Recent macroeconomic data reveals a mixed picture of the U.S. economy, with inflation rates showing modest increases, consumer spending demonstrating strength, and labor market indicators suggesting a softening trend.

Inflation Metrics and Consumer Behavior

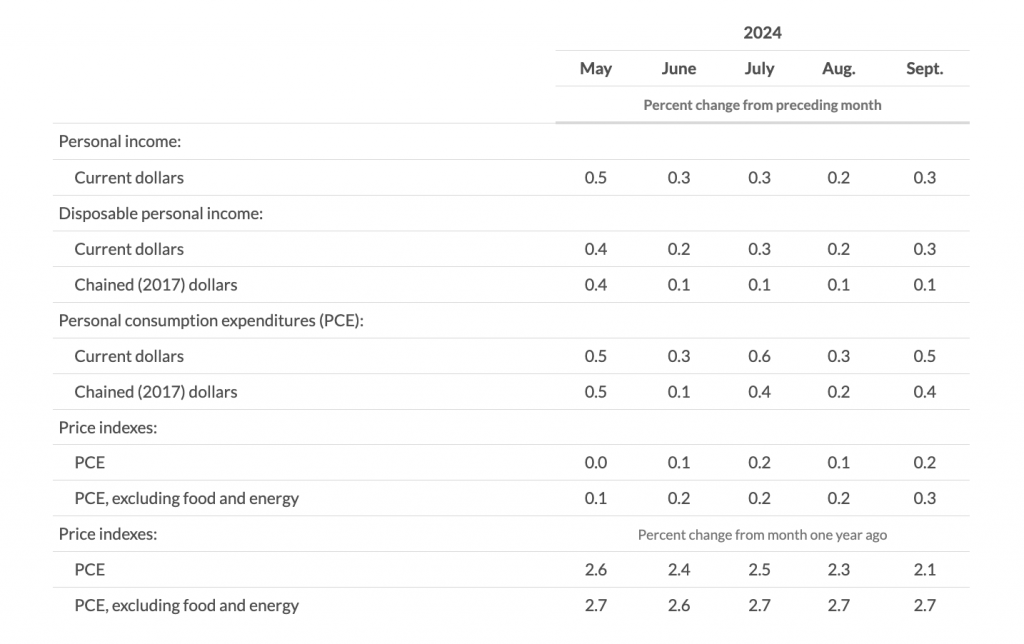

In September 2024, core Personal Consumption Expenditures (PCE) inflation rose by 0.3%, matching expectations and significantly higher than the previous month’s increase of 0.1%. The unrounded data shows an increase of 0.254% in core PCE, marking an annual rise of 2.7%, slightly above the anticipated 2.6%.

Headline PCE inflation maintained a year-over-year increase of 2.1%, aligning with forecasts, although it was revised from a prior estimate of 2.2% to 2.3%. The PCE deflator recorded a month-over-month increase of 0.2%, consistent with expectations, indicating a slightly softer inflation environment than what headline figures suggest.

Consumer spending and income data for August further illuminate economic conditions, with personal income rising by 0.3% and personal spending outperforming forecasts with a 0.5% increase. Real personal spending showed a strong increase of 0.4%, compared to a revised 0.2% in the prior month, indicating robust consumer activity.

Unemployment Claims and Labor Market Trends

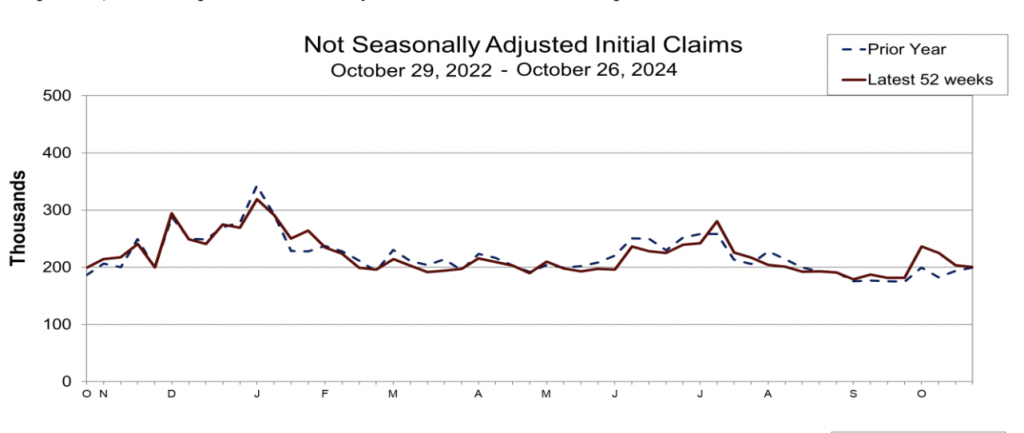

The latest initial jobless claims data showed a total of 216,000 claims, slightly lower than the estimated 230,000. This figure represents a decrease from the previous week’s claims, with the four-week moving average standing at 236,500, slightly down from last week’s average.

Continuing claims decreased to 1.862 million, compared to an estimate of 1.885 million. The overall trend remains downward, suggesting resilience in the labor market despite challenges, although recent data may have been influenced by hurricanes.

Looking ahead, the U.S. jobs report is expected to reveal an addition of 108,000 jobs, with an unemployment rate anticipated at 4.1%. This month’s employment figures could be impacted by recent natural disasters and labor strikes.

Job Layoffs and Broader Economic Context

In October 2024, U.S.-based employers announced 55,597 job cuts, reflecting a nearly 24% decline from September’s figures but a 51% increase from October 2023. This statistic indicates a potential softening in the labor market, raising concerns about employment stability moving forward.

Job openings data reported 7.443 million positions available, falling short of the estimated 8 million. On a positive note, consumer confidence for October surged more than 11% to a reading of 138, the largest one-month increase since March 2021.

Brief Opinion

The macroeconomic landscape as of late October 2024 reflects a mixture of resilience and underlying challenges. Strong consumer spending and improving consumer confidence suggest that the economy is navigating a complex recovery phase.

However, elevated layoff figures and fluctuations in job openings indicate potential vulnerabilities in the labor market. Ongoing adjustments in monetary policy by the Federal Reserve and other central banks highlight a concerted effort to stabilize economic conditions amidst global uncertainties.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

US Manufacturing PMI Rises to 49.7 in November

PCE Inflation Comes In-Line With Expectations

*AI technology may have been used to develop this story and publish it as quickly as possible.