The latest labor market data indicates a decline in job openings and a shift in consumer confidence, suggesting a complex interplay between job availability and economic sentiment as the U.S. approaches the presidential election.

Job Openings Decline to 7.44 Million

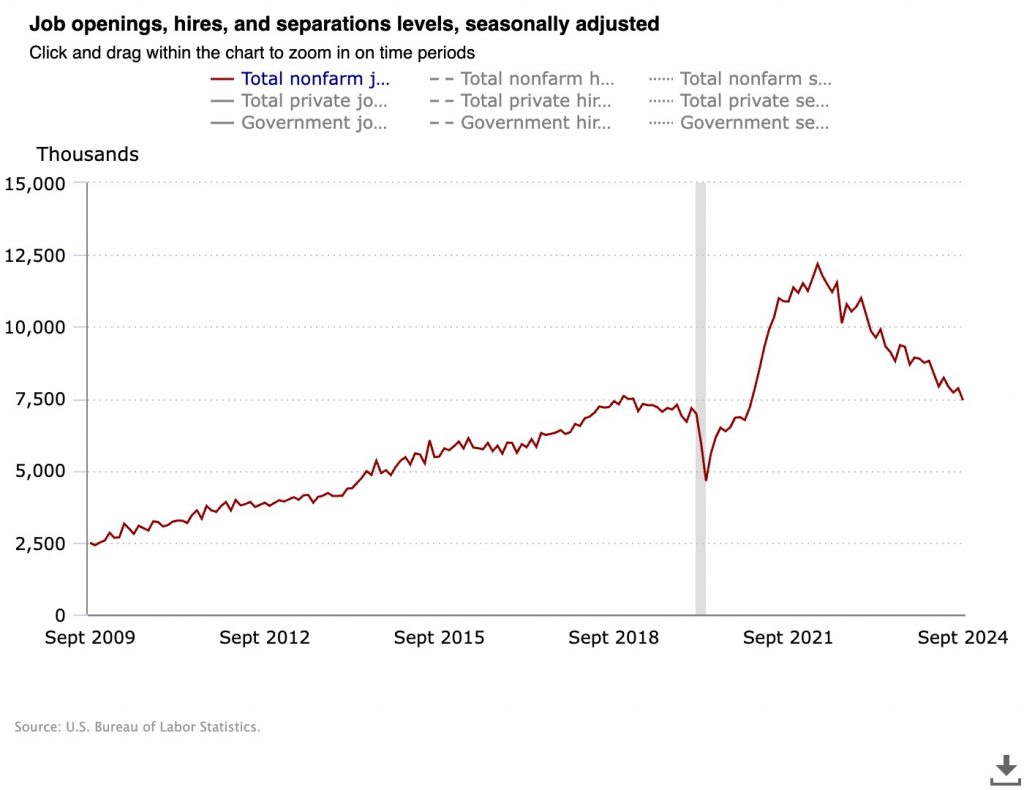

The U.S. labor market has shown signs of softening, with job openings plummeting to 7.44 million in September, a decrease of over 418,000 from August’s revised figure of 7.86 million.

This drop marks the lowest level of job openings since January 2021 and is significantly below the Wall Street estimate of 8 million. The vacancy rate now stands at 4.5%, a slight decline from the previous month’s revised rate of 4.7%.

The decline in job openings has impacted the ratio of available jobs to unemployed workers, which has fallen to approximately 1.1 to 1. In mid-2022, this ratio was more than 2 to 1, indicating a tighter labor market.

The decrease in job opportunities is further reflected in the report from the Bureau of Labor Statistics, which noted that only 34% of businesses reported unfilled job openings in September, a marked decline from August and the lowest level since January 2021.

The sectors that observed the most significant declines in job openings included healthcare and social assistance, which saw a reduction of 178,000 positions, and state and local government roles (excluding education), which decreased by 79,000.

Conversely, job openings rose in the finance and insurance sector, which gained 85,000 openings.

Steady Hires but Falling Quits

Despite the decline in job openings, the number of hires remained stable at 5.6 million, with a hire rate of 3.5%. This indicates that while employers are reducing open positions, they are still actively hiring at a consistent rate.

Total separations, which include layoffs and voluntary departures, remained unchanged at 5.2 million in September; however, this figure represents a decrease of 326,000 from the previous year.

In terms of voluntary job departures or “quits,” the number was reported at 3.1 million, which is unchanged from the previous month but down by 525,000 year-over-year.

The quits rate, a critical measure of worker confidence and job market health, held steady at 1.9%. This suggests that while employees may be hesitant to leave their jobs, the overall environment appears less optimistic than in previous months.

The stability in hires, despite the decline in openings, indicates a complex labor market dynamic. Employers are likely focusing on filling critical roles rather than expanding their workforce, leading to a scenario where quits are down along with job openings.

The increase in layoffs, which remained at 1.8 million—up by 238,000 over the year—hints at growing caution among employers.

Consumer Confidence Surges Amid Job Market Uncertainty

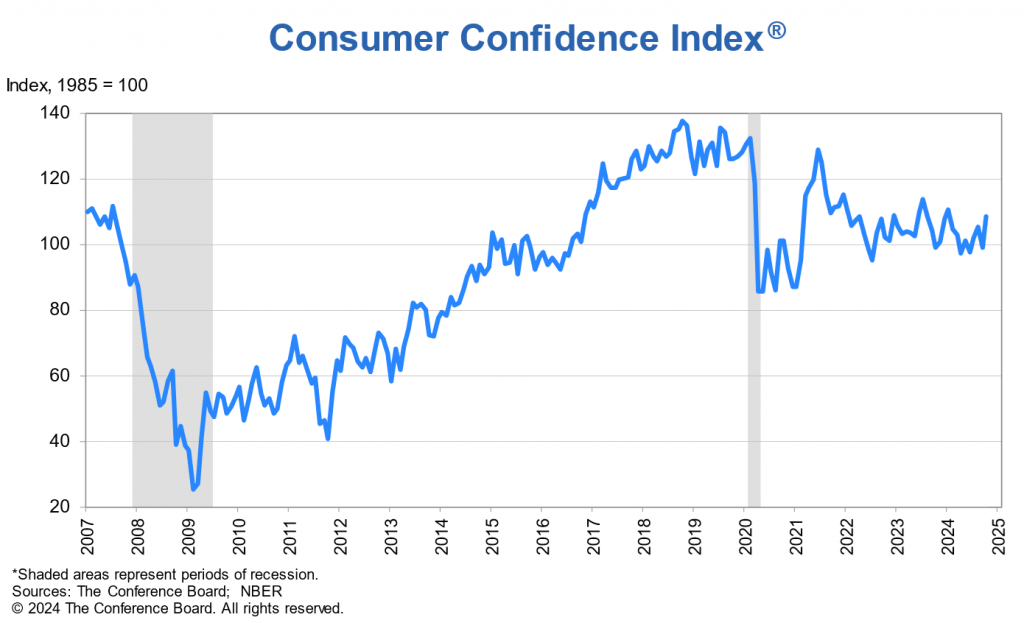

In a contrasting development, consumer confidence surged ahead of the upcoming presidential election, with the Conference Board’s consumer confidence index rising more than 11% to a reading of 138 in October.

This significant increase is the largest month-over-month rise since March 2021. The expectations index, which gauges consumer outlook on future economic conditions, jumped nearly 8% to 89.1, suggesting a robust sentiment that remains above the recessionary threshold of 80.

Dana Peterson, Chief Economist at the Conference Board, noted that “consumers’ assessments of current business conditions turned positive.” This rebound in confidence comes despite the reported decline in job openings, indicating that consumers are possibly interpreting recent data as a sign of a healthier labor market, or are optimistic about upcoming economic conditions.

However, the optimism among consumers appears disconnected from the current labor market realities, as job openings have dropped to their lowest levels in years.

While hires increased by 123,000 in September, separations remained relatively unchanged, and quits decreased by 107,000, reflecting a divergence between consumer sentiment and labor market dynamics.

Conclusion on Macroeconomic Context

The latest macroeconomic developments reveal a multifaceted picture of the U.S. economy. Following the Federal Reserve’s decision to cut interest rates for the first time since the onset of the pandemic, further attention is being directed toward job market stability rather than inflation.

Jerome Powell’s recent comments highlight a reduced focus on inflation as the Fed aims to prevent deterioration in the job market.

Moreover, recent data indicates fewer claims for jobless benefits than anticipated, signaling potential resilience in employment despite ongoing economic challenges.

Retail sales figures show a slight increase month-over-month, suggesting consumer spending remains robust, although inflation concerns are starting to influence market expectations regarding the Fed’s upcoming decisions.

In the broader context, market participants are adjusting to expectations of a pause in interest rate cuts, with Polymarket reflecting a 13% probability of no cuts in November.

Meanwhile, aggressive stimulus measures initiated by the People’s Bank of China on September 24th may also impact global economic sentiment and dynamics, adding another layer of complexity to the U.S. economic landscape.

As these various factors unfold, the relationship between job market conditions and consumer sentiment will be critical in determining the trajectory of the U.S. economy heading into

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

US Manufacturing PMI Rises to 49.7 in November

PCE Inflation Comes In-Line With Expectations

*AI technology may have been used to develop this story and publish it as quickly as possible.