PCE inflation rates align with expectations, revealing a stable economic outlook ahead of GDP estimates and jobless claims.

PCE Inflation Figures: Stability Amid Expectations

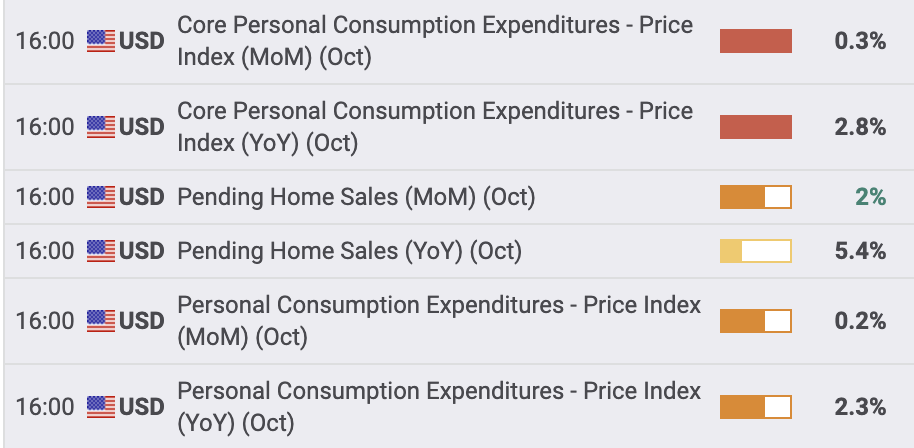

The latest data reveals that the Personal Consumption Expenditures (PCE) inflation rate on a year-over-year basis stands at 2.3%, matching analysts’ expectations. Similarly, the Core PCE inflation rate, which excludes food and energy prices often subject to volatility, is reported at 2.8%, aligning precisely with forecasts.

These figures indicate that inflation is currently stable and within the target range anticipated by economists. The PCE inflation metric is significant as it is the Federal Reserve’s preferred measure for gauging changes in the price level of consumer goods and services.

A stable inflation rate suggests that consumer purchasing power remains intact, which can influence monetary policy decisions by the Fed. As such, the adherence to predicted inflation rates signals a level of confidence in the underlying economic conditions.

Economic Indicators: GDP and Jobless Claims

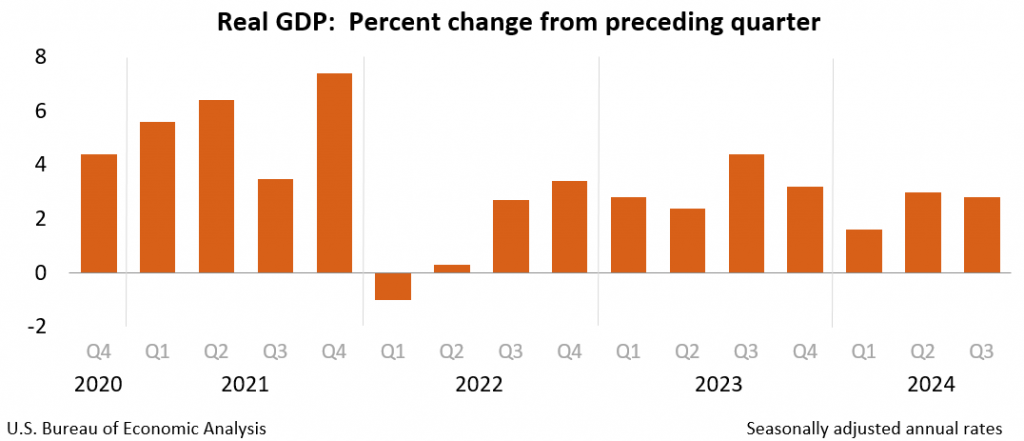

In conjunction with PCE data, the second estimate for Gross Domestic Product (GDP) growth for the third quarter has been reported at 2.8%, consistent with prior expectations. This growth rate provides insight into the overall economic performance, reflecting a stable expansion phase in economic activity.

A GDP growth rate of 2.8% suggests robust consumer spending and business investment, contributing positively to the economy’s resilience. Moreover, the jobless claims report indicates that unemployment filings reached 213,000, slightly below the expected figure of 217,000.

Although this number is marginally lower than expectations, it is important to note that jobless claims are known for their volatility. A lower-than-expected figure may imply a stronger labor market, where fewer individuals are seeking unemployment benefits, potentially leading to increased consumer spending and further boosting economic growth.

Insights from FOMC Minutes: Macroeconomic Perspectives

Recent minutes from the Federal Open Market Committee (FOMC) meeting highlight several key insights regarding current labor market dynamics and inflationary pressures. While discussing housing services, some committee participants noted that elevated price increases in this sector are anticipated to slow down in the near future.

This could lead to more manageable housing costs, supporting overall economic stability. Regarding labor market conditions, comments reveal that supply and demand remain in relative balance. With recent productivity gains, it is expected that wage increases will not exert significant inflationary pressure in the near term.

This perspective is crucial, as wage growth often correlates with inflation rates. The focus on maintaining balanced labor market conditions aligns with the Fed’s objectives of achieving stable prices and full employment.

Additional comments from FOMC participants pointed to businesses becoming more selective in their hiring processes, reflecting an increase in qualified job applicants. This trend indicates a strengthening labor market, which could lead to improved productivity and economic performance.

However, some participants acknowledged that evaluating underlying trends in labor market developments remains challenging due to fluctuating economic data. The FOMC minutes also indicated that many participants view the risks associated with achieving employment and inflation goals as balanced.

There is acknowledgment that month-to-month economic movements may continue to exhibit volatility, yet incoming data suggest a consistent trajectory toward the inflation target of 2 percent. This is an important consideration for monetary policy, as sustained inflation around this target would allow for more flexibility in future rate adjustments.

In terms of broader economic risks, some members raised concerns about vulnerabilities in the commercial real estate (CRE) sector, particularly in office spaces, highlighting potential issues tied to changing work patterns. Additionally, discussions about asset valuation pressures in various markets point to emerging challenges that could affect financial stability.

The recent PCE inflation figures, GDP growth estimates, and jobless claims data collectively paint a picture of stability within the macroeconomic landscape. As the Federal Reserve navigates these indicators, the insights gleaned from the recent FOMC meeting minutes will be crucial in shaping future monetary policy decisions.

With the FED currently contending with complex uncertainties surrounding rising inflation risks, these macroeconomic developments will play a pivotal role in guiding both fiscal and regulatory frameworks in the coming months.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

*AI technology may have been used to develop this story and publish it as quickly as possible.