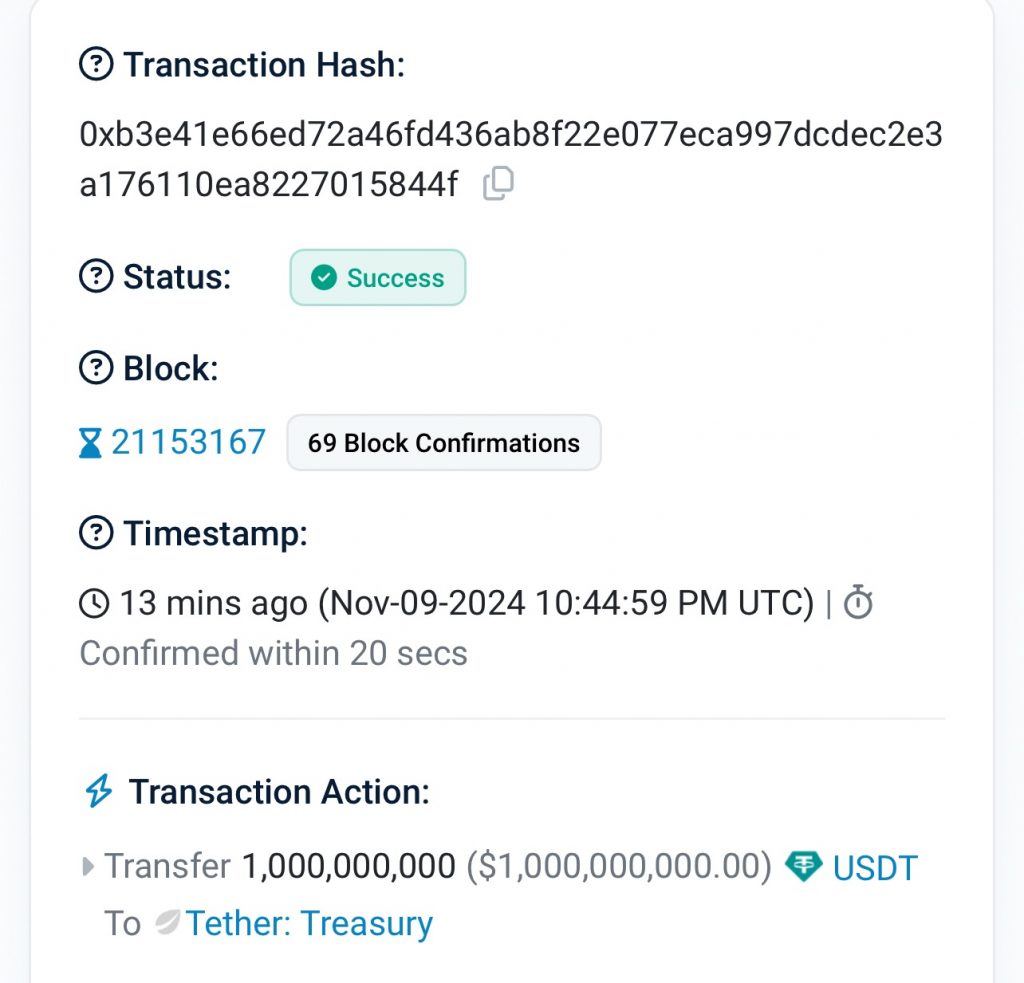

Tether recently minted 1 billion USDT on the Ethereum blockchain, signaling an active management of liquidity by the stablecoin issuer, while Ethereum’s prices increased following political developments.

Key Points

- The minted USDT was a direct transfer from an unspecified wallet to the Tether Treasury.

- Movements involving the Tether Treasury are seen as indicators of potential market movements.

- Tron has recently minted $1 billion in USDT, bringing its stablecoin supply close to $63 billion.

Tether’s Recent Minting Activity

On November 9, 2024, Tether executed a notable blockchain transaction, minting 1 billion USDT on the Ethereum network. This significant event occurred at 10:44 PM UTC, with confirmation achieved within seconds. The transaction involved a direct transfer of the minted USDT from an unidentified wallet into the Tether Treasury.

The Tether Treasury is maintained by Tether, the issuer of the USDT stablecoin, and serves as a central reserve. This reserve is critical for managing the circulation of USDT, allowing for various financial maneuvers, including redemptions, liquidity adjustments, and other corporate activities. As such, the recent transaction indicates Tether’s ongoing efforts to manage its asset supply effectively.

Implications of Large Transfers

When substantial amounts of USDT are transferred to the Tether Treasury, it may suggest preparations for liquidity management, among other strategic financial maneuvers. Stablecoins, such as USDT, play a pivotal role in the cryptocurrency ecosystem by offering liquidity and a relatively stable store of value. The volatility of traditional cryptocurrencies often necessitates the need for stablecoins, which can help mitigate price swings.

Changes in the supply or distribution of USDT can have widespread implications across the crypto market. For traders and investors, large inflows or outflows from the Tether Treasury can serve as indicators of potential market shifts. Historically, such transactions have been correlated with fluctuations in market demand, demonstrating the interconnectedness of stablecoin management and broader market dynamics.

Context of Stablecoin Supply and Market Dynamics

In conjunction with Tether’s activities, the stablecoin supply within the Tron network has also seen substantial growth. Recently, Tron minted $1 billion in USDT, raising its total supply to approximately $63 billion. This expansion positions Tron as a significant player within the decentralized finance sector, highlighting its growing influence in the stablecoin market.

The increase in USDT supply on the Tron network is notably reflective of the demand for stablecoin transactions. Tron’s blockchain is recognized for its low transaction fees and high speed, attracting a wide user base. The consistent upward trend in USDT supply on Tron, which has risen by over 28% in the past year, underscores its increasing importance in the market.

Chain Swap Initiatives and Their Importance

Tether frequently employs chain swaps to enhance the flow and availability of its assets across various blockchains without altering the total supply of USDT. This method enables the issuer to maintain liquidity while ensuring that the USDT remains accessible on preferred networks. The recent transaction on Ethereum is part of a broader chain swap initiative, where Tether collaborates with third-party exchanges to facilitate the movement of USDT between different blockchain ecosystems.

As illustrated in Tether’s recent activity, transfers across multiple networks have been significant. The breakdown of these transfers included substantial amounts designated for various blockchain networks, such as TRC20 on the Tron Network, Avalanche, NEAR Protocol, Celo Network, and EOS Network. This strategic movement of assets aims to bolster liquidity on Ethereum, which remains a favored platform for decentralized finance and institutional use.

Maintaining Stability in the Cryptocurrency Market

Despite the large volume of USDT involved in these transactions, Tether’s management has reassured investors that the overall circulating supply of USDT has not changed. The tokens minted on Ethereum resulted from a strategic move rather than an increase in market supply. This management strategy indicates Tether’s commitment to maintaining stability in the stablecoin ecosystem.

The chain swap initiative is indicative of Tether’s proactive approach to ensuring decentralized availability across multiple blockchain environments. By effectively managing its liquidity, Tether enhances transaction throughput and addresses the demand fluctuations experienced within various networks.

The recent minting of $1 billion USDT on Ethereum serves as a prime example of Tether’s ongoing efforts to address liquidity demands across blockchain networks. Through strategic minting and transfer initiatives, Tether can adapt to the evolving landscape of the cryptocurrency market while maintaining its position as a liquidity pillar. This flexibility underscores the issuer’s role in stabilizing the market and facilitating seamless transactions across various platforms.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.