The U.S. government has transferred approximately 19,800 Bitcoin, valued at about $1.9 billion, from a Silk Road-related wallet to Coinbase Prime, with the wallet still retaining around $18 billion in Bitcoin.

Key Points

- Following the transfer, Bitcoin’s price experienced a dip, landing at approximately $94,300, reflecting a drop of more than 2%.

- The Bitcoin transferred was part of a haul seized from James Zhong, who manipulated the Silk Road system to steal over 50,000 Bitcoins.

- The U.S. government has established a contract with Coinbase Prime to manage its digital assets, indicating that the recent transfer may not directly signify an impending sale of the Bitcoins.

U.S. Government Transfers $1.9 Billion in Bitcoin to Coinbase

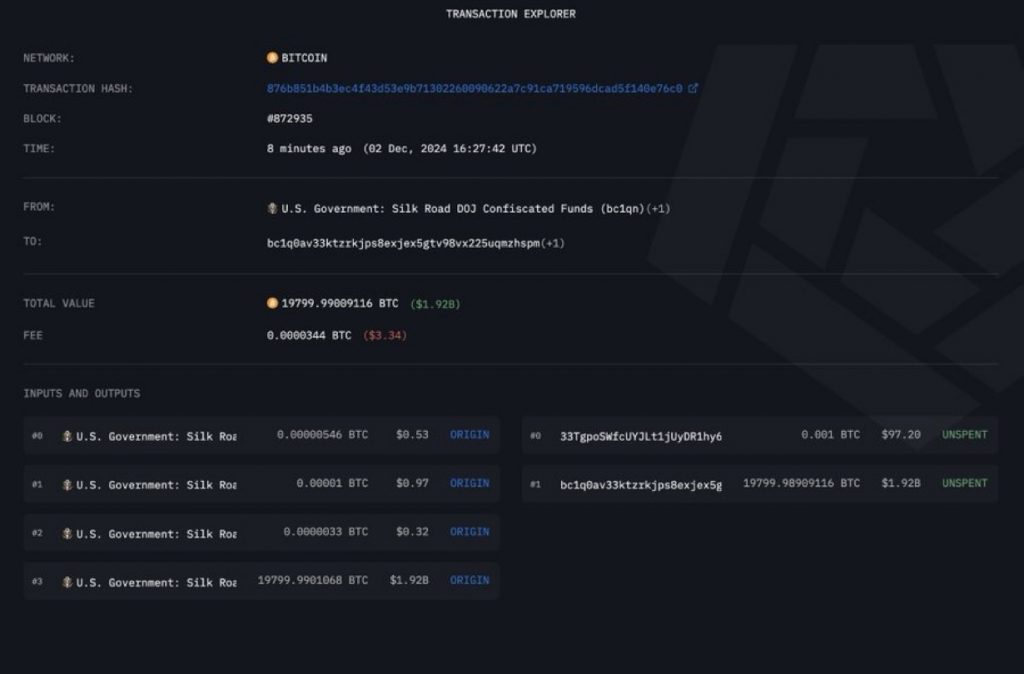

In a significant move, the U.S. government has transferred roughly 19,800 Bitcoin, valued at $1.9 billion, to Coinbase Prime from a wallet connected to the infamous Silk Road marketplace. According to data from Arkham Intelligence, the transfer took place on December 2 and is part of the ongoing management of seized assets linked to illegal activities.

The wallet from which the Bitcoin was moved still retains a considerable amount, approximately $18 billion in Bitcoin, highlighting the scale of assets acquired through federal investigations.

The Silk Road was a notorious dark web marketplace that facilitated the trade of illicit goods and services before being shut down in 2013. The Bitcoin in question has its origins in assets seized from various criminal investigations, primarily related to the platform’s operations. The digital currency continues to be a focal point for discussions around illegal activities involving cryptocurrencies and how governments manage such seized assets.

Details of the Recent Transfer

The recent Bitcoin transfer was executed in two separate transactions. Initially, a test transfer of 0.001 BTC, valued at around $97, was conducted to verify the Coinbase Prime deposit address. Following this, a larger transfer of approximately 1,920 BTC, equating to about $1.9 billion, was sent to an intermediary wallet before being finalized to the Coinbase Prime platform. This method of transferring assets demonstrates a cautious approach to ensure the security and accuracy of the transactions.

Prior to this transfer, in late August, the government had reportedly sent 10,000 BTC, worth around $600 million, to Coinbase from the same wallet. Such transfers have raised eyebrows within the cryptocurrency community, with market participants keenly observing the government’s handling and potential future actions involving these significant Bitcoin holdings.

Additional Cryptocurrency Holdings

In addition to the substantial amount of Bitcoin, the U.S. government holds approximately 59,000 Ethereum, valued at around $217 million, along with 122 million USDT. The diverse portfolio of digital assets managed by federal authorities indicates a growing recognition of the importance of cryptocurrencies in financial and investigative landscapes.

The price of Bitcoin saw a decline following the recent transfer, dropping to approximately $94,300. This decline of more than 2% reflects the sensitivity of the crypto market to large movements of digital assets, particularly when they are associated with government activities. Investors often speculate about the implications of such transfers, worried that the coins may soon be up for sale, which could impact market dynamics.

Historical Context of Bitcoin Seizures

The Bitcoin moved during this transaction is part of a larger narrative concerning asset seizures from criminal enterprises. The funds are linked to James Zhong, who, in 2021, was implicated in a scheme that involved manipulating the Silk Road transaction system to acquire over 50,000 Bitcoins.

The U.S. government has been active in liquidating some of its seized Bitcoin in the past, which raises questions about the future of the recently transferred assets. However, with a contract in place with Coinbase Prime to manage these digital assets, it remains unclear when or if a sale will take place, and whether these movements are simply part of a strategic reserve approach.

Implications for the Crypto Market

The transfer of nearly $2 billion worth of Bitcoin has ignited speculation regarding the U.S. government’s intentions with its cryptocurrency holdings. While large transactions can lead to concerns about immediate liquidations, the established relationship with Coinbase Prime suggests that the government may be taking a more calculated approach to handling its digital assets.

Investors are particularly vigilant during such transfers, as they can significantly influence market trends and investor sentiment. The actions of the U.S. government serve as a barometer for regulatory responses and the broader acceptance of cryptocurrencies within mainstream financial systems. As the cryptocurrency landscape continues to evolve, attention remains focused on how government action will shape the future of digital currencies.

The situation surrounding Bitcoin and other cryptocurrencies remains dynamic, with overlapping narratives around regulation, market volatility, and criminal activity. The ongoing management of seized assets by government authorities ensures that cryptocurrencies like Bitcoin will remain a topic of interest and concern for market participants and regulators alike.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.