, reflecting a shift in market dynamics as cryptocurrencies become increasingly integrated into the financial discourse of the nation.

In summary, Scott Bessent’s potential appointment as Treasury Secretary under Trump could catalyze pivotal changes in U.S. cryptocurrency policy, fostering a more favorable environment for digital assets and significantly impacting the regulatory landscape while aligning with broader trends in the financial markets.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.