Federal Reserve Chair Jerome Powell has reinforced his commitment to maintaining a dovish monetary policy stance, signaling to markets that he will not step down and that the Fed plans to continue gradually easing interest rates.

Powell’s Commitment to Dovish Policy

In a recent press conference, Jerome Powell made it clear that he remains firmly in position as the Federal Reserve’s chair, regardless of any political pressures. Analysts noted, “We know exactly what we will get with Powell: A dove,” highlighting the predictable nature of his policy approach.

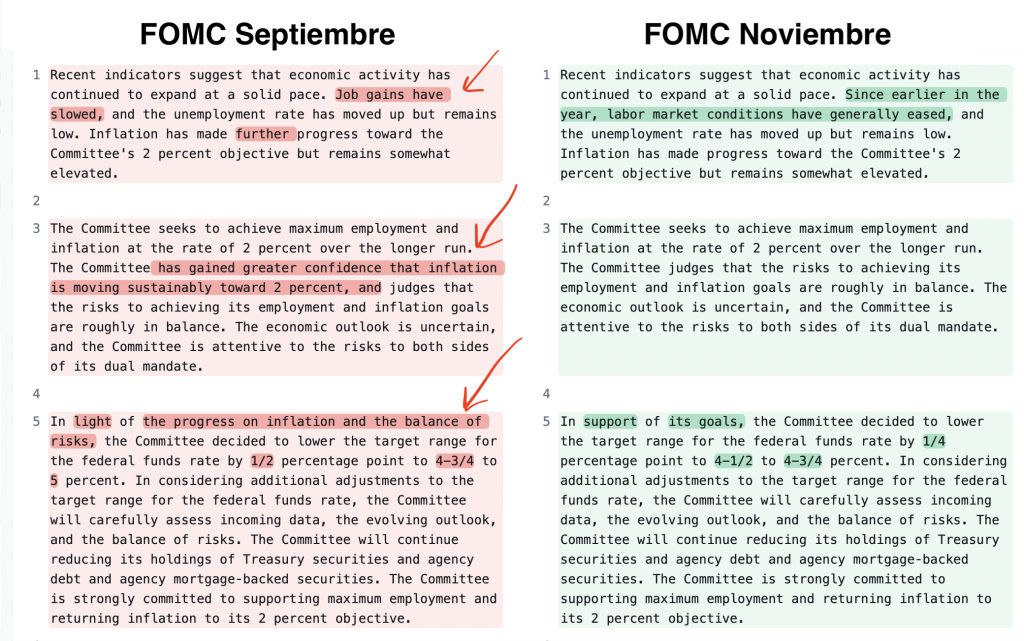

Powell dismissed initial market reactions to the Federal Open Market Committee (FOMC) statement, which removed language about gaining greater confidence in inflation returning to target. He indicated that this change held no meaningful implications, emphasizing the Fed’s intention for the coming year to proceed with gradual rate cuts.

The Fed Chair expressed confidence that the economy can maintain strong performance without triggering inflation. He acknowledged some uncertainties about the pace of economic recovery but underlined that the destination for monetary policy, referred to as “neutral,” is not yet clearly defined.

Economic Indicators and Outlook

In his Q&A session, Powell discussed recent trends in bond rates, stating that they remain significantly lower compared to a year ago. He expressed optimism regarding strengthening economic activity, noting that improved growth prospects—rather than inflation—are contributing to the rise in yields.

While acknowledging that inflation is approaching the Fed’s target, Powell mentioned that the central bank will make its rate decisions based on upcoming data, particularly in December. He indicated that the labor market has cooled somewhat but remains in a balanced state.

Powell highlighted that any significant changes in inflation would not necessarily require drastic policy shifts, reiterating the Fed’s commitment to achieving maximum employment and price stability goals.

Political Considerations and Future Actions

During the press conference, Powell was asked about his potential resignation should it be requested by the President, to which he firmly replied, “no,” reinforcing his stance on independence from political influence.

The conversation around political dynamics and the Fed’s role highlights tensions that may affect future monetary policy decisions. Powell’s responses indicate a commitment to focusing on the economic landscape rather than external pressures.

Overall, Powell’s remarks underscore that despite fluctuating economic indicators and political pressures, the Fed is prepared to navigate these complexities with a measured and cautious approach moving forward.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

US Manufacturing PMI Rises to 49.7 in November

PCE Inflation Comes In-Line With Expectations

*AI technology may have been used to develop this story and publish it as quickly as possible.