UK regulators have issued warnings regarding the cryptocurrency “Retardio,” highlighting concerns related to consumer protection, market manipulation, and compliance with financial regulations amidst a tightening regulatory environment for cryptocurrencies.

Key Points

- The Financial Conduct Authority (FCA) is implementing stricter regulations for cryptocurrency public offerings.

- Retardio is currently ranked 467th in market capitalization.

- Retardio has cultivated a distinct community identity, often described as a “cult-like” following.

Regulatory Warnings and Framework

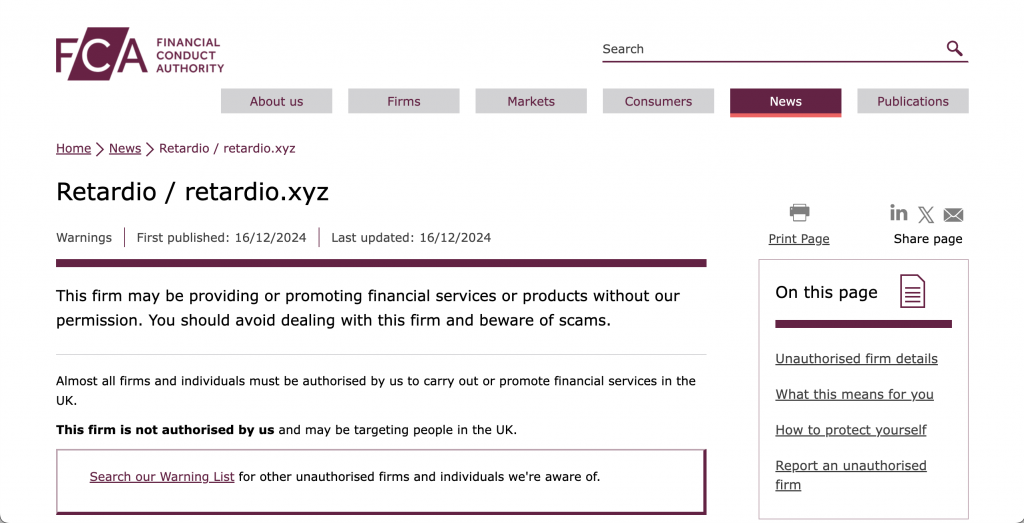

Recent reports indicate that UK regulators have issued warnings concerning the cryptocurrency known as “Retardio.” This situation arises amid escalating concerns about the stability and legitimacy of cryptocurrencies in the UK market. The Financial Conduct Authority (FCA) has taken a proactive stance in tightening the regulatory framework governing cryptocurrencies, emphasizing consumer protection and market integrity.

The FCA has been working on establishing a more comprehensive market abuse regime specifically tailored for crypto assets. This includes implementing consumer protective measures such as risk warnings and mandatory cooling-off periods for first-time buyers. Such initiatives are designed to enhance the overall consumer experience while ensuring the integrity of the evolving cryptocurrency market.

The specific warning regarding Retardio may stem from multiple concerns. It is possible that the cryptocurrency does not meet the transparency and safety standards expected from financial products. Additionally, there may be apprehensions related to potential market manipulation or other forms of financial misconduct linked to Retardio. The cryptocurrency’s compliance with existing regulatory standards, especially those pertaining to fiat-backed stablecoins and digital assets, is also in question.

Market Activity and Performance

As of November 30, 2024, Retardio was observed trading at a price of approximately $0.1122, with a market capitalization ranking of $109 Million. This positioning suggests that Retardio operates as a relatively smaller or less mainstream cryptocurrency, which could render it more susceptible to regulatory caution. The trading volume reported indicates that it is actively traded, albeit with lower overall market activity compared to larger cryptocurrencies.

In the context of market performance, Retardio has shown considerable price fluctuations. It has reached a historical high of $0.2421 and a low of $0.01232, demonstrating its volatility. This level of price variability can make cryptocurrencies like Retardio attractive to speculative traders but also raises concerns about consumer protection in a regulatory environment that is becoming increasingly stringent.

It’s noteworthy that Retardio tokens can be traded on decentralized exchanges such as Raydium, with the RETARDIO/SOL trading pair accounting for a significant volume of trades. However, it is not available on major exchanges like Coinbase, which may limit its accessibility to broader market participants.

Community and Cultural Impact

Retardio has evolved beyond its identity as a cryptocurrency to become a notable cultural phenomenon within the crypto community. The token is often categorized as a memecoin, characterized by its playful and humorous nature, which resonates well within various cultural contexts. The community surrounding Retardio is recognized for its dynamic engagement on social media, creating a sense of belonging among its members.

This community is sometimes referred to as a “CT cult,” with references to its members as part of a broader trend in crypto culture that blends satire and digital assets. The narratives circulating around Retardio contribute to its appeal as both a financial asset and a form of cultural commentary, making it a unique entity within the rapidly evolving cryptocurrency landscape.

Regulatory Developments

In line with the warnings regarding Retardio, the FCA has also announced new measures aimed at regulating public offerings of cryptocurrencies. The FCA’s proposed restrictions will limit these offerings to entities that meet specific regulatory criteria, a decision that underlines the authority’s commitment to enhancing market integrity and consumer protection. This initiative reflects a broader strategy to ensure that only accountable and transparent companies can engage in public cryptocurrency offerings.

Additionally, as of December 16, 2024, Bitcoin’s price is reported to be around $106,489. The current Fear & Greed Index stands at 80, indicating a state of extreme greed in the market. This sentiment can often lead to heightened volatility, further complicating the regulatory landscape for cryptocurrencies, including memecoins like Retardio.

In summary, the regulatory landscape for cryptocurrencies is evolving rapidly, with Retardio facing scrutiny as part of this trend. The interplay between market performance, community dynamics, and regulatory measures will continue to shape the future of cryptocurrencies in the UK and beyond.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.