In October, the U.S. labor market showed signs of significant weakness, with only 12,000 jobs added, which fell short of expectations and was influenced by recent strikes and natural disasters.

Employment Changes: Disappointing Job Growth

The Bureau of Labor Statistics (BLS) reported a significant slowdown in job creation for October 2024, with only 12,000 jobs added, a stark contrast to the anticipated 113,000. This figure marks the lowest increase since December 2020.

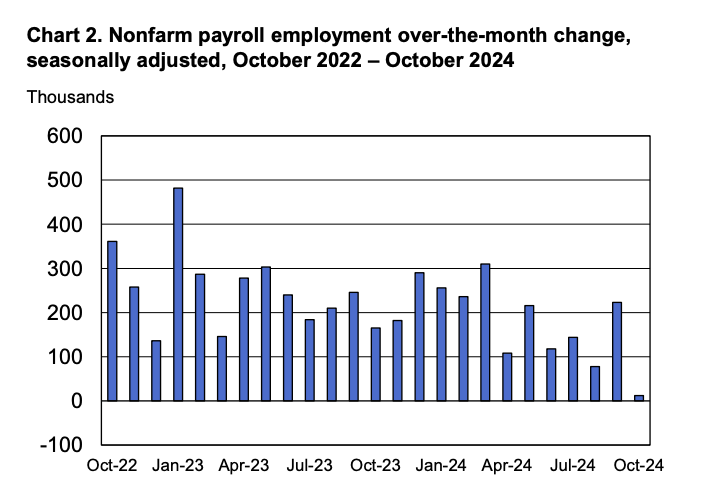

The previous month’s job gain for September was revised down from 254,000 to 223,000, and also for August, which was revised down by 81,000, indicating a net decrease of 112,000 jobs across two months. The employment situation reflects broader economic challenges, including adverse weather conditions and strikes affecting major industries.

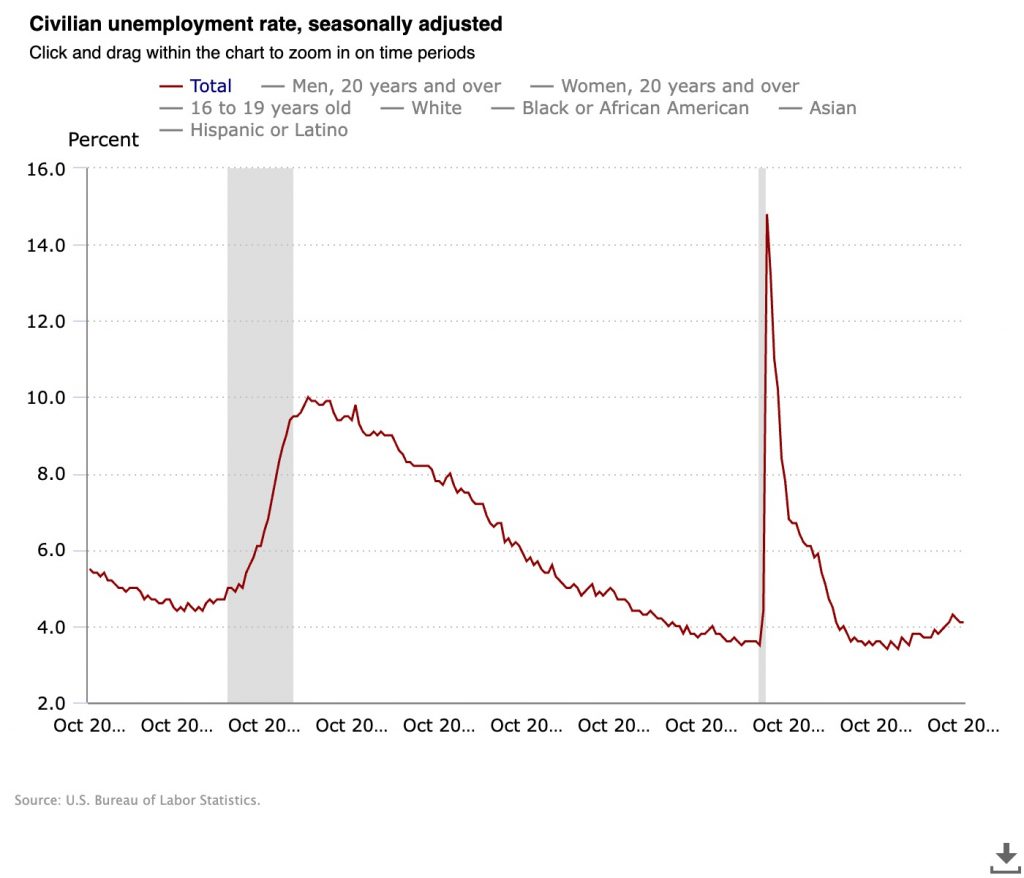

The unemployment rate remained unchanged at 4.1%, aligning with expectations, but this stability may mask underlying tensions in the labor market. A broader measure of unemployment, which includes discouraged workers and those involuntarily working part-time, also held steady at 7.7%.

The labor force participation rate decreased slightly from 62.7% to 62.6%, suggesting that fewer individuals are engaging in the job market, which could be attributed to the impacts of recent hurricanes and strikes, particularly the Boeing strike that was noted to have removed approximately 44,000 jobs from the manufacturing sector.

Impact of External Factors on Employment

The employment report underscored the significant impacts of external factors on job growth. The BLS highlighted that the Boeing strike contributed heavily to the downturn in the manufacturing sector, which saw a net loss of 46,000 jobs.

Additionally, the effects of hurricanes Helene and Milton were cited as contributing factors, although the BLS admitted that they could not quantify the exact impact of these storms on employment figures.

Meanwhile, the average hourly earnings rose by 0.4% for the month, which was slightly higher than economists’ estimates, while the year-on-year increase remained consistent at 4.0%. The average workweek duration was stable at 34.3 hours, suggesting that while hiring has slowed, wage growth has not significantly faltered.

Economic Outlook and Federal Reserve Response

The disappointing job figures have led to increased speculation regarding potential monetary policy adjustments by the Federal Reserve. Following the release of the non-farm payrolls report, the U.S. dollar weakened, with a notable drop in the USD/JPY exchange rate.

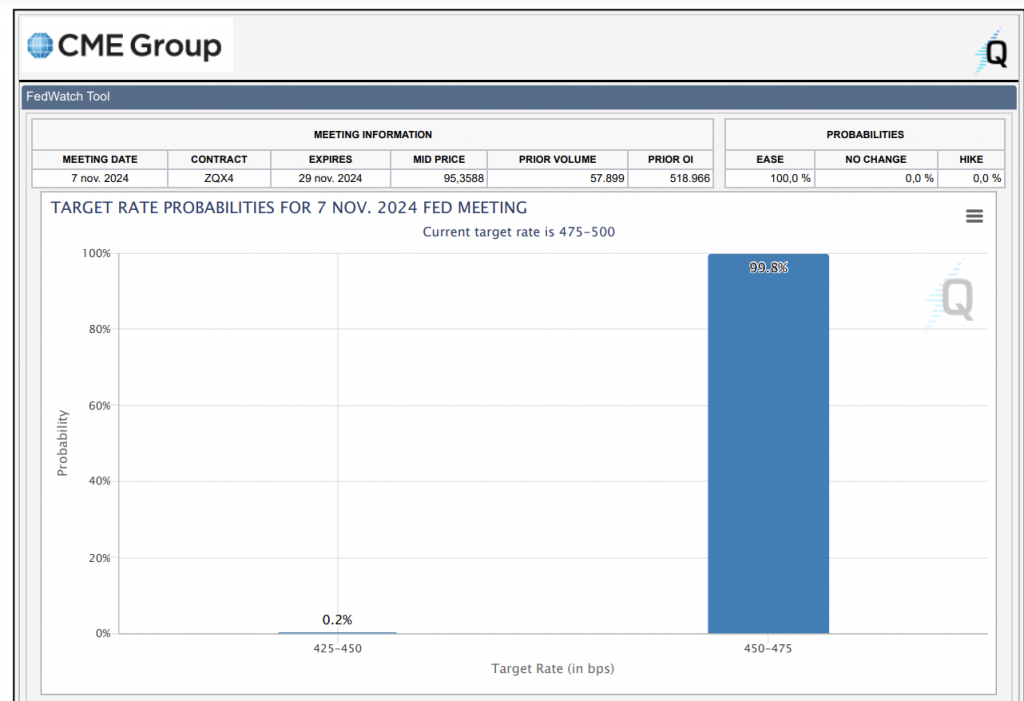

Market expectations for a rate cut next week surged to 99%, up from 93%, indicating that investors anticipate the Fed will respond to the softened labor market conditions.

The Federal Reserve faces a challenging environment as it navigates economic indicators that signal both job market weakness and inflationary pressures. Although the unemployment rate remains relatively stable, the drop in participation and the lower job growth figures complicate the Fed’s outlook.

The Fed’s last meeting highlighted a shift in focus from inflation concerns towards stabilizing the job market, particularly following the rate cut of 50 basis points initiated in September—the first cut since the onset of the pandemic in 2020.

Brief Opinion

In light of the recent macroeconomic landscape, several key developments have influenced the current state of the U.S. economy. The Federal Reserve’s approach to monetary policy has evolved, especially after their recent rate cuts.

Jerome Powell’s emphasis on preserving job market stability reflects a growing concern that ongoing labor market weakness may exacerbate economic challenges.

Recent statistics highlight a mixed economic environment. Job openings were reported at 7.443 million for October, falling short of the 8 million estimate and marking the lowest level since January 2021.

Meanwhile, consumer confidence surged by over 11% to a reading of 138, the largest acceleration since March 2021, indicating potential resilience among consumers despite the turbulent labor market.

Furthermore, the ADP employment change for October showed a significant increase of 233,000 jobs, far surpassing the expected 115,000, suggesting discrepancies between different employment reports and indicating potential volatility in job creation moving forward.

However, the GDP for Q3 came in at 2.8%, below the expected 3%, pointing to slower economic growth.

The interplay of these factors will be critical as stakeholders navigate the evolving economic landscape, focusing on the balance between growth and stability in the weeks ahead.

Disclaimer: All information provided on this website is for informational purposes only and should not be construed as financial or investment advice. We do not guarantee the accuracy, completeness, or timeliness of the information, and we are not responsible for any financial decisions you may make based on this information. Cryptocurrencies are highly volatile assets, and any investment in them carries a high level of risk.

More Like This

US Manufacturing PMI Rises to 49.7 in November

PCE Inflation Comes In-Line With Expectations

*AI technology may have been used to develop this story and publish it as quickly as possible.