WisdomTree has submitted a registration for an XRP exchange-traded fund (ETF) in Delaware, positioning itself among other asset managers seeking approval from the SEC.

Key Points

- XRP is currently the sixth-largest cryptocurrency by market capitalization.

- WisdomTree’s filing follows similar applications from Bitwise, Canary Capital, and 21Shares.

- The anticipated departure of SEC Chair Gary Gensler may lead to a more favorable regulatory environment for cryptocurrency ETFs.

WisdomTree Registers XRP ETF in Delaware

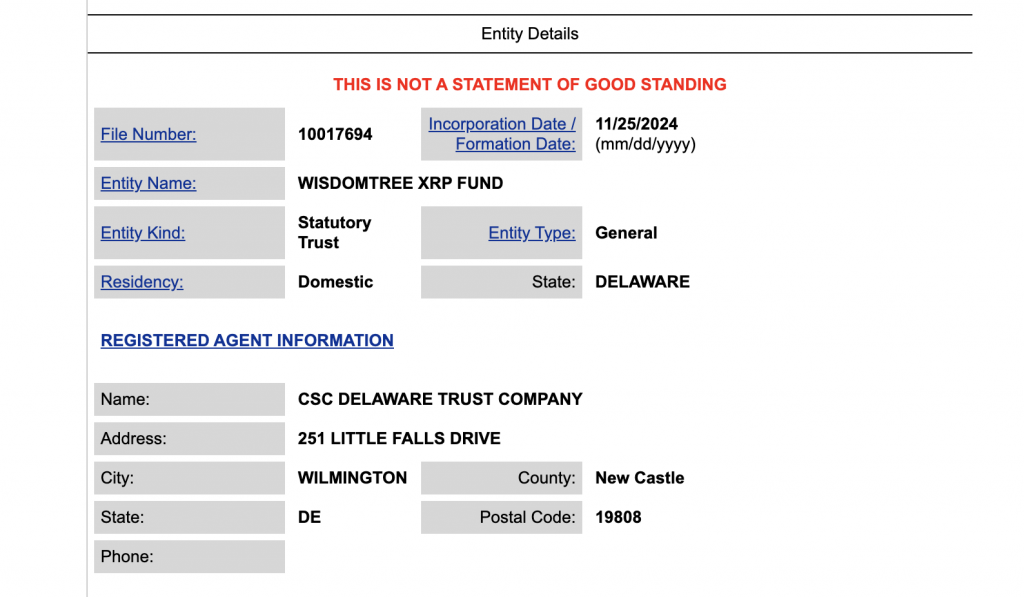

WisdomTree, a prominent issuer of exchange-traded funds with approximately $113 billion in assets under management, has officially registered an entity for a proposed XRP ETF in Delaware. This registration is a crucial initial move that suggests the fund manager is preparing to submit a formal S-1 registration to the U.S. Securities and Exchange Commission (SEC). By taking this step, WisdomTree joins the ranks of other asset managers, such as Bitwise and Canary Capital, who have expressed their intentions to launch spot XRP ETFs.

The registration reflects the growing interest in cryptocurrency investment products, moving beyond traditional offerings like Bitcoin and Ethereum. WisdomTree’s interest in an XRP ETF comes amid a broader wave of applications for cryptocurrency ETFs, signaling a shift in the financial landscape as more asset managers explore these innovative investment avenues.

Regulatory Environment and Market Speculation

The filing by WisdomTree is seen as a preliminary step toward potential approval from the SEC, which has historically taken a cautious stance regarding cryptocurrency-based financial products. The landscape may shift soon, particularly with the recent announcement of SEC Chair Gary Gensler’s impending departure from his role. His resignation could lead to a reassessment of the SEC’s regulatory approach and open the door for more favorable legislation surrounding cryptocurrency ETFs.

Other issuers recent filings has also claimed that XRP should not be classified as a security, disputing the SEC’s previous position on the matter. This assertion underlines a growing sentiment among asset managers that the regulatory framework governing cryptocurrencies may evolve, especially concerning assets like XRP, which are viewed as decentralized digital currencies.

XRP’s Current Market Standing

XRP holds the position of the sixth-largest cryptocurrency by market capitalization, creating a substantial interest among investors and fund managers. The proposed ETF would aim to track the price movements of XRP, further integrating this digital asset into the mainstream financial system. As the popularity of cryptocurrencies continues to rise, products like the XRP ETF could provide investors with a regulated and accessible way to gain exposure to this digital asset.

As part of its broader strategy, WisdomTree has previously launched spot Bitcoin ETFs, with one fund reportedly managing around $932 million in assets. This experience may bolster their efforts in the XRP market, enhancing investor confidence in the viability of the proposed ETF.

Growing Interest in Crypto ETFs Beyond Bitcoin and Ethereum

The interest in launching an XRP ETF is part of a larger trend among asset managers looking to diversify their cryptocurrency offerings beyond Bitcoin and Ethereum. Following WisdomTree’s initiative, several firms, including Bitwise, Canary Capital, and 21Shares, are actively pursuing similar applications, indicating a collective movement towards a more expansive view of cryptocurrency in investment portfolios.

Recent applications for various cryptocurrency ETFs, including those targeting assets like Solana and Litecoin, demonstrate the growing acceptance of digital assets in mainstream finance. This diversification may cater to a broader audience of investors seeking to balance risk and opportunity in their portfolios.

Implications for Future Crypto Investments

The evolving landscape of cryptocurrency regulation and investment products highlights the potential for significant changes in the financial market. As asset managers prepare for the approval of various cryptocurrency ETFs, the future of XRP and other digital assets could be shaped by the regulatory landscape established by the incoming SEC leadership.

With increasing interest in cryptocurrency investment products and the possible easing of regulatory constraints, asset managers are poised to capitalize on the growing demand for diverse digital asset offerings. This trend reflects a maturation of the cryptocurrency market, where more traditional financial institutions are beginning to integrate digital assets into their investment strategies.

The rapidly changing regulatory environment, alongside the competitive landscape of ETF offerings, positions XRP and other cryptocurrencies as significant players in the future of financial markets. As institutions and retail investors alike seek new opportunities, developments in the ETF space could greatly influence the trajectory of cryptocurrency adoption and investment.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

Ark Invest Sells $3.9 Million In Coinbase Shares

HBAR May Get ETF Approval Before Solana or XRP Does

*AI technology may have been used to develop this story and publish it as quickly as possible.