The Trump campaign has reportedly engaged in discussions about potentially declaring victory in the upcoming election before official results are announced, while the presidential candidate has also made notable promises regarding cryptocurrency, including freeing Ross Ulbricht and firing SEC Chairman Gary Gensler.

Key Points

- Trump’s commitment to support the cryptocurrency sector includes pledges to free convicted Silk Road operator Ross Ulbricht and dismiss SEC Chairman Gary Gensler.

- Analysts speculate that a Trump victory could lead to a significant increase in Bitcoin’s price, projected to rise to between $80,000 and $90,000.

- The SEC’s actions under Gary Gensler have been viewed as detrimental to the crypto industry, which is seeking clearer and more favorable regulatory frameworks.

Trump Campaign Discussions

As the 2024 presidential election approaches, the Trump campaign is reportedly considering the possibility of declaring victory prematurely, according to a report that cites unnamed sources. This strategy mirrors similar actions taken by Trump during the 2020 election, which ultimately did not lead to significant political gains. Political experts express concern about this potential move, particularly regarding its implications for election integrity and public perception.

The report indicated that Trump may announce a premature victory soon after the initial batch of ballots is counted, particularly if early results show a Republican lead in key battleground states. This could result in a later shift towards Democratic leads as absentee and mail-in ballots are processed, especially in critical states like Pennsylvania. Such a scenario could set the stage for contentious debates around election fairness, reminiscent of the “stop the count” or “stop the steal” rhetoric seen in previous election cycles. While this situation could create political turbulence, analysts suggest it may not significantly affect financial markets, which often react more to substantive economic news than electoral disputes.

Trump’s Commitment to the Cryptocurrency Sector

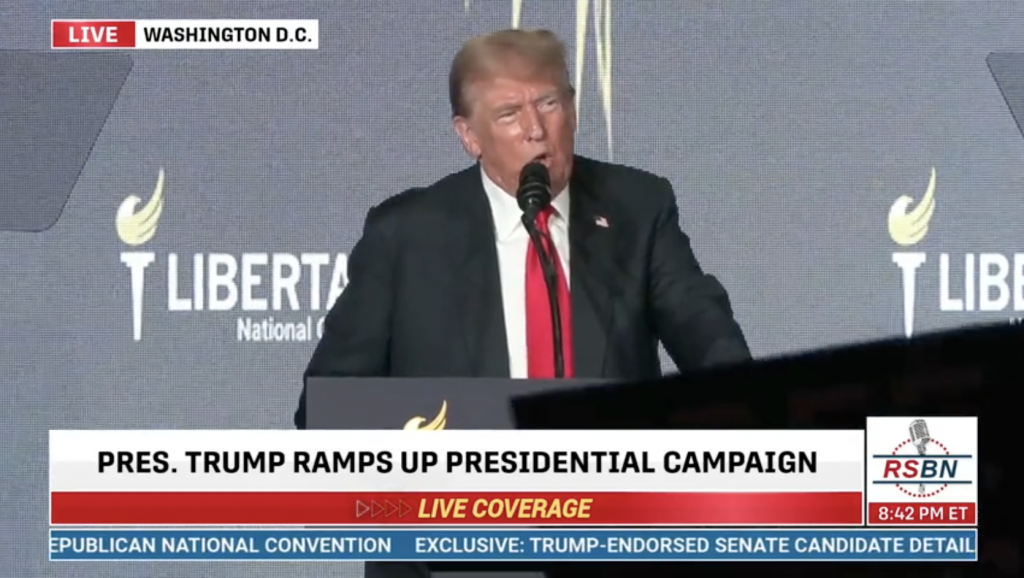

Donald Trump has made noteworthy commitments to the cryptocurrency community, which have sparked both interest and enthusiasm among supporters. During his campaign, Trump has promised to prioritize the commutation of Ross Ulbricht’s life sentence if elected. Ulbricht, the creator of the Silk Road marketplace, has become a symbolic figure for libertarians and those advocating for reforms in the criminal justice system, especially concerning non-violent offenses related to technology and finance.

In May, during a speech addressing crypto policy, Trump expressed his intention to support and uplift the cryptocurrency industry. His pledges received enthusiastic responses from audiences, who chanted “Free Ross.” Ulbricht himself expressed gratitude via social media, noting the profound impact of public support on his potential for a second chance after more than a decade in prison. Furthermore, Trump reiterated his commitment to crypto at the Bitcoin 2024 conference held in Nashville, where he also promised to fire Gary Gensler, the current chairman of the U.S. Securities and Exchange Commission (SEC), on his first day in office.

The Response to SEC Regulations

Trump’s focus on the SEC is particularly relevant, given the agency’s significant influence over the cryptocurrency industry’s regulatory landscape. Many in the crypto community view Gensler’s regulations as detrimental, arguing that they stifle innovation and hinder the growth of legitimate crypto enterprises. Trump’s declaration to remove Gensler indicates a potential shift towards a more favorable regulatory environment for cryptocurrencies, which could resonate positively with investors and stakeholders.

The outcome of the upcoming election has significant implications for the cryptocurrency market. Bernstein anticipate that if Trump wins, Bitcoin could see a dramatic price increase, potentially reaching between $80,000 and $90,000. Conversely, a victory by Kamala Harris could result in Bitcoin’s price plummeting to around $50,000. Investors and market watchers are keenly aware that political leadership and regulatory direction play crucial roles in market stability and growth.

While Trump’s promises present a clear and direct stance on cryptocurrency, the Biden administration, particularly through Vice President Kamala Harris, has offered a more ambiguous approach. Harris’s campaign has signaled support for blockchain investments and aims to create a regulatory framework that protects digital asset investors. However, the lack of specificity regarding policies leaves some uncertainty for market participants.

Broader Implications for the Crypto Community

As the election draws near, the cryptocurrency community is closely monitoring political developments, recognizing that the election outcome could significantly influence the market’s trajectory. The ongoing discussions around regulatory policies and potential leadership changes at key agencies like the SEC underscore the importance of political dynamics in shaping the future of cryptocurrency.

Meanwhile, the recent transfer of $2.2 Billion in Bitcoin by the bankrupt exchange Mt. Gox to cold storage highlights ongoing issues within the crypto ecosystem. The move, part of a lengthy repayment process for clients affected by the exchange’s 2014 hack, adds another layer of complexity to the market landscape. As major exchanges work to distribute funds to affected clients, the eventual resolution of these outstanding issues will also play a role in shaping market sentiment and trust in the broader cryptocurrency space.

Overall, the intertwining of electoral politics and cryptocurrency regulation is a developing narrative that merits close attention as the election approaches and the landscape evolves in response to these significant events.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.