The Federal Open Market Committee (FOMC) of the Federal Reserve has implemented a 25 basis point rate cut, reflecting ongoing adjustments in monetary policy amidst evolving economic conditions.

Rate Cut and Monetary Policy Adjustments

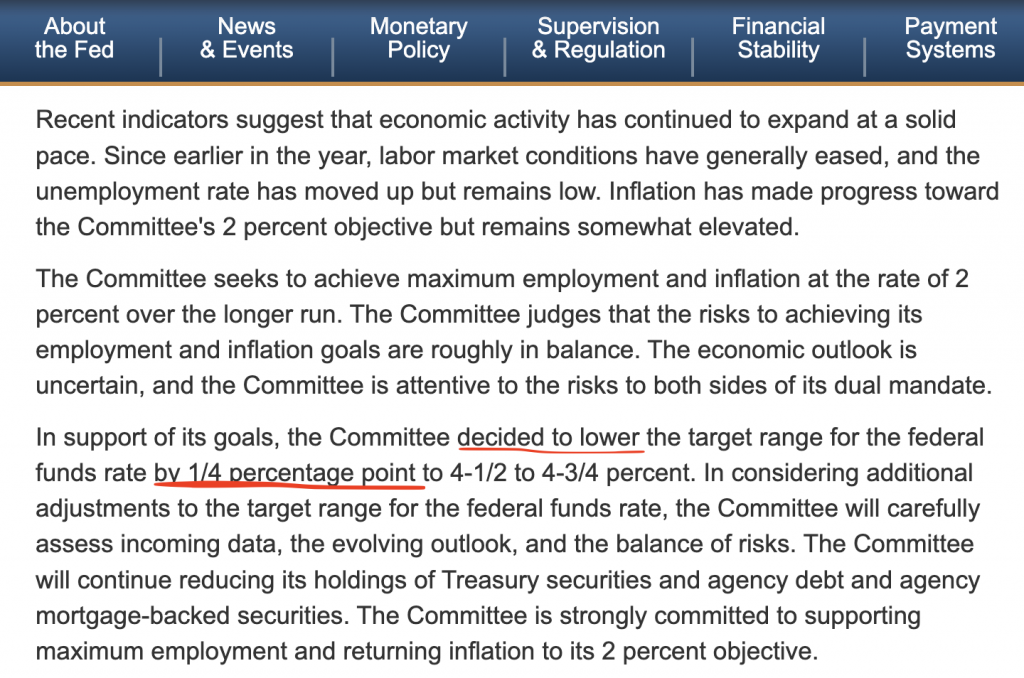

The Federal Reserve has announced a reduction of interest rates by 25 basis points, a move that was widely anticipated by the market participants. This adjustment aligns with previous expectations and comes as the FOMC aims to stimulate economic growth while addressing inflation concerns.

Prior to the announcement, the market had priced in a 68% likelihood of an additional rate cut in December and projected a total reduction of 110 basis points by October of the following year. As of the decision, the USD/JPY currency pair was trading at 153.01, and the yield on 2-year Treasury notes stood at 4.21%.

The decline in rates is a strategic response to various economic signals, particularly those related to employment and inflation, indicating that the Fed is closely monitoring the macroeconomic landscape.

Economic Activity and Inflation Outlook

In their latest statement, the Federal Reserve adjusted its language regarding inflation, omitting the phrase indicating increased confidence in inflation moving sustainably towards the 2% target. However, the Fed acknowledged that “inflation has made progress toward 2%, but remains somewhat elevated.”

This admission reflects the central bank’s cautious stance on inflation pressures, which, while improving, have not yet fully aligned with the desired target. The Committee reiterated that economic activity “has continued to expand at a solid pace,” suggesting that, despite inflationary pressures, the overall economy is maintaining a growth trajectory.

The acknowledgment of ongoing economic expansion is crucial as it indicates resilience in the face of tightening monetary conditions.

Labor Market Conditions

The Federal Reserve’s statement also highlighted the evolving conditions in the labor market. The Fed noted that “labor market conditions have generally eased,” indicating a slight softening in job availability or growth.

The unemployment rate has increased but remains low, suggesting that while there may be challenges in job creation or retention, the job market is not in a state of crisis. This nuanced view is critical as it underscores the Fed’s balancing act between supporting economic growth through lower interest rates while managing inflation and labor market stability.

The drop in labor participation and recent lower job growth figures complicate the Fed’s outlook, particularly as it shifts its focus from inflation concerns to stabilizing the job market.

The Federal Reserve’s latest rate cut and accompanying statements reflect a complex interplay of economic indicators. By strategically adjusting interest rates and acknowledging shifts in inflation and employment conditions, the Fed aims to navigate the current economic landscape.

This move is part of a broader effort to ensure a stable economic environment while addressing the challenges posed by inflation and labor market dynamics. As the Fed continues to monitor these indicators, market participants will be closely observing the implications for future monetary policy adjustments.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

US Manufacturing PMI Rises to 49.7 in November

PCE Inflation Comes In-Line With Expectations

*AI technology may have been used to develop this story and publish it as quickly as possible.